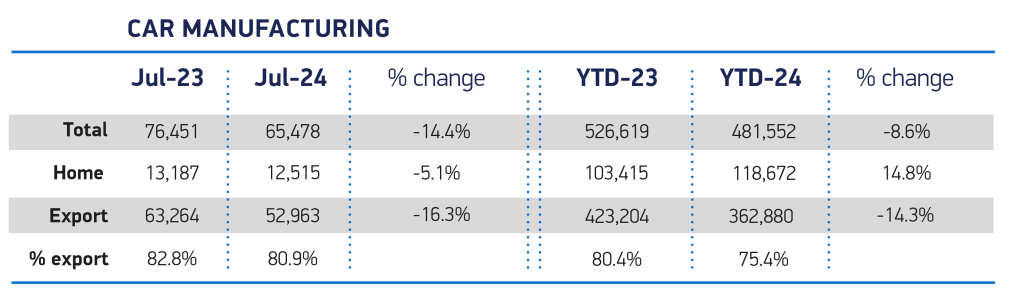

UK car production fell by 14.4% in July, according to new figures published by the Society of Motor Manufacturers and Traders (SMMT). Output of passenger cars in the month totalled 65,478 vehicles, with the decline in output due predominantly to model changeovers and ‘temporary supply chain challenges’, the SMMT said.

Despite an 18.6% decline in volume, electrified (battery electric, plug-in hybrid and hybrid) vehicle manufacturing maintained a relatively stable 37.5% share of overall output, compared with 39.5% in July 2023.

Production of cars for the UK market fell slightly, by 5.1%, although in volume terms this represented just 672 fewer units. More than four in five (80.9%) cars produced in July were destined for customers overseas, with the five largest markets by volume encompassing the EU (51.3% of exports), US (17.6%), China (8.6%), Turkey (5.5%) and Japan (3.1%).

Total export volumes for the month fell 16.3%.

So far this year, domestic production remains up 14.8% while export volumes are down 14.3%. The SMMT estimates that total output was still calculated to be worth more than £20 billion at factory gate prices – unchanged on the same period last year, demonstrating the high value of UK automotive production.

Mike Hawes, SMMT Chief Executive, said: “Following significant growth last year, some readjustment in output was to be expected. Indeed, an ongoing degree of volatility is likely as the industry restructures to transition to zero emission vehicle production. As the billions already committed to new models start to deliver a return, volume growth will resume, providing we seize every opportunity to enhance our global competitiveness. We need investment in skills, healthy markets, cheaper green energy, and fair trade deals that help British-built vehicles reach international customers more easily, all of which should be wrapped in an over-arching industrial strategy that ensures automotive continues to be a key driver of economic growth.”

