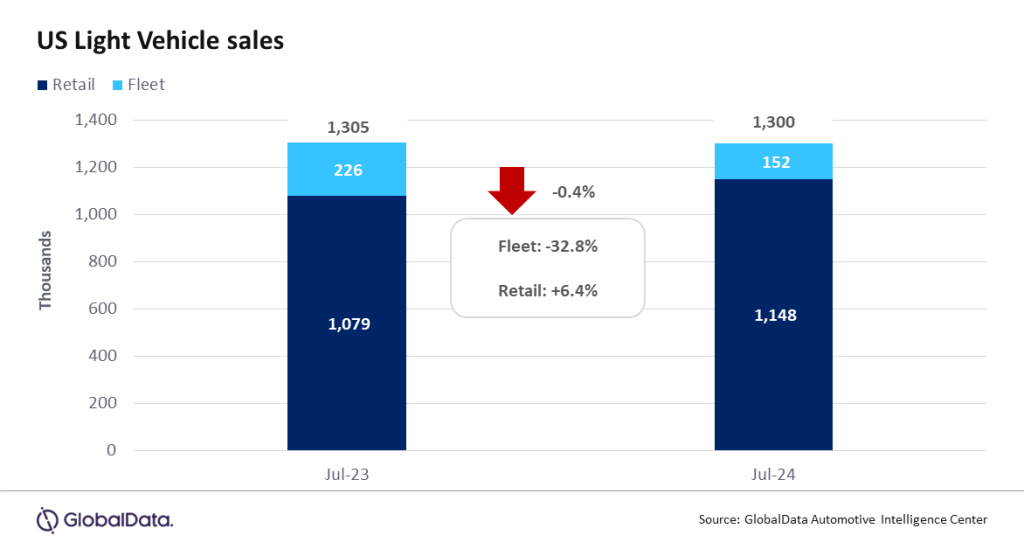

According to preliminary estimates, Light Vehicle (LV) sales fell by 0.4% YoY in July, to 1.30 million units. After sales contracted in June due to the CDK cyberattack, it was expected that the market would experience a significant rebound in July, but that failed to materialize to the anticipated extent.

US LV sales totaled 1.30 million units in July, according to GlobalData. The annualized selling rate was 16.1 million units/year in July, up from 15.3 million units/year in June. The daily selling rate was estimated at 52,000 units/day in July, up from 50,800 units/day in June.

Taking June and July combined – which smooths out distortions caused by the CDK cyberattack in June – the selling rate averaged 15.7 million units/year over those two months. Given that the rate had averaged 15.6 million units/year in the first five months of the year, the market is ticking over at a steady rate overall, but will need to accelerate in the coming months if annual sales forecasts are to be met. According to initial estimates, retail sales totaled 1,148,000 units in July, while fleet sales finished at 152,000 units, accounting for 11.7% of total volumes. The low fleet total was likely due to a greater focus on serving retail customers whose purchases were delayed by the CDK cyberattack in June.

There was little change in the relative performance of the largest-volume OEMs in July, as compared to the preceding months. GM led the market on 212k units, around 30k units ahead of Toyota Group, with Ford Group in third place on 167k units. At a brand level, however, Ford topped the rankings on 159k units, around 6k ahead of Toyota. This was the first time that Ford had outsold Toyota since February. Chevrolet was the third bestselling brand, on 134k units.

The Toyota RAV4 has become accustomed to being either number one or two in the sales rankings in recent months, but the Compact SUV finished third in July – the first time since June 2023 that the model has not been at least second. The Ford F-150 is thought to have been the nation’s bestselling Light Vehicle in July, on 39.0k units, just ahead of the Tesla Model Y, estimated at 38.2k units, while the RAV4 recorded 35.6k units.

The hot streak that Compact Non-Premium SUVs have enjoyed recently continued to cool in July, as the segment accounted for 19.9% of the total market, its lowest share since August 2023. However, the Midsize Non-Premium SUV segment also performed relatively poorly in July, claiming 14.8% of the market, its lowest share since December 2019. Large Pickups accounted for 13.9% of total sales, a good return by recent standards, but slightly down on the segment’s 14.1% share in June.

