Volkswagen Group will purchase critical semiconductors directly from a group of chips suppliers, rather than rely on its main component suppliers to source them as part of their operations.

VW Group began striking deals directly with chips companies late last year.

Previously, VW Group said that electronic components like control units were procured and the Tier 1 suppliers were largely free to decide which parts they used. Going forward, in close collaboration and partnership with Tier 1 suppliers, VW Group procurement will define which semiconductors and other electronic parts are to be used.

VW said that by 2030, the average value of these components is expected to more than double from around EUR600 per vehicle.

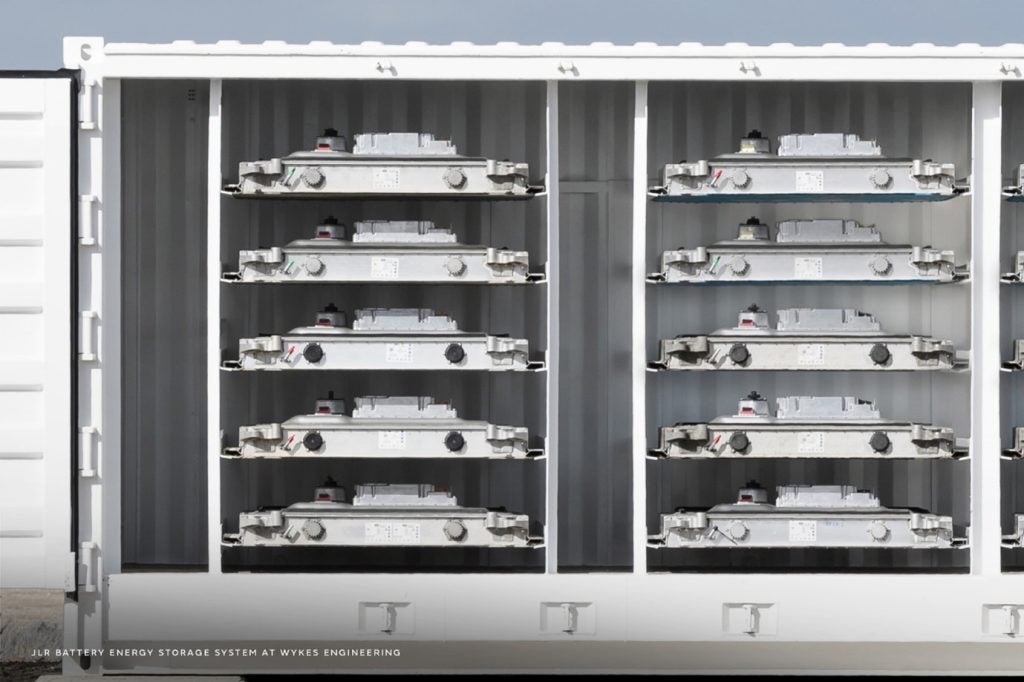

In response to ongoing COVID-19 repercussions and chip shortages, Volkswagen launched the COMPASS initiative in 2022. Initially focused on protecting the vehicle programme, the initiative has expanded to address broader semiconductor supply chain challenges.

According to VW, industry assessments show that while currently fifth among major buyers, the automotive industry is projected to rise to third by 2030, with an expected market volume of about US$147bn.

VW notes that semiconductors are increasingly indispensable in the automotive industry: not only are they elementary for mass production, but they are also innovation drivers and key for launching new products on the market.

The greatest increase in demand for semiconductors is the result of the increasing electrification of vehicles and the trend towards the growing use of assistant functions through to fully autonomous driving. The corresponding innovations will also result in the use of more sophisticated semiconductors, while the demand for more common semiconductors will remain or even rise further.

Vehicle innovations are heavily characterised by the use of semiconductors: in 1978, only eight semiconductors were installed in a control unit of a Porsche 911. Today, a Škoda Enyaq has around 90 control units with some 8,000 electronic components.

“A high degree of transparency in the semiconductor value chain – the exact knowledge of the parts used – enables us to better determine the global demand and availability of these components. This is underscored by risk management which, in future, will extend to the level of individual electronic parts and help us detect bottlenecks early on and avoid them. For strategically important semiconductors and even the group’s own planned developments in the future, we will rely on direct purchasing from the semiconductor manufacturers,” said Dirk Große-Loheide, Board Member for Procurement of Volkswagen Passenger Cars and member of Group management.