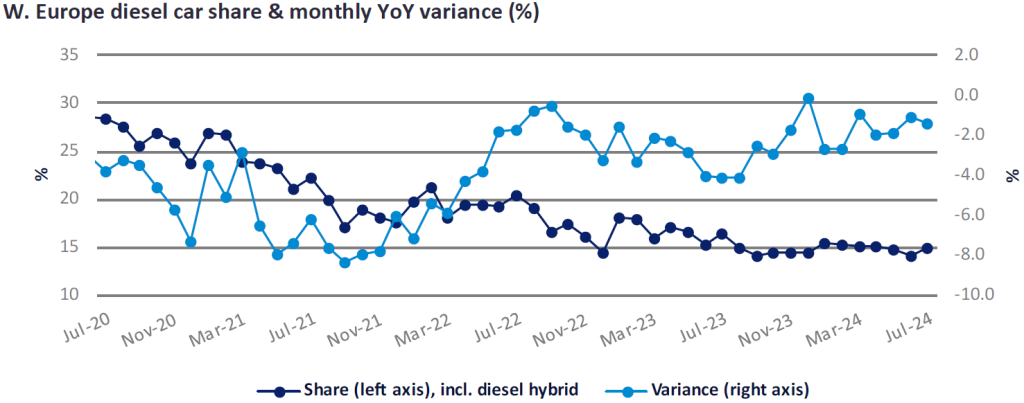

In July, for the 12th month in a row, diesel captured around 15% of the region’s new car market. In fact, the preliminary July result was exactly that figure with June being confirmed at 14.2%. July historically is a robust month for diesel sales though the reason for this isn’t clear. So, while the MoM diesel share was positive, the YoY comparison was more negative than seen in June.

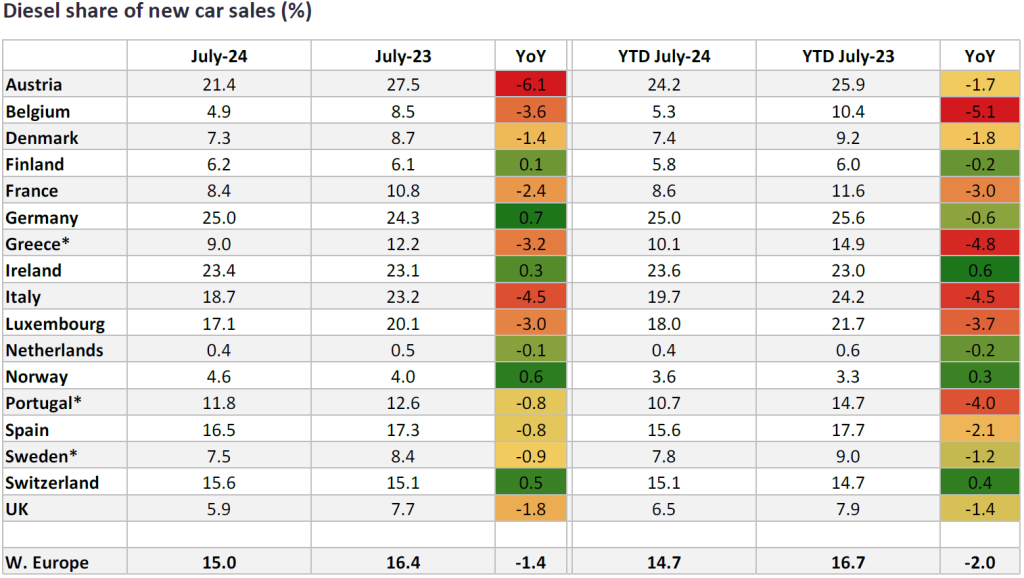

Overall, YoY comparisons have revealed a flat diesel market in the region through 2024 and for some months prior to that period. Five markets saw YoY increases in diesel share in July while the rest saw mostly small declines with Austria (-6.1pp) and Italy (-4.5pp) the biggest losers from a share standpoint.

