Cutting through the noise, GlobalData’s analysts are on the ground at Auto China 2024 to help you identify the risks, the opportunities, and the hyperbole.

Which brands and models are going global? Any planned production facilities? Are solid state vehicles really imminent? What’s happening to the foreign brands in China? All this and more will be assessed by our team of analysts at the event and will help shape our global forecasts.

All major markets around the world will be impacted one way or another by the announcements made in Beijing over the next couple of weeks. We start below with John Zeng’s take on China’s next-generation smart cars.

Can China’s tech giants succeed where Apple failed? From electrification to intelligence

- The rising power of China automakers overseas is putting pressure on international brands

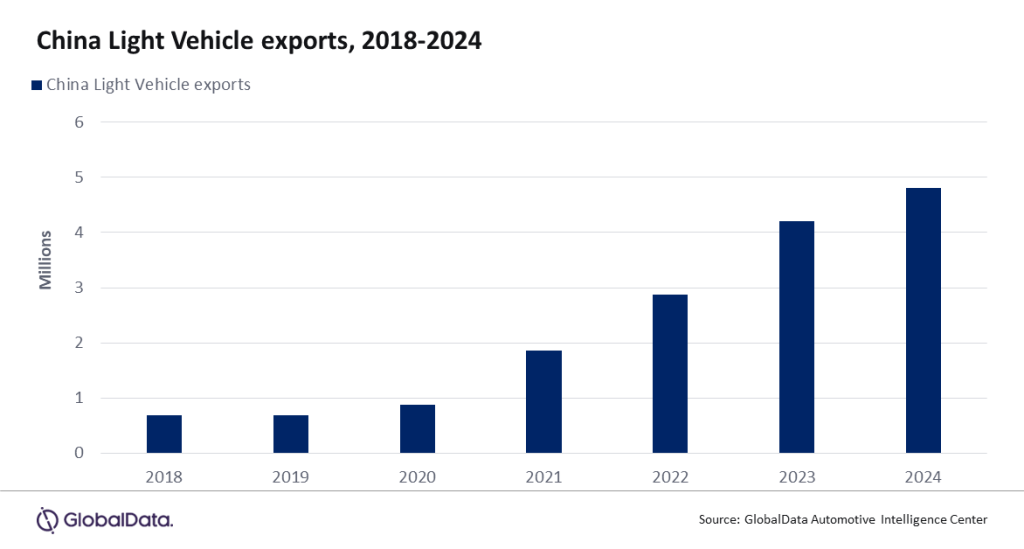

- More growth expected, with Q1 2024 China exports increasing by 34%

- Only in the Chinese auto market can internet giants successfully enter the automotive industry as US giants such as Apple abandon their plans for intelligent models

The China auto market is booming. In 2023, domestic passenger car sales increased by 4.5% to 22.5 million units, and exports exceeded 4 million for the first time—surpassing Japan to become the world’s largest exporter. The growing power of local automakers overseas is placing increasing pressure on international brands worldwide, leaving some international brand manufacturers wondering how to respond. If any action is to be taken, it should be done quickly, as we expect the China auto industry will maintain its high growth rate this year, with Q1 domestic increasing by 6% year-on-year and Q1 exports increasing by 34% to 1.09 million units.

So, what are the drivers? Well, one point to note is that March saw the official launch of Xiaomi SU7. This marked a competitive shift within China’s passenger car market from ‘electrification’ to ‘intelligence’. The ‘Internet of Everything’ ecosystem brought by Xiaomi Auto has set a very high entry threshold for other car manufacturers. At present, Huawei and Xiaomi have become the leading autonomous vehicle players in the Chinese market. Huawei has set a clear goal of achieving Level 4 and Level 5 autonomous driving by 2025 and 2030, respectively. Relevant data shows that in 2023, the penetration rate of L2 assisted driving in the Chinese market has exceeded 35%.

From the perspective of the global automotive industry, only in the Chinese auto market can internet giants successfully enter the automotive industry and quickly seize their right to speak. In Europe and the US, such giants are largely abandoning their plans to build, making it possible for the Chinese market to grow into a ‘smart car’ market independent to the rest of the world. Consequently, the automotive supply chain will be quickly reshaped.

John Zeng, Director, Asian Forecasting, GlobalData

As part of GlobalData’s coverage of Auto China 2024, we are offering a complimentary edition of our China Automotive Monthly Market Update report. This report provides up-to-date analysis of current demand and assessments of OEM strengths and weakness in China, helping you to understand and track the latest market changes.

Please click here to login or register to download the report.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.