There is a massive shift occurring in the North America Light Vehicle (LV) production landscape that will impact what, where and how vehicles are built and ultimately could affect regional economies, the supply chain, labour, and consumers alike.

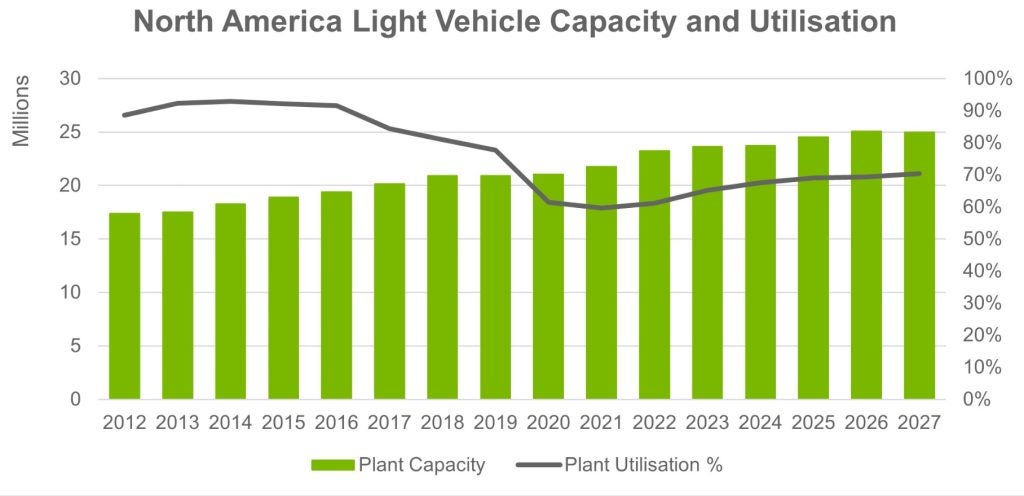

As billions of dollars are planned to be invested by automakers to produce battery electric vehicles (BEVs) and onshore previously imported models, we are expecting to see a vast increase in the ability of the North America region to build vehicles. As recently as 2018, North America Light Vehicle production capacity sat at nearly 21 million vehicles across 88 plants. But in just 5 years from now, those numbers are expected to balloon to over 25 million vehicles and 108 plants.

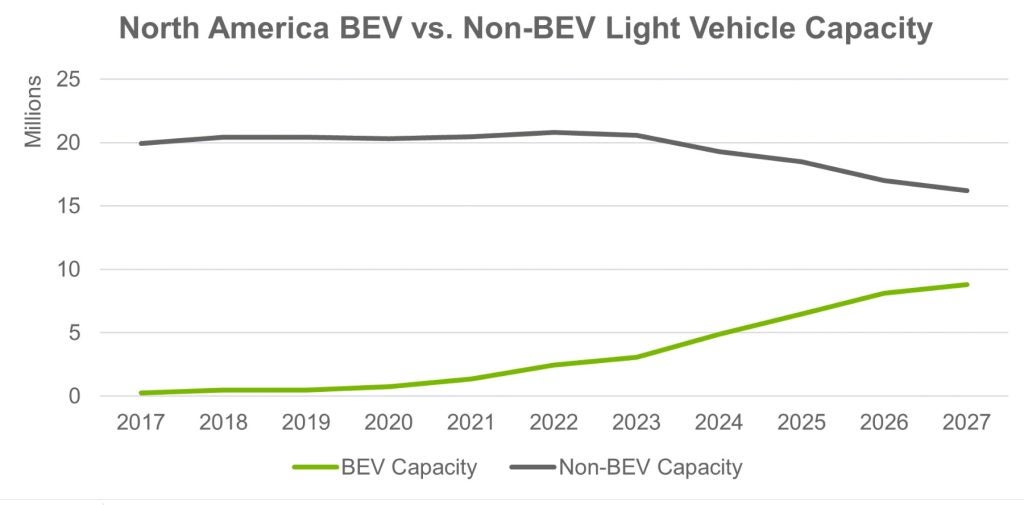

We see BEV capacity growing by over 6 million vehicles by 2027 as traditional gasoline-powered vehicle capacity is reduced by over 4.5 million units. But as capacity increases – especially the capacity to produce BEVs – utilisation of that capacity is expected to remain depressed from the pandemic and chip shortage era until consumers’ thirst for BEVs catches up with the automakers’ ability to produce them.

There are at least three likely effects of the increase in BEV capacity. First, given that some of the increase is from start-up manufacturers like Lucid, Rivian and Canoo, some of the planned added capacity will ultimately not come to fruition given the high failure rate of such ventures – just ask Electric Last Mile Solutions and Nikola Motors. At a minimum, expansion plans may not come as quickly as envisioned.

Second, M&A involving these new automakers should increase as some of their valuations inevitably wane – but only if their technology and intellectual property are attractive enough to a potential partner. So, what may start out as capacity for one automaker, may end up with another.