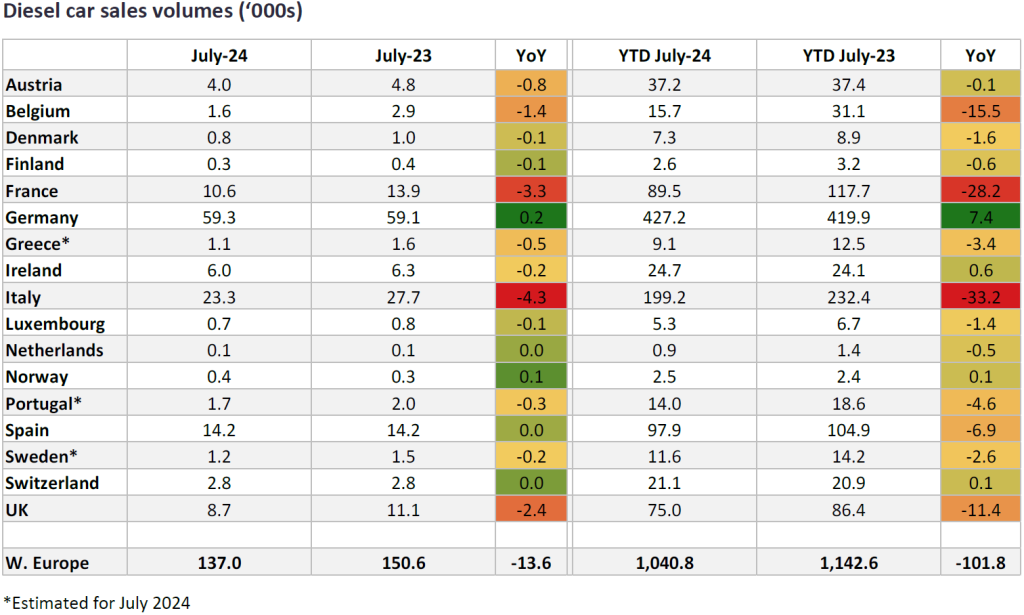

Volume-wise, only Germany saw a notable YoY increase in diesel demand in July though several other sizeable car markets including Spain, Netherlands and Switzerland saw the same diesel car sales as in 2023. France and Italy suffered the largest annualised drop in diesel sales as their long decline from high diesel shares in the past continues.

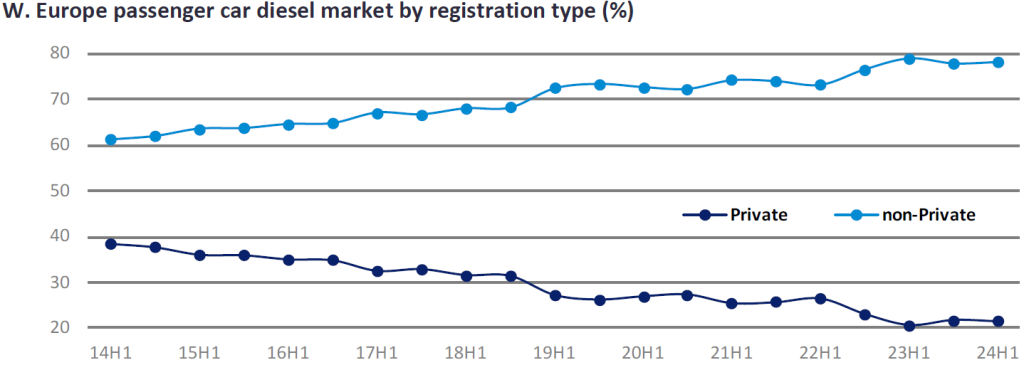

Diesel car buyers have increasingly been confined to the business sector where distances driven are higher and the benefits of diesel car ownership are more apparent (than for the private buyer).

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.