The European Union (EU) announced it will impose provisional tariffs on Chinese Electric Vehicle imports from 4 July through to 2 November 2024. After this, the tariffs will apply definitively unless a qualified majority of EU member states vote against them, or negotiations with China reduce the penalties. It is also important to note that the tariffs are levied upon CIF (Cost of Goods, Insurance & Freight) border prices so that the impact of the penalty on the end user retail vehicle cost is diluted.

Can Chinese car manufacturers still flourish, despite the upcoming tariffs? GlobalData’s forecast suggests yes, even though the tariffs may delay the advance of BYD, MG and others.

Prevailing Chinese advantage on pricing

The imposition of additional tariffs has stemmed from an investigation which concluded that Chinese government subsidies had allowed Chinese Battery Electric Vehicles (BEVs) to be sold at artificially low prices. However, Chinese companies have also developed genuine cost advantages through vertical integration and controlling key components such as batteries in the supply chain. Manufacturing more of their own components allows OEMs to achieve long-term cost advantages and stronger profit margins.

While some Chinese OEMs have this apparent advantage, their brands are only just getting started when it comes to gaining recognition, reputation, and sales volume traction in Europe. In this brand-development phase, keeping car prices higher helps to build a reputation for quality and residual values. BYD, for example, has been selling its products in Europe for sometimes double or nearly triple its pricing in China for an equivalent model. Doing so allows companies like BYD to leverage much higher profit margins when selling in Europe in comparison to the price-cutting environment in China.

So even after the application of tariffs, the prevailing cost advantage could allow Chinese OEMs to keep prices below those of their competitors in the European market, while still charging well above pricing levels in China. However, the underlying profit margins would be eroded to varying extents based on the additional tariffs, and the new regime could eventually lead to costly and time-consuming localisation of vehicle assembly in Europe.

Undercutting on pricing leading to success in cheaper segments

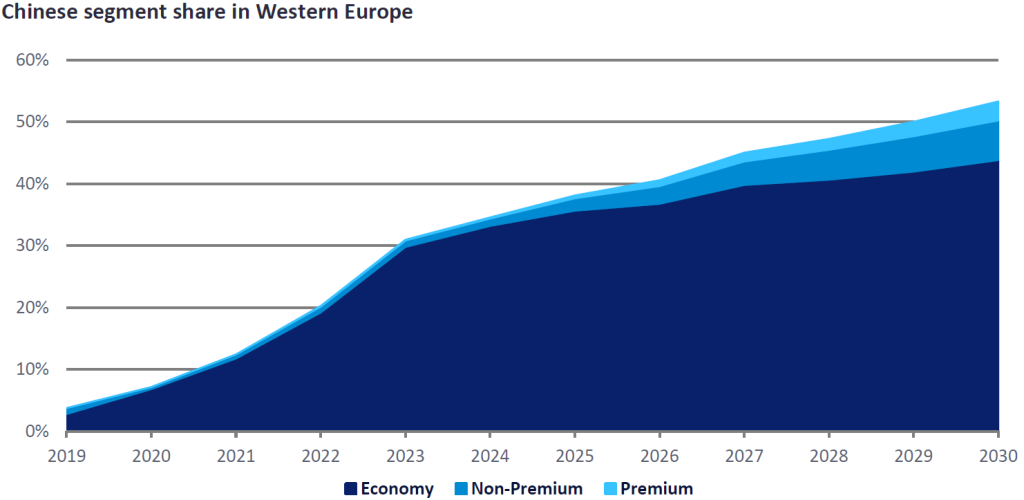

Of the Chinese car brands, MG and Chery have sold the most cars in Europe so far. Part of this is due to sales of their non-electric cars, which the new tariffs are not targeting. By targeting the Economy segment, MG and Chery have undercut Non-Premium segment manufacturers, such as Volkswagen. During a period where inflation and interest rates have been elevated, MG and Chery cars have provided attractive options to European consumers struggling with high vehicle pricing.

Despite the upcoming tariffs, we do expect to see further Chinese brand growth in the Economy segment. Because European brands currently lack Chinese BEV-makers’ efficiencies and lower cost structure they are having to launch entry-level BEVs later to avoid losing money, giving Chinese BEVs in these segments a clearer run.

Longer road to success against Premium rivals

The Premium segment, dominated by Audi, BMW, Mercedes-Benz, Tesla, and Volvo, is where we expect to see Chinese brands face more headwinds in Europe. In this segment, purchasing decisions are not just based on price, but also perceived quality, customer service, residual value, and maintenance cost – factors that are hard to establish quickly. So far, Nio and some BYD models such as its Seal sedan, have been aimed more squarely at Premium segment pricing. However, sales have been a tiny fraction of the volumes shifted by incumbent Premium brands. The European Premium market is notoriously hard to break into, with Hyundai Group’s Genesis brand also finding its second attempt in the continent difficult.

China has used the switch to BEVs as an inflection point, with companies like BYD and NIO pushing the boundaries of battery innovation in a bid to outpace Western carmakers that built legacies around internal-combustion engine dominance. It is no longer a question of whether China can produce similar or even better BEVs than Western OEMs when it comes to the technical specifications of an electric car. Yet BYD, with its state-of-the-art ‘Blade’ battery technology, is still navigating the nuances of European tastes. Following feedback from European customers, its ‘Build Your Dreams’ badging across the rear of its vehicles was removed in favour of the simpler BYD logo.

Becoming a brand that customers aspire to buy, not just in automotive but in any sector, often requires a longstanding legacy where quality and brand identity are synonymous with the name or logo. Therefore, when it comes to success in the Premium segment, the likes of BYD, NIO and Zeekr will still have their work cut out when it comes to developing brand image and becoming a status symbol in Europe.

Sammy Chan, Manager, Sales Forecasts, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.