According to preliminary estimates, US Light Vehicle (LV) sales grew by 0.1% YoY in January, to 1.06 million units. If it were not for the presence of an additional selling day as compared to January 2023, the result would have been in negative territory. Sales were somewhat disappointing compared to expectations, although January came on the heels of a huge surge in activity in December.

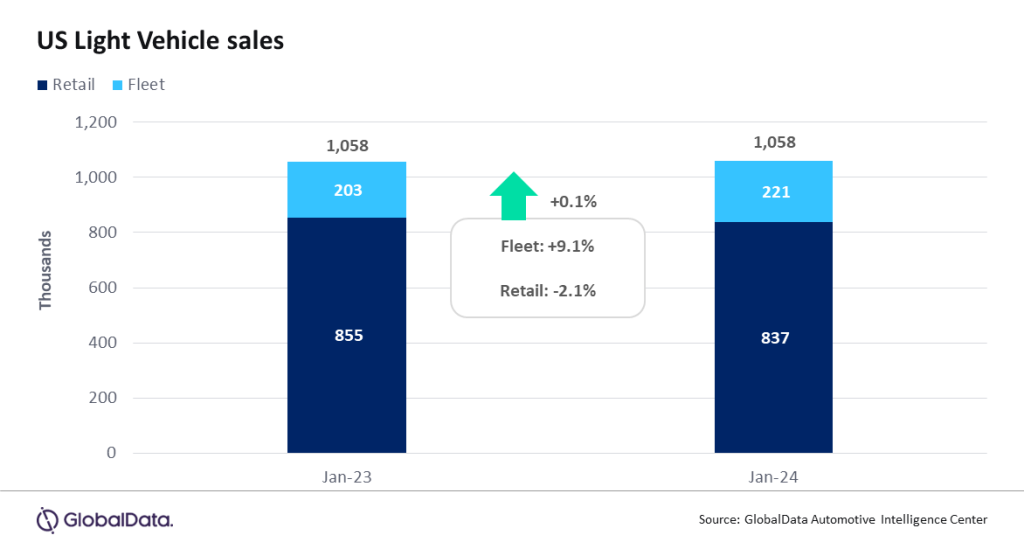

US Light Vehicle sales totaled 1.06 million units in January, according to GlobalData. The annualized selling rate was 14.8 million units/year in January, down from 16.3 million units/year in December. The daily selling rate was estimated at 42,300 units/day in January, compared to 56,800 units/day in December. According to initial estimates, retail sales totaled around 837k units, while fleet sales accounted for approximately 221k units, representing around 20.9% of total sales. If confirmed by final data, that would be the highest fleet share in 11 months. Historically, it is not unusual for fleet sales to account for a larger share of the total market in the opening months of the year, as retail activity takes a breather following the end-of-year push.

David Oakley, Manager, Americas Sales Forecasts, GlobalData, said: “After a flurry of sales activity in December, there was always a risk that January would see some payback, with fewer consumers on the hunt for a new vehicle, and so it transpired. Apart from normal seasonal effects, the current environment is such that buyers remain price-sensitive and if the right deals are not available, volumes are liable to suffer. Generally speaking, more affordable segments such as Compact Non-Premium SUV, Compact Non-Premium Car and Small Non-Premium SUV performed well in January, but not for every OEM. In addition, cold and wet weather impacted various parts of the country at different times in the month, and this may also have played a role in keeping sales subdued. Traditionally the lowest-volume month of the year, January is often not a good indicator of how the remainder of the year will turn out, and that may prove to be the case again in 2024.”

