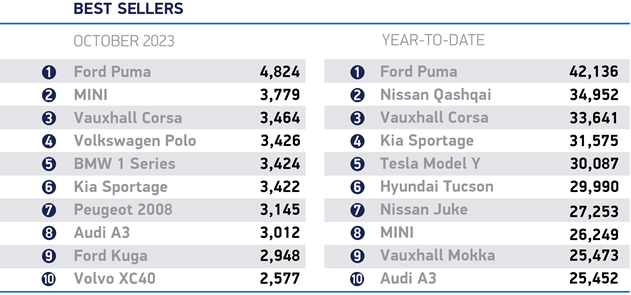

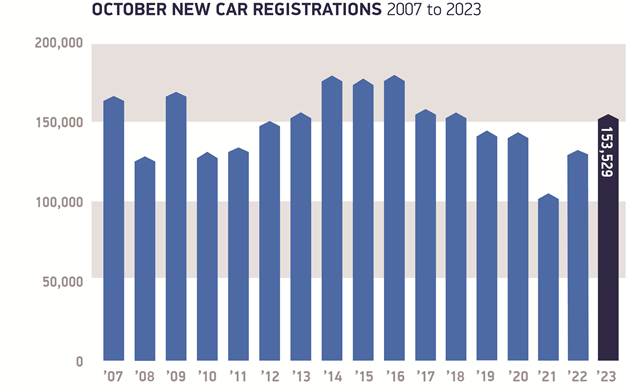

October’s UK new car market grew by 14.3% to reach 153,529 registrations, 7.2% above pre-pandemic levels and marking the best performance for the month since 2018, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

The 15th month of consecutive growth was driven almost entirely by large fleet registrations, which grew 28.8% to reach 87,479 units. Private demand was stable at 62,915 vehicles, a 0.3% increase, while the much smaller business sector saw registrations fall -15.2% to 3,135 units.

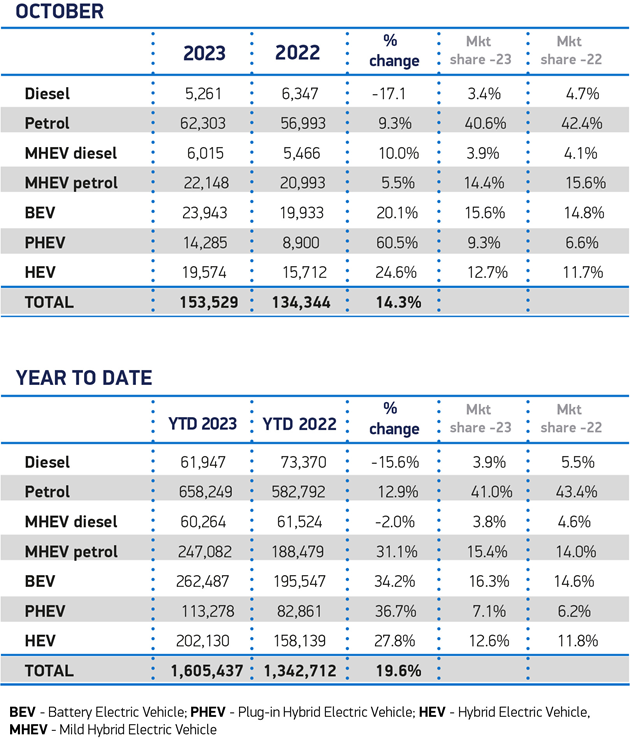

With the sustained increase in new car registrations, overall vehicle uptake is now up 19.6% in the first 10 months, with the market currently enjoying its best year since 2019.

Electrified vehicle uptake continued to accelerate in October accounting for 37.6% of all new car registrations. Hybrid electric vehicles (HEVs) grew 24.6% to reach 19,574 units, while plug-in hybrid vehicles (PHEVs) recorded the highest proportional growth, up 60.5% to 14,285 registrations. Battery electric vehicle (BEV) uptake increased for the 42nd month in a row, by 20.1% to 23,943 units.

Given overall market growth, however, this amounted to a BEV market share of 15.6%, a relatively small rise from last year’s 14.8%. Furthermore, private registrations accounted for fewer than one in four new BEVs this year. The SMMT said this underscores the need for fiscal incentives for private consumers. Year to date, BEV volumes have risen 34.2% to account for 16.3% of new registrations this year, up slightly from 14.6% this time last year.

The SMMT said October’s plug-in vehicle performance follows a significant increase in charge-point rollout in Q3, which improved significantly relative to new plug-in car uptake. Some 4,753 new standard charge-points came online in the quarter, the largest ever quarterly delivery. This equates to one new standard public charge-point being installed for every 26 new plug-in cars reaching the road between July and September, improved from 38 in the same quarter last year. However, installation was disproportionately focused on London and the southeast, which received four out of five new chargepoints commissioned during the quarter – despite the region accounting for fewer than two in five new plug-in registrations during the same period. In comparison, just 13 chargers were installed in Yorkshire and Humberside, while the North actually had 105 chargers taken out of service.

The SMMT said that with EV uptake greatly influenced by perceptions of charge-point infrastructure availability and accessibility, ‘action should be taken to ensure more equitable distribution and pricing for public charging’. Reducing VAT on public charging to match home use would mean those unable to install their own charge-point – typically those in flats, terraces and rented accommodation – would avoid paying four times the tax paid by those who can – typically those who own houses with off-street parking.

The SMMT said that binding targets for charge-point rollout, in line with those set for the car market by the Zero Emission Vehicle Mandate and supported by the necessary changes to planning and grid connections so desperately needed, would also help accelerate installation, giving consumers confidence in being able to charge when and where needed.

Mike Hawes, SMMT Chief Executive, said: “With demand for new cars surpassing pre-pandemic levels in the month, the market is defying expectations and driving growth. As fleet uptake flourishes, particularly for EVs, sustained success depends on encouraging all consumers to invest in the latest zero emission vehicles. The Autumn Statement is a key opportunity for government to introduce incentives and facilitate infrastructure investment. Doing so would send a clear signal of support for drivers, reassuring them that now is the time to switch to electric.”

Richard Peberdy, UK Head of Automotive for KPMG, sounded a warning on planned new customs tariffs on UK-EU electric vehicle shipments, from 2024. He said: “Whilst the cost of living crisis and higher interest rates are inevitably curtailing some car purchases and leading other consumers to switch to cheaper brands and models, overall the UK car market continues to weather the storm.

"The prospect of tariffs on electric vehicles moving across the Channel is another cloud closing in on the horizon however. Higher costs would threaten market competitiveness at a time when lower pricing is key to increasing EV adoption, whilst also being key to the UK meeting the 22% target set for 2024 by the Zero Emissions Vehicle Mandate. UK and EU car makers remain eager that a political agreement can be reached.”