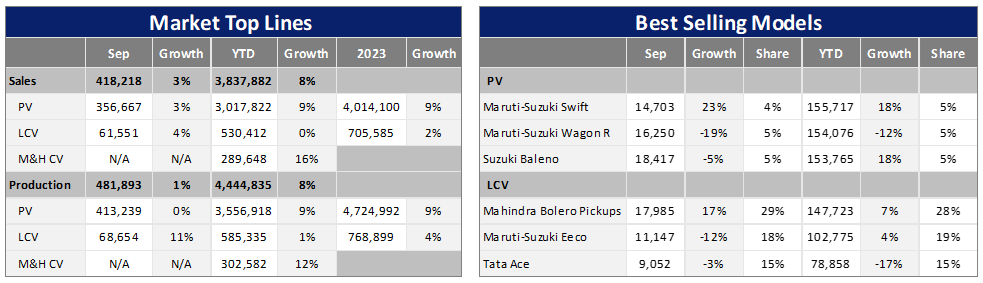

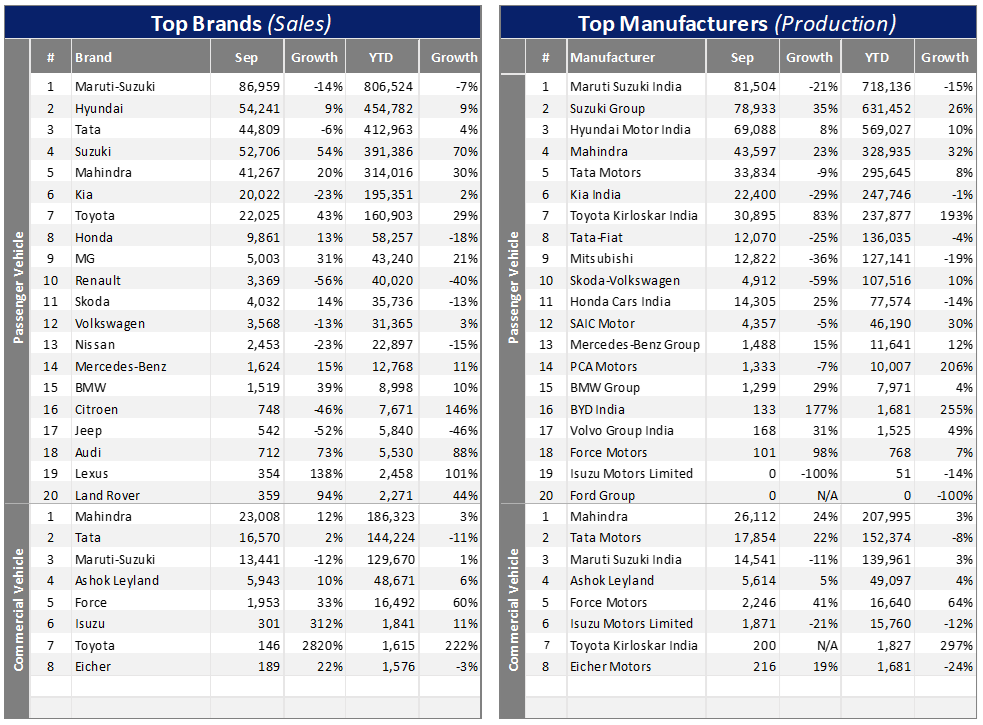

The Indian market is booming as Light Vehicle (LV) wholesales in September touched a record-high of 418k units. This total was up by 1% month-on-month (MoM) and 3% year-on-year (YoY). Accordingly, the selling rate maintained a very strong pace at 4.8 million units, even though it was down by 7% MoM due to an exceptionally robust August.

Passenger Vehicle (PV) sales notched up by 1% from the month before to peak at 357k units (+3% YoY), while demand for Light Commercial Vehicles (LCVs) with GVW up to 6T was at around 61k units (+2% MoM, +4% YoY).

