The Vietnamese economy and automotive market have been growing fast, in the shadow of its giant neighbour, China. Since the country signed a trade agreement with the US and joined the WTO in the 2000s foreign investment and exports have surged dramatically – and helped boost the nation’s income. In more recent years, the economy has benefitted from global corporations (and even Chinese companies) relocating their production facilities from China to Vietnam amid rising labour costs in China and heightened tensions between China and the West. Vietnam has been climbing up the value chains, too, with an increasingly skilled workforce and a growing IT industry. The country’s GDP per capita almost tripled from $1,290 in 2002 to $3,600 in 2022 (in 2015 US dollar terms), the fastest growth among the ASEAN 5 countries.

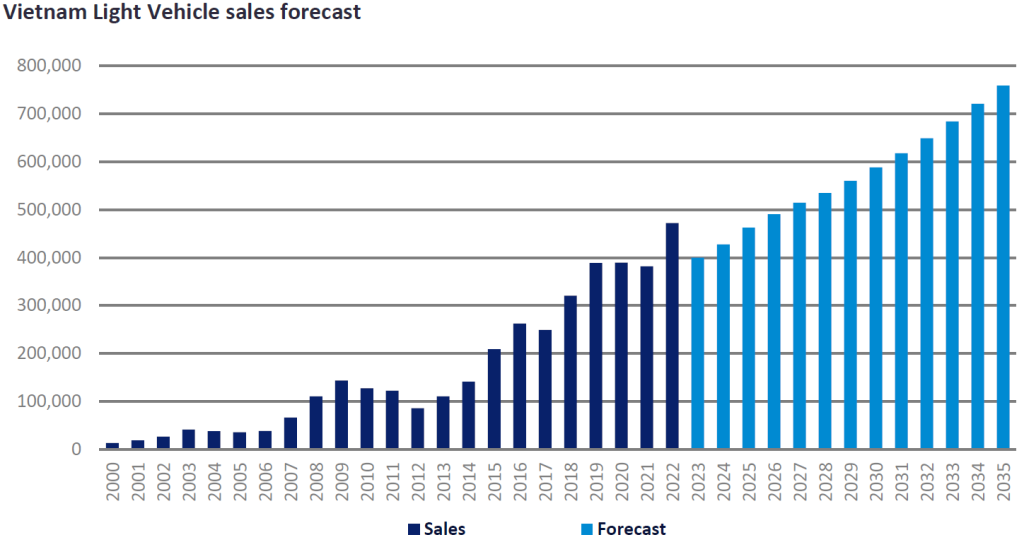

Along with rising incomes, the country’s Light Vehicle sales quadrupled over the past decade to a record high of 472k units last year. Between 2012 and 2022, the compound annual growth rate of Light Vehicle sales reached 18% in Vietnam, far exceeding that of China (3.4%), India (3%), and its peers in ASEAN. Indeed, Vietnam has been a rising star in Asia.

This year, however, the Vietnamese automotive market has tumbled very badly. Light Vehicle sales declined by 25% YoY in the first nine months of 2023. That is owing partially to a high base effect, as sales last year were inflated by the government’s temporary reduction in the vehicle registration fee. Higher financing costs and tightened credit conditions have hit sales as well. Yet, the main factor behind poor sales results was the collapse in consumer and business confidence, as the country’s once bubbling property market has gone bust after the government took measures to rein in leverage and launched anti-graft campaigns.

Vietnam’s property woes echo those in China. Like in China, Vietnamese developers expanded aggressively in recent years, tapping into bank loans and bond markets. And individuals and businesses invested heavily in real estate to profit from soaring property prices. Yet, the fever suddenly came to an end when last year the government made a series of high-profile arrests of top developers and regulators for fraud and corruption, triggering a bank run. Hundreds of bankruptcies among smaller developers and the suspension of unfinished property projects were enough to depress confidence in the economy – and new vehicle sales. To support the struggling automotive market, the government re-introduced the temporary registration fee reduction from 1 July to 31 December 2023. So far, however, the scheme has failed to kick-start the market.

The turmoil in the property sector, as well as an increasingly uncertain global economic outlook, has made us revise Vietnam’s sales forecast downward through the long term. Compared to our projections in July 2023, we have cut the sales forecast by nearly 10% for 2023, 5% for 2024 and almost 14% for 2035. We now expect that Light Vehicle sales will decline by 15% to 400k units this year and reach 760k units in 2035, compared to 874k units projected in July.

Over the long term, there is no doubt that the economy will experience turbulence and so will the automotive market. Remember, Vietnam is still transitioning from a state-controlled economy to a market-driven one. Its economy has a wide range of deep structural issues, such as the elevated levels of public debt and government budget deficit, and the fragile banking sector. The dong (Vietnam’s currency) is still loosely pegged to the US dollar, which could eventually be broken if financial turmoil hits the economy – just as happened in the region during the 1997/98 Asian Financial Crisis.

Nonetheless, we remain cautiously optimistic about Vietnam’s sales outlook. Real GDP per capita has exceeded US$3,000, which is considered to be a threshold for fast motorisation, and it is forecast to rise from US$3,600 last year to US$6,750 by 2035 (which will be higher than Thailand’s current GDP per capita of US$6,300.) Vietnam’s population is large (98 million), and while ageing, over 50% of the population is under 35 years old, and the cohort of age 65 and older accounts for just 9% of the total population at present (compared to 15% in Thailand). Passenger Vehicle density is estimated to be extremely low at about forty units per 1,000 adults (compared to 540 units in Malaysia, 240 units in China and 230 units in Thailand – note, Thailand’s figure includes Light Commercial Vehicles, i.e., Pickup Trucks). The positive income growth prospects and favourable demography warrant that the Vietnamese auto market will continue to expand at a solid pace over the long term.

As such, even after the downward revisions in our sales forecast, we expect Vietnam to remain the fastest-growing automotive market in the region over the next decade. Between 2023 and 2033, the compound annual growth rate of Light Vehicle sales is forecast to be 5-6% in Vietnam, compared to 1% in China, 3-4% in India, Indonesia and Thailand, and 1-3% in Malaysia and the Philippines – but that all depends on developments in the global economy.

Meg Sunako, Senior Analyst, Economics and Topline Forecasts, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center