Indonesian new vehicle sales surged by 66% to 82,097 units in May 2023 from weak year earlier volume of 49,453, according to member wholesale data from automotive industry association Gaikindo.

The market last month rebounded after a 29% drop in April when sales were held back by the annual Eid holidays. The country’s economy has remained reasonably buoyant so far despite multiple interest rate hikes over the last two years, from 3.5% to 5.75%, and slowing global growth. First quarter GDP growth came in at just over 5%, with domestic consumption buoyed by a tourism recovery and higher exports.

Vehicle sales in the first five months of the year were up 7% at 423,404 units, from 396,120 a year ago, with sales of passenger vehicles rising 9% to 320,275 units while commercial vehicle sales were just slightly higher at 103,129.

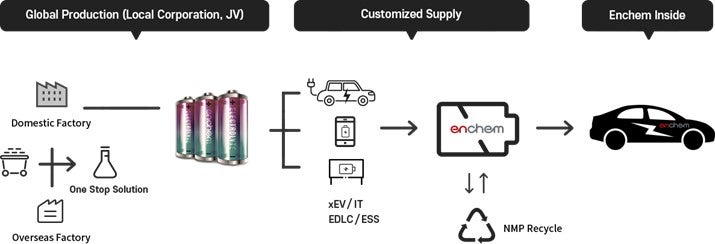

In May, the government cut sales tax on battery electric vehicles (BEVs) to zero to help drive up domestic sales. The government wants to expand the country’s EV charging network to help achieve its target of 2m BEVs in circulation by 2030.

Toyota sales increased 9% to 135,473 units year to date while Daihatsu sales were up 10% to 81,128 units, helped by the launch of the updated Ayla small car. Honda recovery continued with sales rising 18% to 63,140 units, helped by new models including the recent arrival of the WR-V.

Mitsubishi sales fell 27% to 33,787 units following strong growth last year while Suzuki sales were down 2% at 33,481 units.

Local vehicle production increased 8% to 587,263 units year to date (YTD) while exports of assembled vehicles surged 29% to 205,112 units.