OEMs continued to meet pending orders (mostly PVs), which are still estimated at around 700k units – or equivalent to two full months of PV sales. The strong wholesales in September were also driven by the recently launched new models (all of them SUVs, including variants and facelifts).

At the same time, automakers stocked up their dealerships in varying degrees to prepare for the height of the festival season occurring from the second half of October to almost mid-November.

All of this was of course helped by better supplies of semiconductors that allowed OEMs to sustain output.

Indeed, stock building was evident in an unprecedent inventory level of 60-65 days by the end of September, according to the Federation of Automobile Dealers Associations (FADA).

In the meantime, retail sales of PVs and LCVs in September improved to 378k units, compared to 359k units in August and 327k units in July as per the data from FADA.

FADA President Manish Raj Singhania thus termed September’s retail sales as “seamlessly transitioning into the festive period’s sweet spot set to unfold over the next 42 days”.

“The PV category experienced a stimulating resurgence as the market enjoyed improved vehicle availability and an influx of new and refreshed models from various OEMs. This uplift was supported by enhanced supplies and an increasing variety in the product portfolio, answering to a diversifying consumer demand,” he further commented.

Cumulative LV sales between January and September of this year increased by 7% YoY to 3.5 million units. This total was divided between 3 million PVs (+9% YoY) and 530k LCVs (no growth). The YTD selling rate averaged 4.7 million units/year.

In terms of macroeconomic drivers, the Indian economy appears to have lost some steam after expanding by a robust 7.8% YoY in Q2.

Recent economic data indicates that consumer spending (which was a key growth driver of Q2 GDP) is ebbing, in the face of high interest rates and higher cost of living. While urban consumers are faring well, rural households are being impacted by below-average monsoons, i.e., lower agricultural output and incomes.

Indicators for private investment have been solid so far, but the full impact of the interest rate hikes over the past year is still expected to hit domestic demand in the coming months.

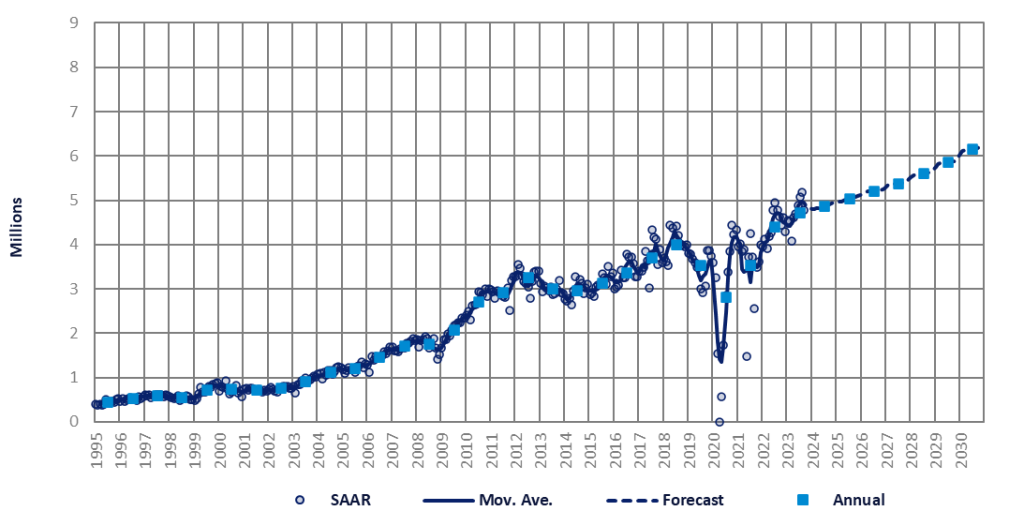

Since LV sales in September were in line with our expectations, we have kept our forecasts unchanged except for minor adjustments in 2023.

Therefore, we still expect sales to expand by 7.5% YoY to an all-time high of 4.7 million units this year and by 3% to 4.9 million units in 2024. Sales in H1 2024 are expected to be boosted by government spending ahead of the general elections in April and May.