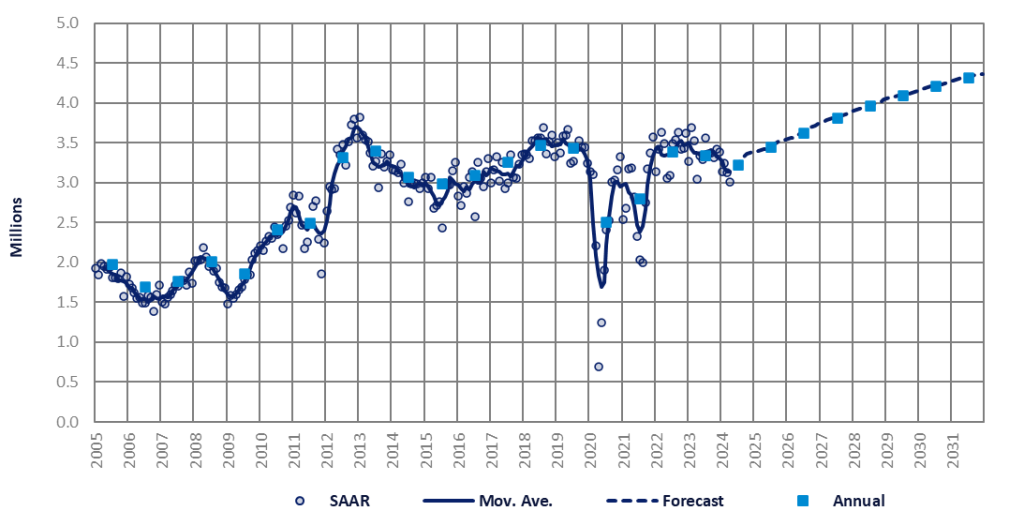

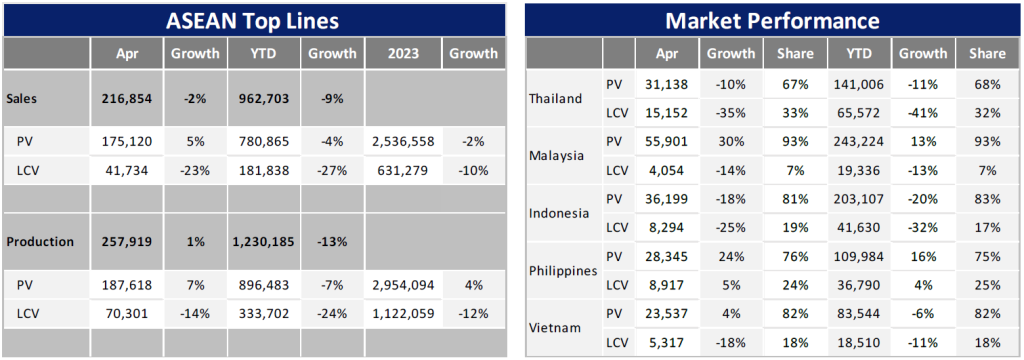

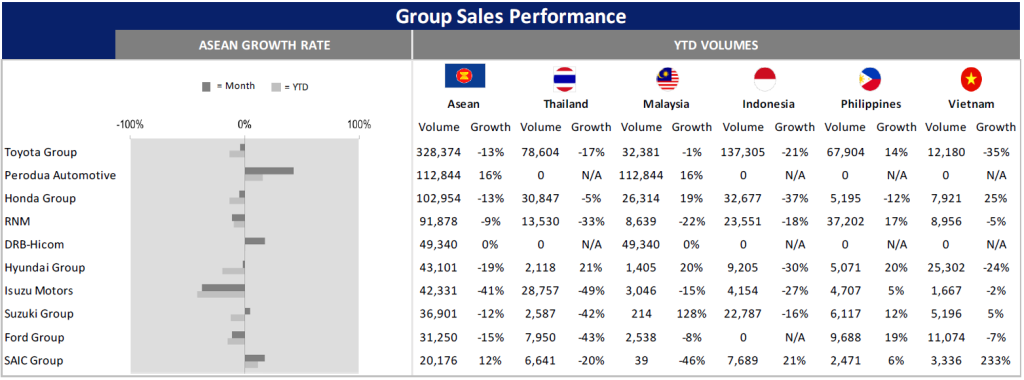

ASEAN Light Vehicle (LV) sales declined by 9.3% year-on-year (YoY) to 963k units from January to April. Malaysia and the Philippines were the only countries to experience positive sales growth, while Indonesia, Thailand, and Vietnam continued to face weak demand.

According to the Malaysian Automotive Association (MAA), LV sales in the country surged by 10.3% YoY to 263k units from January to April. Preliminary data indicates that sales in May sustained the growth momentum, increasing by 9.6% YoY. Cumulatively, sales from January to May rose by 10.2% YoY to 332k units. This exceptional performance was driven by the clearance of a significant backlog of around 200k units as of January 2024. The introduction of new models, such as the Honda WR-V, and the market entry of Chery Group and BYD Auto also contributed to the positive sales trend.

The 2024 sales outlook for Malaysia has been revised upward to a projected flat figure of 795k units (+0.1% YoY) for the year, as opposed to a 1.1% decline forecasted previously. This adjustment reflects the stronger-than-expected Passenger Vehicle (PV) sales observed in the year to date, with Perodua still working through pending orders. Furthermore, a potential surge in LV sales in the second half of 2024 is anticipated, driven by speculation of the government considering cash subsidies for Battery Electric Vehicle (BEV) purchases, a policy similar to that of Thailand.

In the Philippines, LV sales increased by 12.7% YoY from January to April. This robust performance at the start of the year was fueled by pent-up demand, alleviation of supply constraints, and the entry of Chinese automakers offering competitively priced vehicles. Subdued demand in the Chinese market has led Chinese automakers to export their vehicles, thereby reducing their inventories.

Despite the strong growth in the first four months, the Philippines’ LV market is expected to decelerate in the second half of 2024, with projected growth of only 2.9% to 449k units for the year. This slowdown can be attributed to several factors, including the lagged impact of high-interest rates, with the central bank raising its policy rate to 6.5% – the highest level since 2007 – to manage inflation and the depreciation of the PHP. Also contributing is weakening consumer confidence, particularly in the “good time to buy motor vehicles” sub-index, due to high borrowing rates, a weak PHP, and increased cost of living. