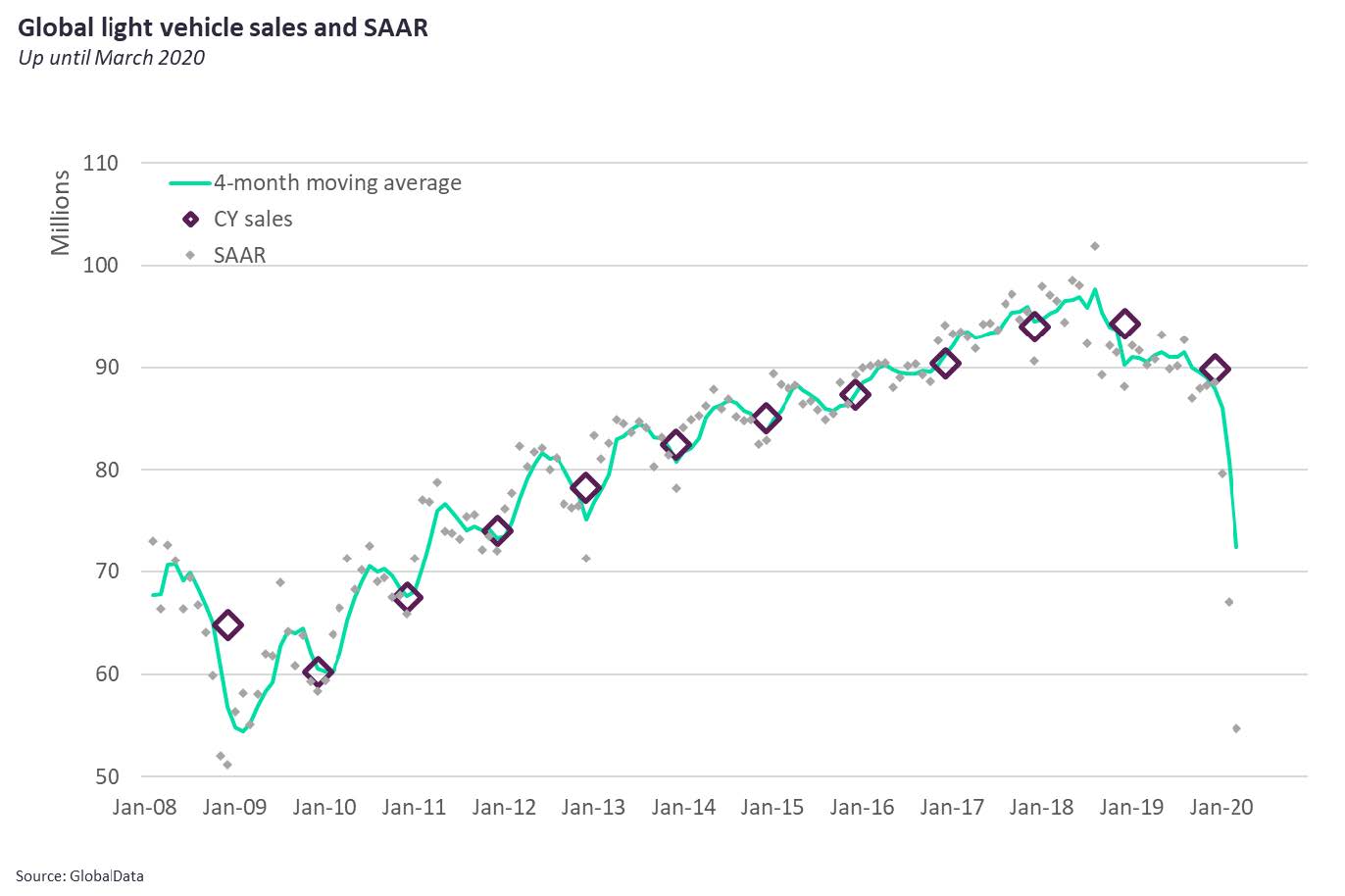

Our analysis shows that the global light vehicle market hit a seasonally adjusted annual running rate (SAAR) of just 54 million units in March, which compares with almost 90 million light vehicles sold globally in 2019.

The decline in trend in the first quarter of the year is sharp and stark. The 54 million units SAAR figure for March compares with a SAAR of 67 million units in February and just under 80 million units in January.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The speed of decline is worrying and we expect to see April – a month in which many vehicle markets were seized up fully by COVID-19 response population lockdowns – to see a further deterioration to trend.