And third, given the high-cost outlay by traditional automakers to produce BEVs, we will likely see a reduction in complexity for their remaining gasoline-powered models to reduce overall costs. Out of necessity, the chip shortage has already helped serve as a preliminary proof of concept for a complexity reduction strategy. This may ultimately mean that consumers of these vehicles are offered fewer option package choices than they have been used to in the past.

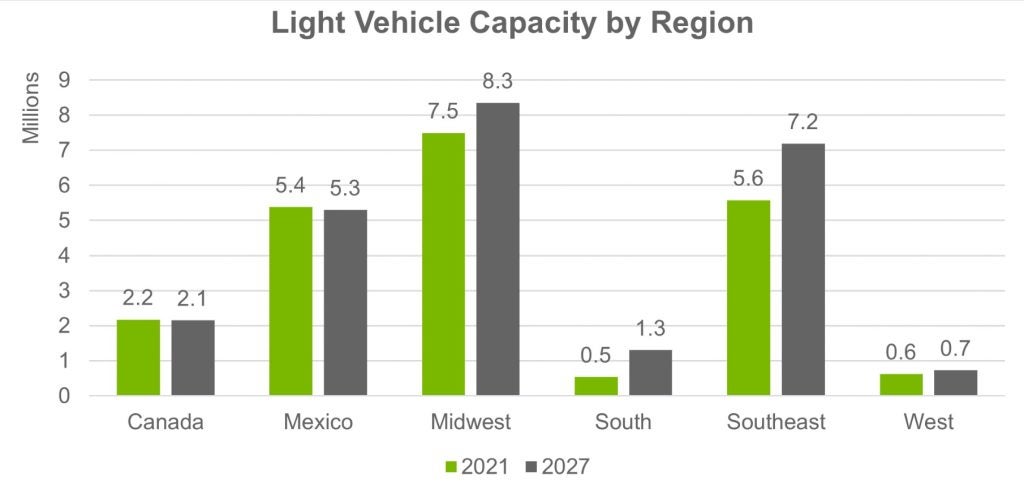

We are also seeing a shift in where vehicles are being produced within the region. The US Midwest is expected to remain the hub of auto manufacturing in the region, gaining nearly 1 million units of capacity by 2027 thanks in part to Stellantis’ new Mack Assembly plant and Ford’s Rouge Electric Vehicle Center.

But advancing fast is the US Southeast region, as start-up and established auto manufacturers – including two in Georgia by Hyundai-Kia and Rivian – are planning to build new dedicated BEV plants there. With 7.2 million units of capacity expected by 2027, the Southeast is expected to nearly surpass the capacity of Canada and Mexico combined.

The shift to the Southeast can be attributed to an established supplier network – which should likely continue to grow – as well as generous incentives that add to the region’s attractiveness. But the impact of USMCA and its origin of content rules, and the Inflation Reduction Act’s electric vehicle incentives favouring the US in terms of BEV production cannot be understated.

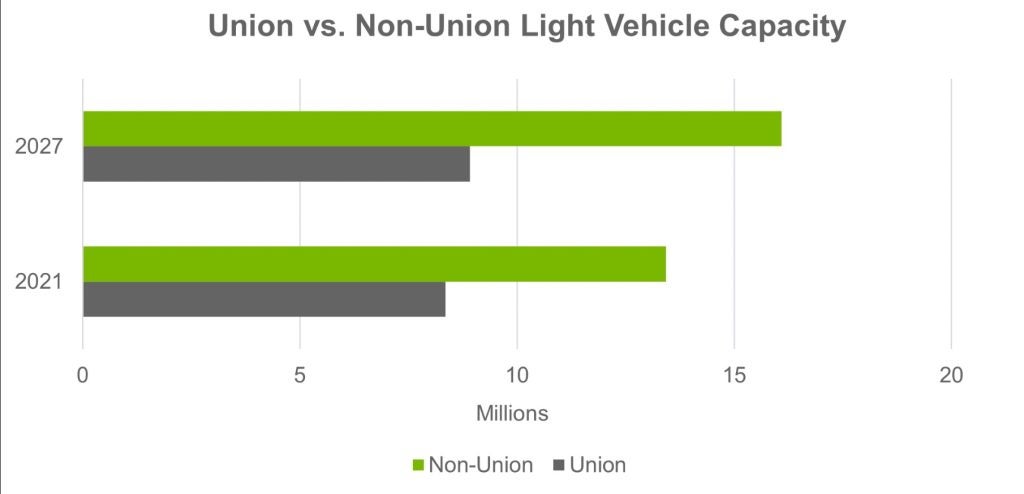

And as we look ahead to union contract talks between Ford, GM and Stellantis and the United Auto Workers and Unifor, product commitment at existing unionized plants will be at the forefront. But contract talks aside, what also should be at the forefront for the unions is how they capture some of this growing capacity.

Bill Rinna, Director, Americas Vehicle Forecasts, LMC Automotive (a GlobalData company)

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center