The Chinese car market encompasses around fifty Electric Vehicle (EV) brands, many supported by sales groups with abundant resources. The sales group will tend to research and invest in their own battery assembly facilities. However, the less financially privileged brands are unlikely to have the financial resources to do the same. This makes outsourcing their battery pack assembly a better business decision. Mostly they have sourced battery packs of consistent and straightforward design which typically follow a similar pattern in which cells are put into modules and the modules are then assembled into the battery packs themselves. Third-party assemblers can supply multiple OEMs with battery packs from the same production line, making this business model feasible.

More recently, the Battery Electric Vehicle (BEV) market has become far more competitive, constantly pushing OEMs to advance technology to maintain a competitive business case. One of the key performance metrics for automotive batteries is battery capacity. However, existing battery chemistries are reaching development thresholds, with no commercially viable breakthrough chemistry on the horizon. Therefore, the industry is continuously looking for relatively uncomplicated ways to increase the energy density of batteries in the near term, without the time lag, uncertainty and cost of developing new electrode chemistries. Hence OEMs are working hard to invent new battery pack designs, helping to optimise the performance of existing battery ingredients.

A key way to increase pack energy density is to utilise all the space in the pack by packing the cells more tightly or employing packing technologies such as Cell-to-Pack (CTP) and even Cell-to-Chassis (CTC), enabling a reduction in parts count and ‘dead’ space. Since the battery acts as a structural part of the vehicle for CTP and CTC design approaches, intimate cooperation between the battery pack and body in white engineering is required to ensure vehicles are safe, efficient, and rigid. Hence, in-house battery pack design and integration are becoming more favourable.

Moreover, the increasing demand for EVs means OEMs need a stable, reliable, and cost-efficient battery pack supply. Some common battery pack supply chains in China include:

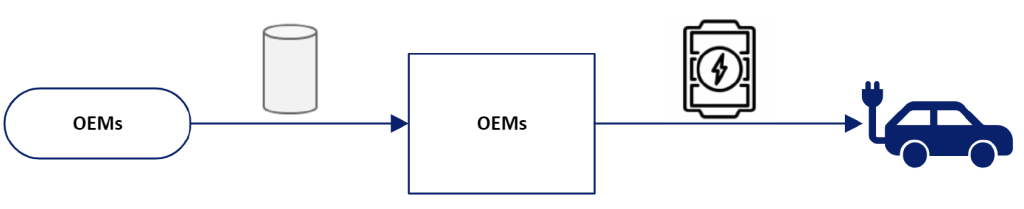

OEMs develop a complete battery supply chain

The most efficient solution is for OEMs to build every element of their batteries, from cells to complete packs – this is what Chinese EV giant BYD does. The biggest advantage of having full control of the battery supply is to employ technologies that allow low-cost, scalable platforms, and architectures built around them. A complete supply chain means OEMs can employ high flexibility in cell and battery pack specifications to satisfy the fast-changing technical demands of the BEV market. In addition, the cell manufacturing facility and battery assembly plant can be located close to the car assembly plant. This helps OEMs decrease logistic costs and increase profit margins.

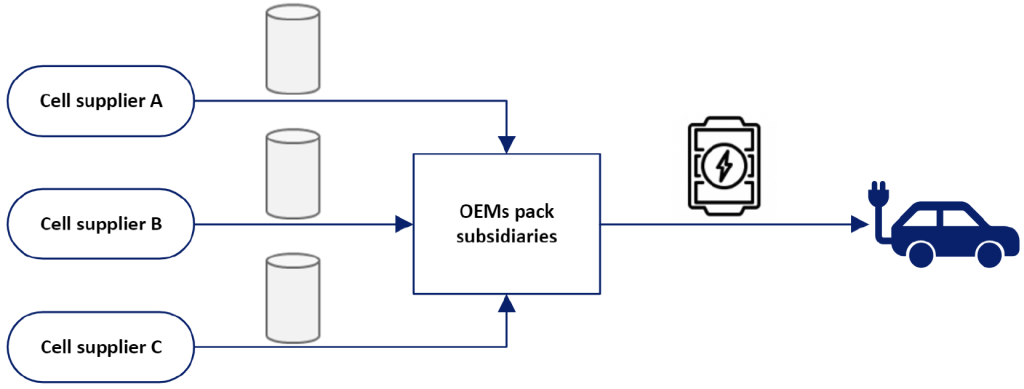

OEM pack subsidiaries

Having a battery pack subsidiary can help OEMs stabilise their battery supply by diversifying their cell sourcing strategies. This approach can help the company stabilise its supply chain without the full related cost of cell research and production.

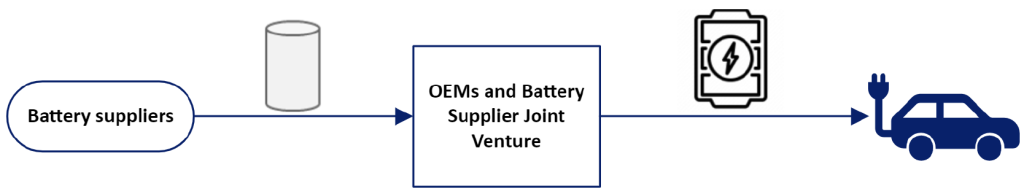

Joint venture with major battery suppliers

Some OEMs chose to form joint ventures with major battery suppliers. Similarly, to the subsidiary model, this approach stabilises supply because battery makers are likely to prioritise cell orders from their business partners. In addition, the capital cost can be split with multiple partners to lower financial risk, for example, if a change in battery chemistry is required.

OEMs purchase a part-complete/finished product from a major battery supplier

Under this method, OEMs can benefit from the latest advancements in battery technology without heavily investing in assembly facilities and battery research. For example: Zeekr’s 009 model’s 140 kWh battery pack is entirely made by CATL and utilises its latest CTP 3.0 technology.

To conclude, the shift in the supply chain is making the independent battery pack assemblers’ business difficult to sustain and will eventually lead to sector decline in our view. However, some OEMs still outsource their packing step for entry-level models, such as Wuling for its Xingguang and Hongguang mini models. They are generally more focused on price advantage rather than performance. Therefore, the major battery pack assemblers will continue to exist until more advanced pack designs (CTP, CTC) become widespread and eventually industry standards.

Chun Fung Lee, Analyst, Powertrain Forecasts, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center. For more details on GlobalData’s designated Global Light Vehicle Powertrain Forecast module, click here