It looks like the hit to the global vehicle market this year will be much greater than in the 2007/8 financial crisis, when growing emerging markets such as China helped to provide support.

Our base COVID-19 global light vehicle sales scenario forecasts a fall of 16% on 2019 to 75 million. How does this compare with the last big recession? Well, China was a smaller market then, but a rapidly growing one. In 2007 the global vehicle market was 66.6 million units, declining to 64.8 million in 2008 and 60.2 million in 2009 (a relatively mild looking 7% annual decline). The lower falls then reflect the impact in our global composite of a rapidly growing Chinese market; the hit was felt severely in the US and Europe – the US light vehicle SAAR running rate sinking below 10 million.

Forecast declines for the global SAAR this year are heavily weighted to Q2 with measures to suppress the virus allow for recovery from Q3 onwards. When conditions improve, a body of pent-up demand will quickly appear in new registrations. What is key is how real and sustainable demand shapes up after that, given the state of economies as well as consumer and business sentiment.

Comparisons of this public health crisis-based slump with the international financial crisis and subsequent recession during the 2007-2009 period show an interesting structural difference in the automotive sector.

The crisis at the end of the noughties had its origins in the financial sector and hit the developed economies especially hard. Emerging markets – especially China – were a lot less exposed by a sub-prime lending crisis in North America that rapidly spread to the domestic banking sector, with investment bank linkages that hammered the financial centres of New York and London. The same was largely true of the subsequent recession in the so-called ‘real economy’. As developed countries’ economies suffered, China’s economy continued to grow at an impressive rate with burgeoning domestic demand taking over from exports as major driver.

Back in 2007, China’s light vehicle market was just 6.4 million units. It grew to 8.6 million units in 2008 and 9.6 million units in 2009. China’s automotive demand curve had passed an important inflection point and was on a high-growth trajectory to becoming by far the world’s largest vehicle market. By the middle of the next decade it was in the mid-twenties and by 2017, it peaked at 28.3 million units.

China’s market has slipped back since – in 2019 it was 25.4 million units – but the rising trend in the 2007-09 period helped to support the global SAAR as sales in the US and Europe plummeted.

Our calculations show that the global light vehicle SAAR back then declined to a low of 51.2 million in December 2008, which is below the number of 54 million recorded for March 2020. That is perhaps surprising given the apparently ‘unprecedented’ strength of the slump this time around, including the market collapse in China, where the crisis began. China’s market movement is key.

The China market’s relative strength and growth in 2007-09 lifted the global SAAR then. If we take China out of the calculations – so look at the global market minus China (SAAR-C) it works out at 41 million units last month compared with 44.6 million in December 2008. That suggests the automotive hit this time around is much worse, China excepted, than at the nadir seen in the last recession.

Similarly, China’s much bigger market will offer the global SAAR support in the coming months, even as the crisis hits a low spot in the US and Europe. China was first into the COVID-19 crisis and is the first country to come out of it, albeit with caveats surrounding the dangers of further outbreaks.

As China’s SAAR numbers pick up over the coming months, they will help to counter the big market declines expected elsewhere. China’s vehicle market decline has been considerable, but the low point for the Middle Kingdom was in February – with sales of just 217,000 units. In March China’s vehicle market had recovered to 1.1 million units – still well under where it should be in normal times, but it is growing again, with dealerships now open and factories reporting much higher capacity utilisation after February restarts. The recovering trend in China will support the global SAAR in April and May, but the question is, how much?

When we enter the third quarter of this year, demand should finally be returning to other major global markets to get us to our 75 million unit 2020 base case forecast. However, margins of error for the large implied market movements in the second and third quarters are inevitably large at this stage of an unprecedented global event. There are huge uncertainties surrounding the timing of any relaxation or ending of still necessary public health restrictions on populations across the world, which means the vehicle demand outlook faces an unusually wide spectrum of possible outcomes.

We do know that the crisis impacting the auto industry this year is unprecedented. With most automotive plants in Europe and North America closed until the end of April, some 4.1 million light vehicles will have been removed from production. We estimate a revenue loss of $131.1 billion to the vehicle manufacturers alone. The COVID-19 crisis is clearly exacting a heavy toll on the global auto industry right through the value chain, from retailers to vehicle manufacturers and parts suppliers.

Our forecast is subject to revision as we learn more about the immediate impacts of this unprecedented crisis and make judgments on how underlying demand is shaping up for the short- and medium-term. Make no mistake, this recession and the market adjustments it forces are like no other.