David Oakley, Manager, Americas Sales Forecasts, GlobalData, said: “Expectations coming into the month of July were high, given that there was an assumption that tens of thousands of sales from June were delayed due to the CDK cyberattack, which would therefore boost July’s volumes. However, one of the effects of the attack is that much of the industry has been working with lower-quality data than normal. On this occasion, it seems that July’s performance was disappointing, suggesting that the market could be losing a little momentum as we head into the second half of the year. Holiday sales events around Independence Day also appear to have been relatively ineffective this year. Elevated interest rates and stubbornly high pricing are keeping some potential buyers away, while some OEMs are being hampered by recalls preventing the sale of certain models”.

In July, it is estimated that US inventory levels contracted by 4% month-on-month as production aligned with demand. The days’ supply is also expected to have decreased from 56 days in June to 50-52 days in July. Concurrently, demand appears to be stabilizing at the current level. Looking forward, there is believed to be sufficient industry-wide inventory to meet demand. Consequently, some production balancing at the brand and segment level is likely during the remainder of the year and into 2025, unless strong demand growth resumes.

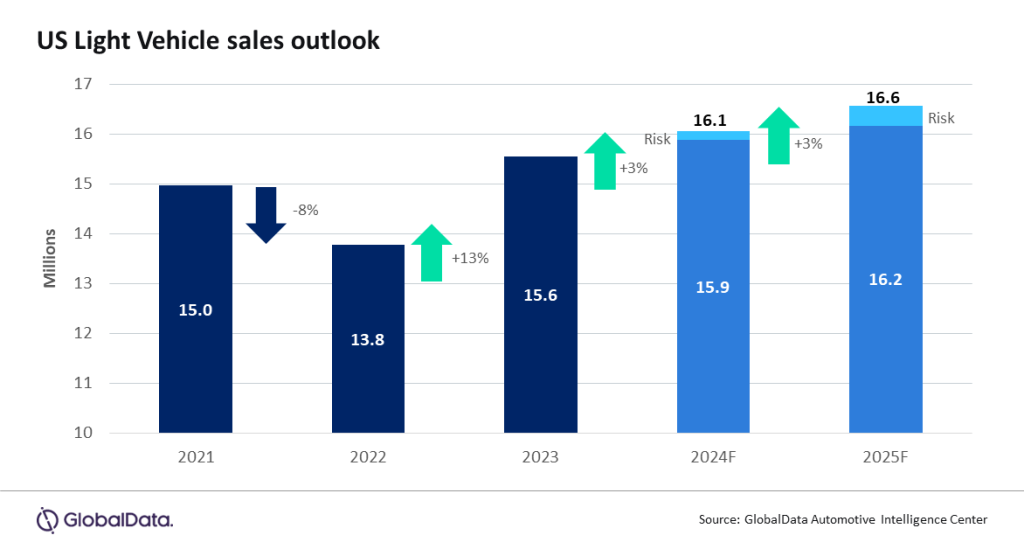

Lower-than-expected sales in July have solidified the current forecast for US LV sales at 16.1 million units this year, marking a 3% increase from 2023. Fleet sales are projected to average 18% for the rest of 2024, slightly lowering the share to 18.6% from the previous estimate, yet still the highest level since 2019. The outlook for 2025 remains steady at 16.6 million units, but this represents a decrease of approximately 50,000 units from the prior forecast. Growth from 2024 is anticipated to be at 3%.

Jeff Schuster, Vice President Research and Analysis, Automotive, said: “While the Federal Reserve is indicating upcoming rate cuts and the overall economy is heading towards a soft landing, the concept of a rolling recession and vulnerabilities in certain sectors could materialize. Lower transaction prices and availability of affordable vehicles are crucial in reigniting growth in LV sales. The forecast remains optimistic, although it has slightly tempered over the next 18 months”.

Global outlook: In June 2024, the global Light Vehicle (LV) sales rate hit a milestone, reaching 89.7 million units, the highest level of the year to date, showing a significant increase of 2 million units from May. Although slightly below expectations, the comparisons are becoming more challenging. In June 2024, sales volume declined by 1.9% to 7.6 million units compared to the same period last year. However, this figure remains robust and aligns with the expected volume average for the second half of 2024.Several major markets experienced fluctuations in June due to various reasons. China’s domestic market saw an 8.0% decline, while the US faced a 4.2% decrease due to a cyberattack, and Japan experienced a 4.8% drop due to vehicle shortages. In contrast, Europe managed to grow by 6.2%. The outlook for 2024 has been slightly revised downwards, with the forecast now at 88.7 million units, representing a 2.2% increase from 2023. Despite the adjustments, 2024 is still expected to be a strong year for auto sales, with anticipated rate cuts and pricing reductions creating a positive atmosphere for consumers.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.