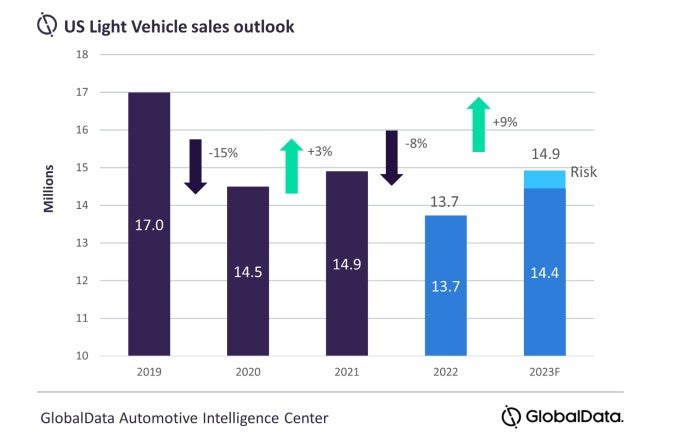

There is no escaping the fact that 2022 was a disappointing year for the US Light Vehicle market. What was initially expected to be a year of solid recovery ended with the lowest sales since 2011. We were not alone in missing the mark with our outlook and neither was the US the only one to unexpectedly struggle across the world last year. However, the reasons are not particularly difficult to discern with hindsight: inventories failed to recover at the pace we anticipated, as the lingering effects of the chip shortage continued to cast a shadow over the industry. Later in 2022, inventories improved – albeit in an uneven manner – but aggressive interest rate hikes from the Federal Reserve and record-high transaction prices kept some customers out of the market.

So, what can we expect from 2023? Although it may appear stubborn to repeat last year’s projection of decent growth, we believe there is good reason to have at least a modicum of optimism as we kick off the New Year.

We see total US sales at 14.9 million units, which would be around the same volumes as were achieved in 2021, but still well below the average of 17.1 million units between 2014 and 2019. But it might seem counterintuitive to forecast an increase in sales in a year in which a recession is predicted – although how mild or severe it will be is open to debate. Why are we relatively upbeat, if not exactly bullish, about prospects for US Light Vehicle sales?

The first and most obvious reason is that improved inventories should allow for increased model availability, and therefore more sales. Some OEMs are already seeing much healthier stock levels, bringing up average inventory – which differs markedly from the situation a year ago. We expect other manufacturers to catch up as 2023 goes on. Although hard to gauge precisely, we think there is still pent-up demand from three years of disruption to new Light Vehicle sales.

More availability of vehicles presents OEMs with more options. One factor to watch in 2023 will be a potential resurgence in fleet sales, which have been depressed ever since the early months of the pandemic. Fleet could help to boost volumes as other customers stay away amid economic uncertainty. In the closing months of 2022, fleet already appeared to be making gains.

We also anticipate that 2023 will finally see some – modest – easing in transaction prices and increased incentives. There were some false dawns in 2022, but as supply improves and demand remains lukewarm, elementary economics suggests that discounting will gradually become more commonplace. Still, don’t expect to be snapping up bargains this year, compared to pre-pandemic times. As interest rates are unlikely to be lowered until 2024, financing a vehicle will remain more expensive than in recent years.

Of course, forecasts can always be knocked off course by unforeseen factors. One such example in 2022 was Russia’s invasion of Ukraine in late February, which had repercussions across the global economy. We cannot rule out such a “curve ball” again in 2023, but neither do we assume that there will be such an event when we cannot predict what it will be when it will occur, or what its consequences will be for the automotive industry. For now, it seems fair to say that the risks are tilted to the downside of our forecast, but if the market failed to grow again, that would be a real disappointment.

David Oakley, Manager, Americas Vehicle Sales Forecasts, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center