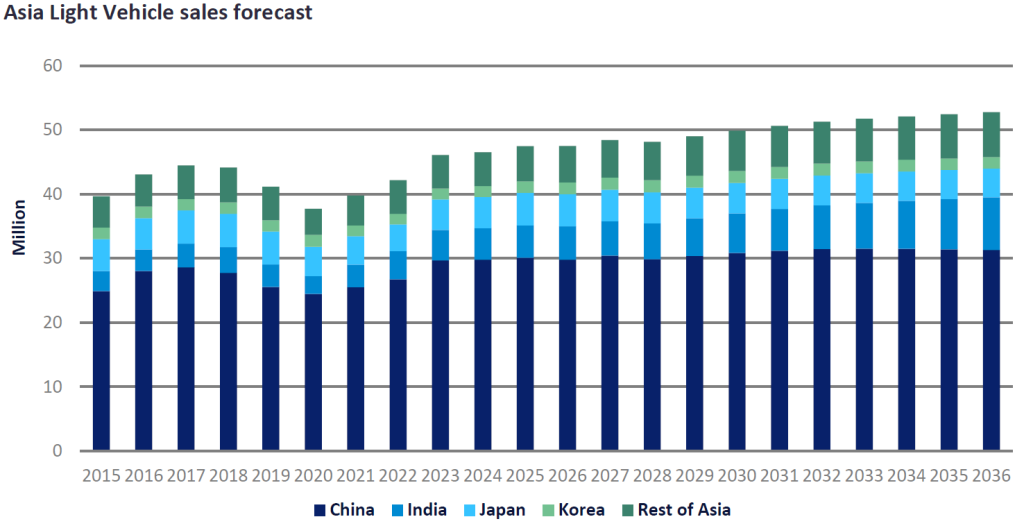

The Asian automotive market finished 2023 with phenomenal results. Total Light Vehicle (LV) sales in the region reached an all-time high of 46.1 million units (+9.3%), exceeding the previous record-high of 44.5 million units in 2017. Out of the twelve Asian countries that we tracked in detail, four countries broke their records and registered their all-time highs: China*, India, Australia, and Malaysia. In addition, Japan, Chinese Taipei, and the Philippines ended the year with double-digit growth. Korea managed to post a small gain. While four other markets (Indonesia, Pakistan, Thailand, and Vietnam) contracted last year, their loss was more than offset by robust growth in the rest of the region.

It was, however, very obvious that the strong expansion in 2023 was driven mainly by pent-up demand and a catch-up in production after significant disruptions caused by the pandemic and the global supply-chain bottlenecks. In four years between 2020 and 2023, total LV sales in the region averaged 41.4 million units per year, which was the same level as 2019’s 41.2 million units, but below 44 million units in 2017 and 2018. In other words, on average, sales hardly increased in the last four years. Now that pent-up demand has been mostly satisfied, will there be any growth this year?

After a bumper year last year, we expect that the Asian markets will slow significantly, expanding by only 1% to 46.5 million units. Across the region, the lagged full impact of high interest rates (except in China and Vietnam, which have been cutting interest rates), still-elevated inflation, and a weak local currency are eroding consumers’ purchasing power. The post-pandemic recovery in the services sector is mostly over, and many businesses are holding off on investment (i.e., job creation) amid an increasingly uncertain global outlook. Indeed, the major risk to the Asian economies (and hence new vehicle sales) arises from China’s slowdown and softer global demand for Asia’s exports that range from high-tech products to commodities. Rising tensions between China and the West are another risk – and the possible re-election of former President Trump in the US presidential election in November will likely escalate the tensions. Furthermore, the impact of intensifying global warming (drought, flood, and extreme heat) on the region’s economic activity raises a concern. It appears that the economic challenges in the region are mounting.

Remember, however, that Asian automotive markets are very diverse and often resilient. Facing the economic headwinds, each market has been managing to keep new vehicle sales running satisfactorily within its unique situation. In China, sales surged strongly in H2 2023, despite a slowing economy, the property crisis, and high youth unemployment. The ongoing “price war,” increasingly affordable NEV models, and the shift from ICEs to NEVs continued to bolster sales – and that trend is expected to continue this year. In India, the shift from Cars to SUVs has been and will continue to be a key factor for the market’s rapid expansion. Major OEMs have expanded their SUV lineups (including small SUVs), creating both new and replacement demand for SUVs. In India, a number of OEMs are planning to increase investment in the country significantly over the next few years, betting on strong growth in demand. Global investors are also shifting or considering shifting their investment away from China to India, which bodes well for India’s job and income growth – and new vehicle sales.

In Southeast Asia, a resource-rich Indonesia is attracting investment in the EV sector, which will likely help drive the automotive industry and market. In Thailand, the government’s EV incentive program is leading to strong growth in EV sales. The recovery in the country’s large tourism sector also raises hope for a rebound in demand for new vehicles this year.

Among Asia’s more advanced markets, in Japan, major corporations are set to implement substantial pay hikes for the second straight year this year to cope with high inflation. That bodes well for new vehicle sales. In Australia (which is a 100% import market and has no local production), automakers are offering an extensive array of models across various price brackets, including xEVs. That is helping to support sales.

At present, the risk to the region’s 2024 sales forecast of 46.5 million units is skewed to the downside. Yet, there is a chance that the diverse Asian markets will prove to be resilient and expand faster than we currently expect.

*China’s sales data and forecast are currently based on wholesales data that includes exports. We are planning to switch to a domestic sales forecast that excludes exports in the coming months.

Meg Sunako, Senior Analyst, Economics and Topline Forecasts, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center