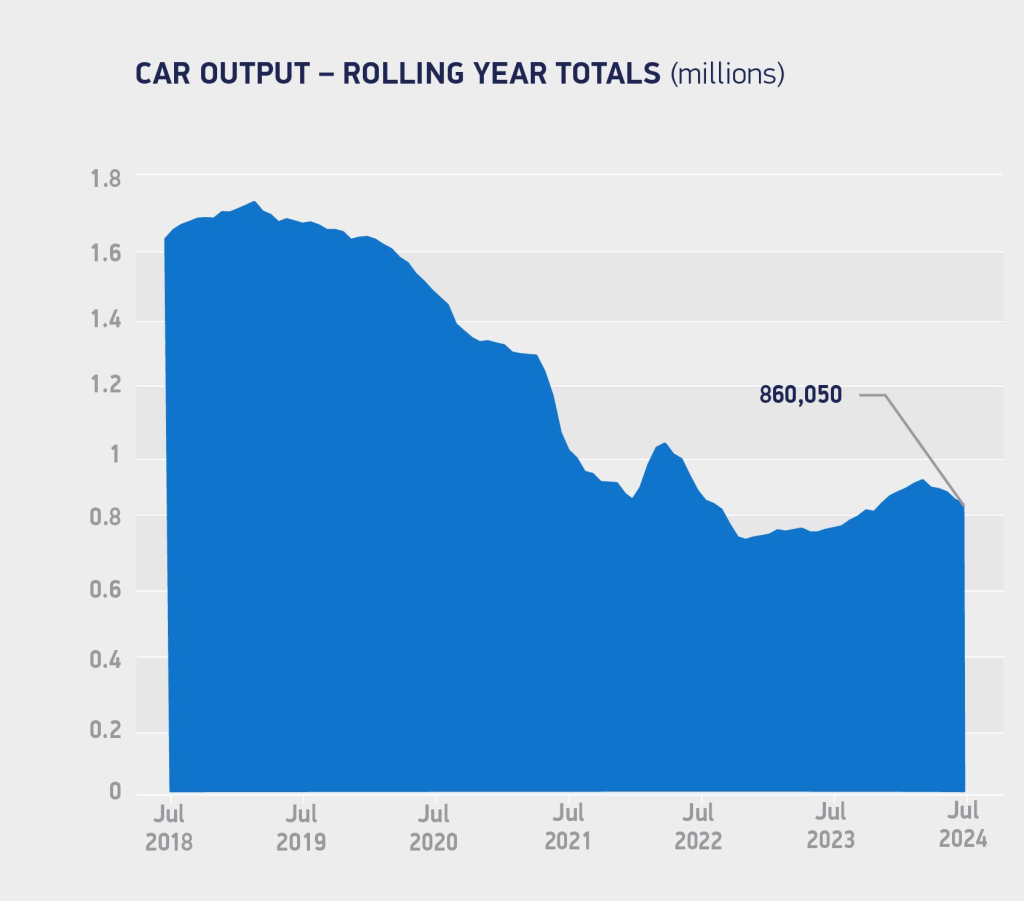

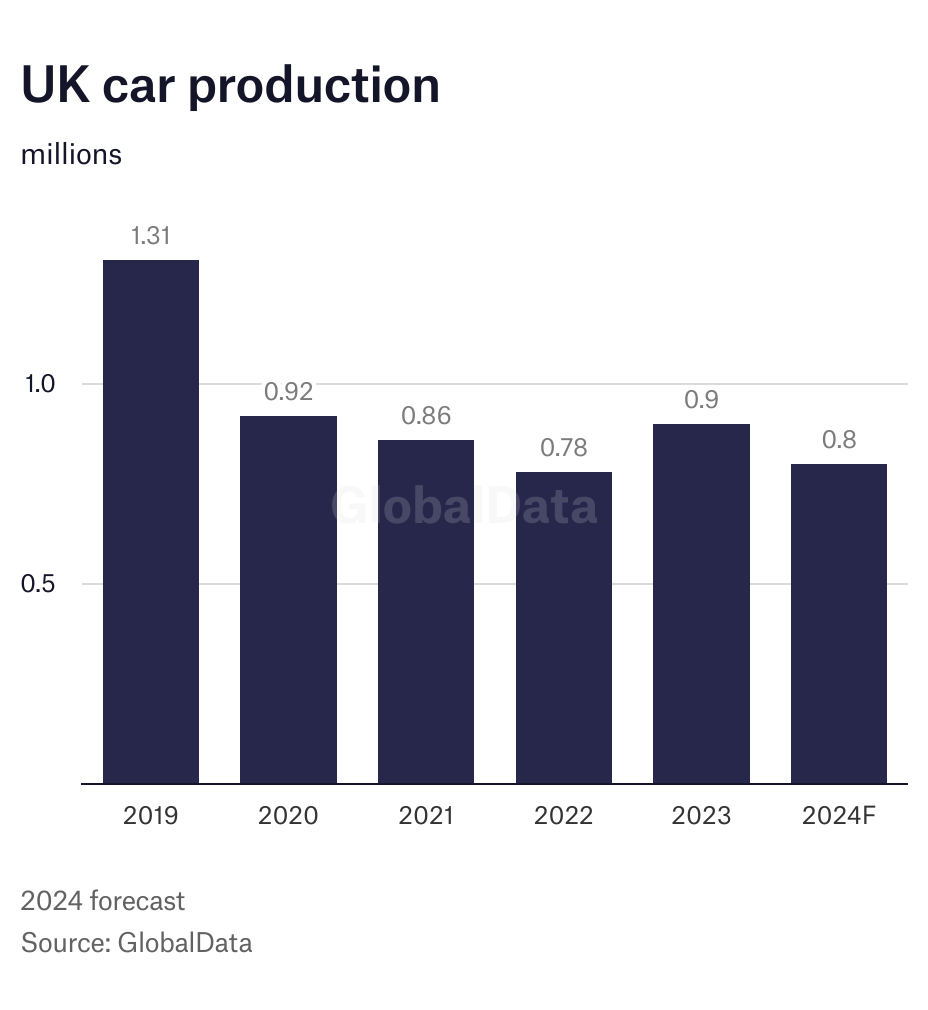

UK car output remains way under pre-pandemic levels and is struggling to recover volume as it faces challenges in electrification and developing more export business to replace recently lost manufacturing capacity, according to a GlobalData analyst.

Justin Cox, an analyst at GlobalData, points out that UK car production is running way under where it was pre-pandemic. “The UK auto industry is struggling in overall volume terms this year,” he points out. “This year there is certainly some negative impact from significant model changes and that’s to be expected.”

“Our forecast sees UK car output at a little over 0.8 million units this year. It was much higher before the pandemic, but we see it settling in the medium-term at around a million units a year.” In 2019 UK car production was 1.3 million units, but the UK industry has seen some structural loss to output caused by the closure of Honda’s Swindon plant and sourcing changes at Stellantis and Jaguar Land Rover.

Richard Peberdy, UK Head of Automotive for KPMG, also points out the heavy reliance on fleet sales this year.

“So far in 2024, car production for the domestic market is up, driven by demand from fleet buying, but the drop-off in manufacture for export has left overall production volumes down on this time last year,” he says.

“Production has also been slowed by car makers having to further gear up factory floors for new EV and hybrid models and an increasingly electric future.”

Peberdy also points out that UK manufacturers are finding the UK governments's Zero Emissions Mandate a big challenge. If they miss annual EV share targets, they could be fined.

“With car makers mandated to scale-up the percentages of electric vehicles that they sell each year, questions continue to remain about how industry and government can increase new electric vehicle sales in keeping with the levels required by the Zero Emission Mandate.”