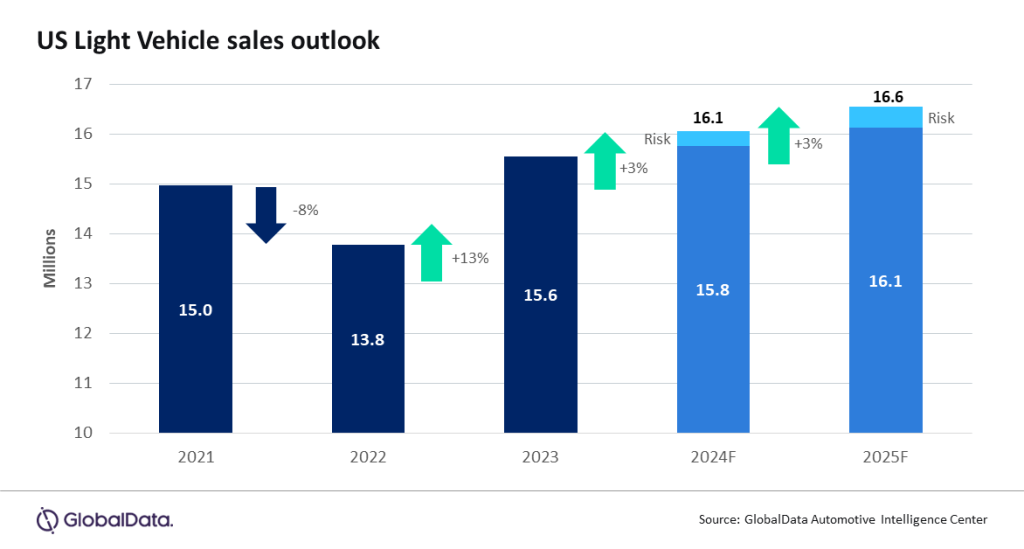

While weakness at the start of 2024 was expected and it follows a pattern more consistent with a normal seasonal pattern, January ended slightly below expectations. The pattern of sales for the year has been impacted but the forecast for 2024 is holding at 16.1 million units, an increase of 3% from 2023. 2025 is expected to hold the 3% growth rate as volume climbs to 16.6 million units.

The payback driven weaker January has driven a surge in days’ supply as the month is expected to have finished at 58 days, up from 42 days in December. While this is the highest level of days’ supply since the pandemic, it is more a function of a pullback in the daily selling rate than a substantial growth in inventory levels. Inventory volume is projected at 2.46 million units, up 5% from December.

At an OEM level, Toyota Group topped GM by just 600 units to return to the top of the sales rankings, on 166k units. Toyota Group and GM have been vying for top spot in recent months, with Toyota having led the market in three out of the last four months, albeit often by small margins. The third largest OEM, Ford Group, enjoyed a relatively strong month, selling 148k units, and claiming its highest market share since November 2021. At a brand level, Toyota was once again the market leader, on 143k units, but this was only 2k units ahead of Ford. Chevrolet was a distant third on 109k units, as GM endured a disappointing month. The Toyota RAV4 was once again the bestselling Light Vehicle, on 36.3k units, 5.5k units ahead of the Ford F-150. Not for the first time in recent months, Compact Non-Premium SUV set a new record high share, at 21.4%, beating the 21.0% share the segment achieved in November 2023. Midsize Non-Premium SUV was second with a 15.9% share, followed by Large Pickup on 13.2%.

Jeff Schuster, Vice President Research and Analysis, Automotive, said: “We continue to expect 2024 to be a return to more normalized patterns of sales and pricing to stabilize, albeit at a higher-than-normal level. Growth in incentives and the eventual cut in interest rates should prove to be a catalyst for continued growth in 2024. There is no question the transition to EVs will be slower than many in the industry expected, but don’t write off EVs in 2024, there will be 47 new BEVs on the market in 2024, accounting for 10% of the total volume. Will this be the year that Tesla’s dominance is finally tested?”

Global outlook: Global LV sales finished the year strongly, posting a selling rate of 94 million units in December 2023—an increase of 13% from December 2022. Strong domestic and export volume in China—up 24% year over year—once again led the way in increases. 2023 ended at 90 million units, an increase of 11% and the highest level since 2019. While uncertainty will continue to play a leading role for the auto market, a level of stability and more consistency is expected as we start 2024. The forecast for global LV sales in 2024 is for 92.4 million units, a nominal increase of 2% from 2023, but most of the attention may be below the topline. Regulatory pressure remains on the industry for the transition to Electric Vehicles (EVs) and we expect continued expansion of the EV market in 2024. Battery Electric Vehicles (BEVs) are forecast to account for 15% of global sales in 2024.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center