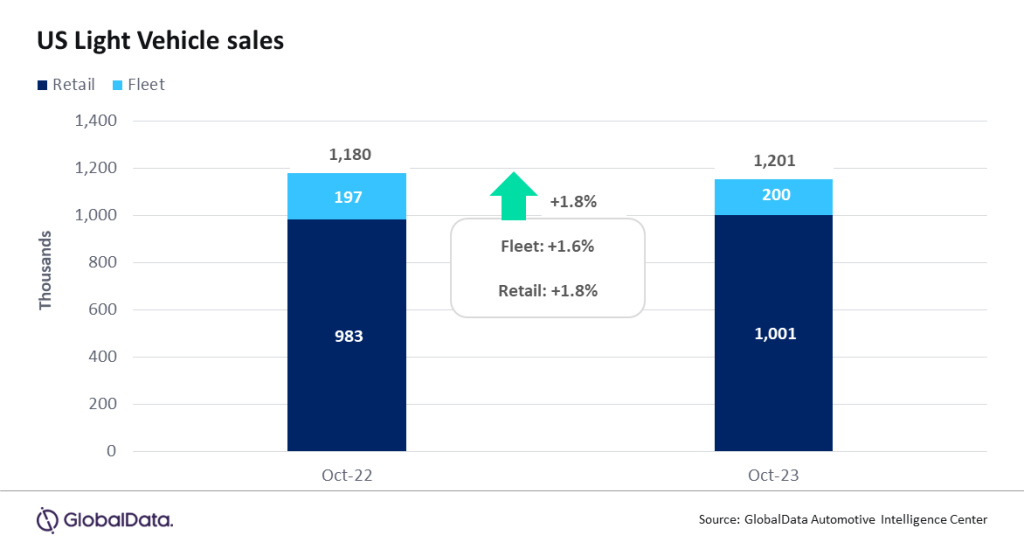

- According to preliminary estimates, Light Vehicle (LV) sales grew by 1.8% year-on-year (YoY) in October, to 1.20 million units. The YoY gain was significantly weaker than in preceding months, partly due to the fact that sales were starting to pick up momentum a year ago. In addition, October 2022 had one extra selling day. When adjusting for this, the YoY gain was around 5.8%. The impact of the UAW strikes on the Detroit 3 that lasted for virtually the whole month was limited, but still enough to trim volumes on certain models enough to keep total sales in check. Other OEMs appeared not to capitalize on the strikes, while economic factors may have played a role in the somewhat downbeat result.

- Global outlook – The global LV selling rate pulled back from the 100 million-unit rate in September, but still hit 93 million units, marking the fourth consecutive month above 90 million units. October is projected to continue at the current pace of strong global sales, with a selling rate of 91 million units. The global LV sales forecast for 2023 has again been increased to 88.6 million units, primarily due to more robust activity in China, given price cuts that continue to entice consumers. The global outlook for 2024 has also been increased by 400k units to 92.0 million units. Some spill-over growth in China and continued recovery in most other markets are key drivers for the increase.

US LV sales totaled 1.20 million units in October, according to GlobalData. The annualized selling rate slowed to 15.5 million units/year in October, from 15.7 million units/year in September. The daily selling rate was estimated at 48k units/day in October, compared to 51.6k units/day in September. This was the slowest daily selling rate since February, although this is not wholly surprising given typical seasonal patterns. According to initial estimates, retail sales totaled 1,001,000 units, while fleet sales accounted for approximately 200k units, representing around 16.6% of total sales. This means that YoY growth was relatively balanced across retail and fleet.

David Oakley, Manager, Americas Sales Forecasts, GlobalData, said: “The UAW strikes were the big news in the industry in October, but the recent strength of the market may have led some to believe that any impact from the walkouts would be “lost in the shuffle”. In fact, notable weakness for some affected models was not made up elsewhere and contributed to a slower month. The restart of student loan repayments in October was a further headwind to add to the mix of high interest rates, sticky inflation and some lingering supply chain issues. Nevertheless, the market has shown resilience all year, and with the UAW strikes now resolved – pending ratification of the tentative agreements – there is still an opportunity for a robust final two months of 2023 if OEMs can entice consumers with attractive offers”.

