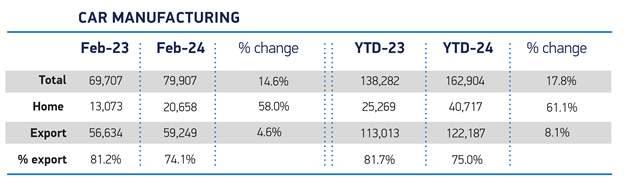

UK car production rose in February, up 14.6% to 79,907 units, according to the latest figures published by the Society of Motor Manufacturers and Traders (SMMT).

It was the sixth consecutive month of growth and best February performance since 2021, with nearly all volume manufacturers posting uplifts, driven by output for the domestic market which grew 58.0% to 20,658 units, an increase of 7,585.

Justin Cox, an analyst at GlobalData, said: “In the year-ago comparisons, we're still seeing some rebound from the supply shortages caused by the global chips crisis that spilled over into 2023, but the February gain is obviously very welcome for the UK's auto industry.

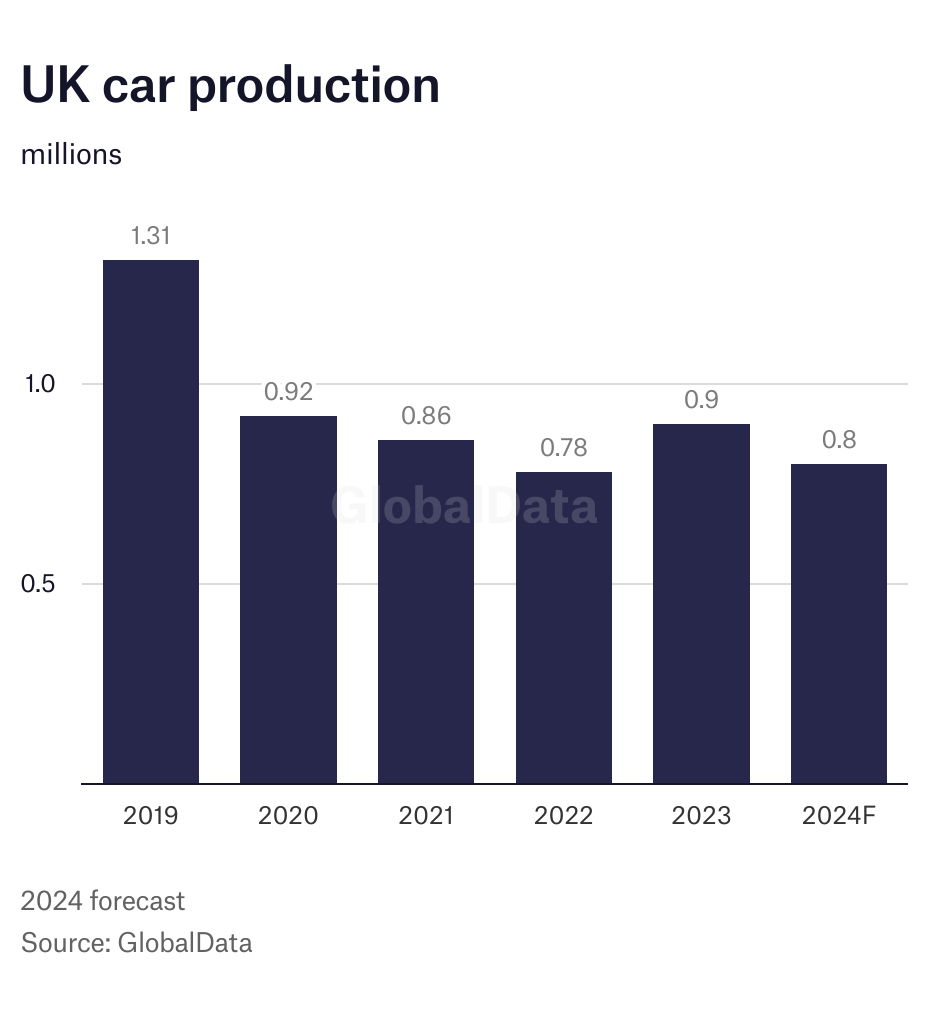

"Our forecast for this year sees UK car output at around 0.8 million units. It was much higher before the pandemic, but we see it settling in the medium term at around a million units a year.”

He also points out that the UK’s auto industry has been hit by structural changes to output plans by some manufacturers. “There’s the closure of Honda’s Swindon plant and the loss of Vauxhall (Stellantis) Astra production from the Ellesmere Port plant in northwest England. Jaguar Land Rover has also moved Discovery and Defender manufacturing from the UK to its plant in Slovakia.”

Volumes for export rose 4.6% to 59,249, representing a rise of 2,615 units, with three quarters (74.1%) of all cars made in the month shipped overseas. The European Union received by far the largest proportion of exports (59.9%) followed by the US (14.8%), China (7.1%), Australia (3.3%) and Turkey (2.3%). Volumes to all these markets apart from Turkey (-20.3%) rose, led by the US up 95.6%.

Production of electrified vehicles (battery electric, plug-in hybrid and hybrid) maintained its recent level, representing more than a third (36.3%) of all output in the month. Factories turned out a combined 29,038 units, up 6.0% on the year before, and with two thirds (67.3%) of these models built for export evidence of the need to ramp up UK battery production and electric vehicle supply chain capabilities.

Mike Hawes, SMMT Chief Executive, said: “Another month of growth for UK car production is welcome news, reflecting strong demand at home and around the world for the latest British-built cars. The industry is transitioning from internal combustion engine cars to electrified vehicles, building on the massive investment commitments made last year. The UK industry faces stiff competition, however, as global competitors seek to secure new models and technologies so a commitment to our industrial competitiveness, from all political parties in this likely election year, must be maintained.”

To date in 2024, UK car production is up 17.8% at 162,904 units, the best start to the year since 2021.

The SMMT noted that as major manufacturers gear up to make new electric models, production volumes may be more variable in the months ahead.

Richard Peberdy, UK Head of Automotive for KPMG, said the positive start to 2024 for UK car manufacturing continues, but also highlighted the importance of fleet buyers in the domestic market.

“Fleet buying continues to drive the bulk of the domestic market growth – which includes EVs being purchased for salary sacrifice leasing.

“Private sales levels have held up relatively well to the ongoing squeeze on household budgets and a higher cost of borrowing, but growing the levels of consumer demand is challenging. Carmakers are trying to stimulate extra demand by discounting and incentivising.”