Summary

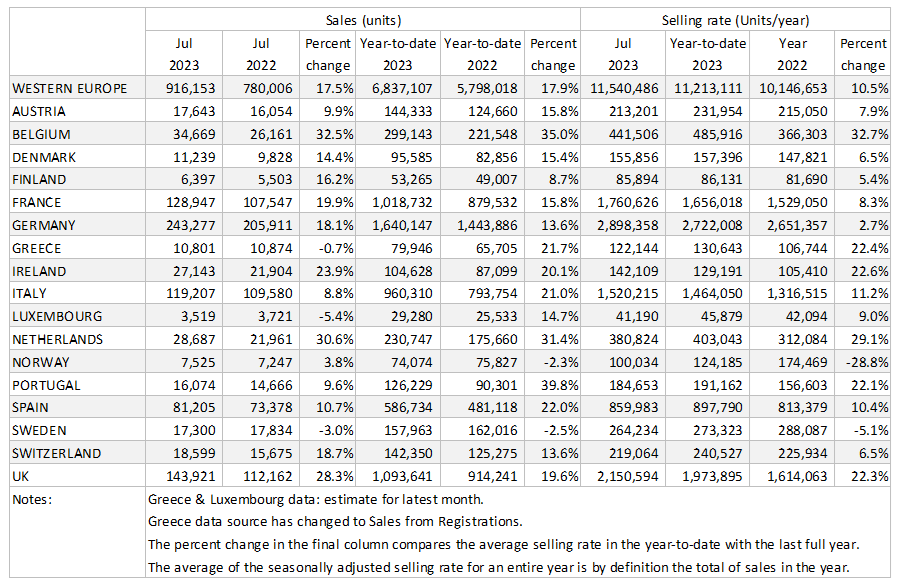

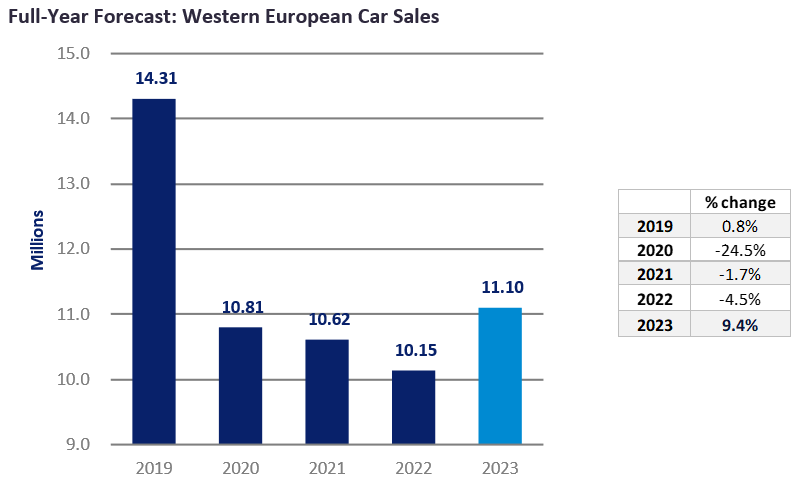

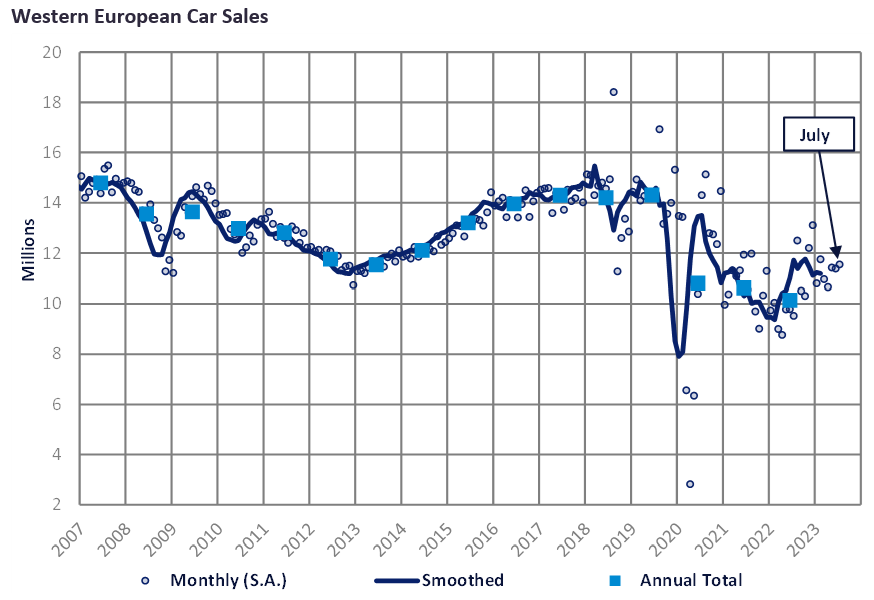

- The Western Europe PV selling rate stood at 11.5 million units/year in July, up fractionally on both May and June. Registrations for the latest month totalled 916k units, representing an increase of 17.5% over July 2022. However, the market is still down 23% from pre-pandemic 2019 levels.

- The UK performed well, with raw monthly registration of 144k units (+28.3% YoY), this representing the 12th consecutive month of YoY growth. While the other major markets saw performances in line with expectations, Spain saw a sharp MoM decline in the selling rate, with monthly registrations to 81k units (still, +10.7% YoY).

- For another month, all the top five Western European markets, barring Italy, experienced double-digit YoY growth for July 2023. While 2022 is a weak base of comparison, it is reassuring to see a solid recovery in these countries as production improves and backlogged orders are met, raising the overall 2023 forecast to 11.1 million units up from the previous report (+9.4% YoY).

Commentary

The Western Europe PV selling rate increased slightly to 11.5 million units/year in July, with total raw monthly vehicle registrations of 916k units (+17.5% YoY). The region’s market has benefited from an improvement in supply constraints, production, and higher delivery rates for consumers. Year-to-date, the region has recorded 5.8 million units, which is 17.9% higher than YTD July 2022.

The German PV market performed close to expectations in July with 243k units sold (+18.1% YoY) and a selling rate at 2.9 million units. So far, the market has accumulated 1.6 million units YTD which is 13.6% higher than the YTD July 2022. This growth trend can be attributed to a further easing of supply constraints and component availability as OEMs fulfil backlog orders. The UK PV market performed well in July 2023, registering 144k units (+28.3% YoY). This July’s result is the best since July 2020, when pent-up demand for new cars was released after lockdowns. With a selling rate of 2.2 million units/year for last month, the PV market has sold 1.1 million units YTD, 19.6% higher than YTD July 2022.

The French PV market’s registration volumes were close to expected at 129k units in July, growing almost 20% YoY with a selling rate of 1.8 million units/year. The market sold 1 million units YTD, 15.8% higher than YTD July 2022, indicating that an easing of supply constraints and improved vehicle production have enabled the market to build on its 2022 performance. The Italian PV selling rate increased MoM to 1.5m units/year in July, despite a slight drop in the raw monthly registration figure to 119k units. While, this figure represents an 8.8% YoY increase, this is largely due to the various headwinds facing the automotive sector in 2022 that have made it a weak base of comparison. Spain’s PV market fell to 860k units/year in July, its lowest level thus far this year, following a sharp MoM drop in the raw monthly registration figure to 81k units. Despite the fall in registrations, this still marks a 10.7% YoY improvement over the same time last year.