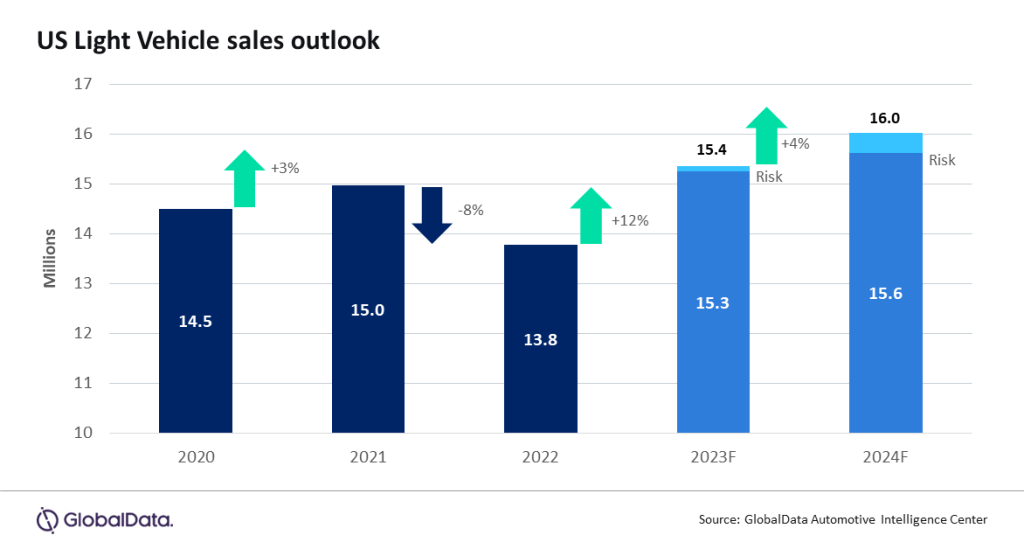

While it will take several weeks to get the impacted plants up and running at pre-strike output, most of the volume risk was absorbed in October. The forecast for 2023 has been reset back to 15.4 million units, given the end of the strike, consistent monthly fleet volume recovery and overall stability in demand. We are holding our 2024 forecast for the US at 16.0 million units, as overall risk in the economy and general affordability risk is expected to keep the market from achieving a higher level of recovery.

Despite the strike for the duration of October, the daily selling rate was slightly below expectation and inventory levels are projected to grow slightly to 2.1 million units. Days’ supply is expected to be 44 days at the start of November. This level, plus the restarting of the plants that were down, should be supportive of volume in the last two months of the year.

At an OEM level, Toyota Group outsold GM for the first time since July 2022, recording sales of 196k units, around 8k ahead of GM. This translated to a market share of 16.3% for Toyota Group, its highest since August 2021. Ford Group was the third-largest OEM with 144k units. Of the Detroit 3, GM appeared to suffer the most from strike action, as its market share dipped to 15.7%, the lowest since July 2022. Models that were already low on inventory before being affected by the strike, such as the Chevrolet Malibu, were partly culpable for the decline. Stellantis’ market share has been weak all year, so the strike impact was not so noticeable, but its share fell to just 8.4% in October, the lowest since January 2010. Toyota was the bestselling brand in October, and the Toyota RAV4 comfortably led the rankings for model sales with 42.2k units, some 9.1k units ahead of the Ford F-150. Compact Non-Premium SUV was again the number one segment and set another new record-high share of 20.8%. Midsize Non-Premium SUV trailed in second place on 15.5%, followed by Large Pickup on 13.3%.

Jeff Schuster, Vice President Research and Analysis, Automotive, said: “The tentative UAW deal removes a layer of added uncertainty that has plagued the auto sector for the last three and a half years; however, pricing concerns and risk of a recession in the US remain as we move toward 2024. The industry faces additional challenges, including a potential softening in EV demand, as investment in the technology grows. Regardless, the auto industry is expected to be in a healthy position in 2024, ready to take on the risks.”