Highlights of the Paris Motor Show 2024

It was heartening to see the Paris Motor Show bustling as visitors (including myself) crowded around the many new releases and prototypes with intrigue, especially after a wholly different experience at the Geneva International Motor Show earlier in the year.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The Western OEMs were present in far greater numbers in Paris and, although not all were world premieres, they exhibited multiple new models. To name a few, Alpine displayed its A290 sporty electric hatchback and premiered the A310 β concept while Citroën showed a “95% complete” version of the flagship C5 Aircross. Ford even enlisted Eric Cantona to unveil its new all-electric SUV, the Capri. Visitors flocked to Renault’s stage to see the all-new 4 and 5 BEVs (Battery Electric Vehicles), with the former model a clear show favourite judging by the crowds it attracted.

A robust contingent of Chinese automakers was also in attendance, with BYD, GAC, Leapmotor, and Xpeng joined by the lesser-known brands Aito, Forthing, and Hongqi. Among the models on display from these brands, the launch of BYD’s Tesla Model Y competitor – the Sealion 7 – garnered a lot of attention. The stands for Mini’s electrified Cooper and Aceman plus Dacia’s Spring were also busy, but these models are built in China despite being owned by European OEMs. There are clear parallels that can be drawn between the show and the European Auto industry as a whole – Chinese manufacturers are offering extremely competitive products and European automakers are striving to catch up on price.

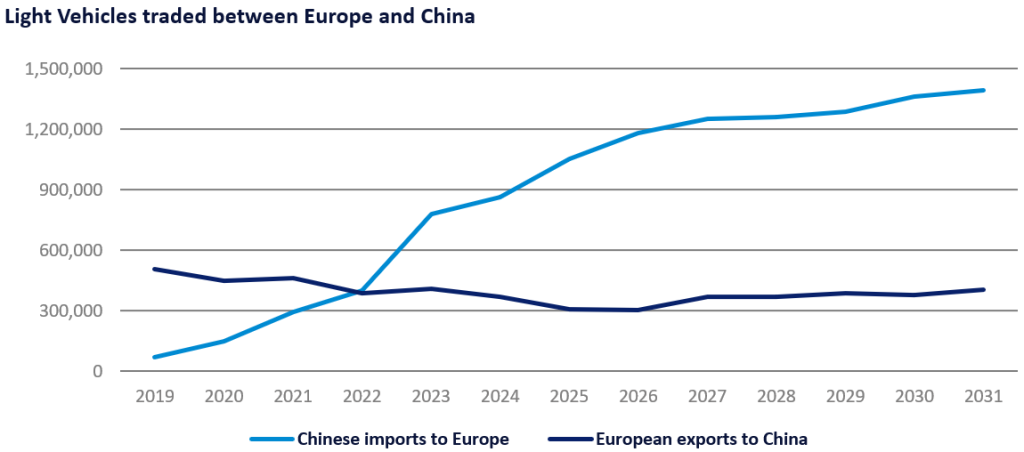

Note: The data show bilateral trade of Light Vehicles between Pan-Europe (referred to as Europe in this article) and China and are measured by mapping the origin of actual sales/registrations rather than wholesales. This method gives a better indication of the preferences of the end consumer (i.e. actual demand) as the data is not potentially skewed by large volumes of cars sitting unsold at dealerships.

China’s pivot towards Europe

Chinese automakers can now compete in terms of quality, technology and, most importantly, price in the European market. Indeed, the average retail price of a Chinese BEV was 30% lower than its European competitors at the start of 2024 even with a 10% import tariff on Chinese-built BEVs, according to JATO Dynamics. This huge margin is possible due to China’s low labour costs, access to a bigger domestic market, control over battery supply and government support. The relocation of BEV production from European OEMs to China to benefit from its production cost advantage, and the influx of Chinese models to Russia, have also substantially boosted Chinese imports to the region.

Elevated costs for materials, energy, and transport (all exacerbated by the Russia-Ukraine war), have inflated car prices in Europe, with the economic climate also squeezing disposable income for consumers. This has reduced the competitiveness of European-built cars, especially against cheaper Chinese-sourced models like the BEVs from Dacia and MG as well as Tesla. With its domestic market slowing, it has been in China’s interest to expand to outside markets, such as Europe. From the EU’s perspective, however, much of China’s competitive advantage has not been accrued fairly, and its members recently voted to adopt higher import tariffs on Chinese BEVs from November 2024 for at least five years. The new levy will be between 17.8% and 45.3% in total, depending on the OEM, with both BMW and VW now qualifying for 31.3% as “cooperating companies”.

Tariff consequences

It is uncertain whether this will benefit European operations on balance, despite losing market share to Chinese OEMs in export markets and in Europe, especially in the BEV segment. Indeed, the three big German automakers including Dacia, Volvo, and Tesla are all exposed to tariffs on BEV models and brands solely sourced from China, and this is likely to hit profitability. Conversely, European-built exports to the more cost-conscious Chinese market could fall severely if China retaliates with punitive tariffs which could lead to more offshoring to China. Consumer sentiment in China may also change to favour domestic brands in response to what the Chinese may see as hostile protectionism by the EU.

The main worry, however, is that Chinese-built BEVs have such a big cost advantage that it will still be too costly for European brands to onshore manufacturing back to Europe and that competitors can absorb these levies and still be more competitive on pricing. The likelihood of this being the case is raised by tariffs being applied to CIF (Cost of Goods, Insurance & Freight) border prices, which means the impact on retail price to the end user will be lower than the headline rate. It is also important to remember that not all Chinese imports are BEVs impacted by tariffs and that not all European markets, such as the UK and Russia, are obliged to adopt these tariffs. With this in mind, we expect Chinese imports to continue their upward trajectory despite the harsher trade environment.

European OEMs, therefore, are working to reduce costs and offer more affordable BEVs and not depend solely on government intervention to regain competitiveness. This trend was also showcased at the Paris Motor Show, with Citroën displaying the ë-C3 and ë-C3 Aircross, Renault showing its R4 and VW the ID.GTI which is based on the ID.2all concept. Each of these models is expected to compete on price with Chinese competitors.

The rise of Chinese imports to Europe should also be stemmed to some degree by reshoring production, with the electrified Mini models set to be produced at the group’s Oxford plant in the UK from 2026. Import volumes should be further tempered by Chinese OEMs’ plans to localise production in Europe, including Leapmotor at Stellantis’ plants from the second half of 2024, Chery in Spain at the end of 2025, and BYD at its all-new facilities in Hungary and Turkey from 2026.

Overall, we expect Chinese imports to Europe to increase by around 350k units between 2025 and 2031 and for European exports to China to grow by a much smaller margin of 100k units, over that time.

James Norris, Manager, Production Forecasts

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.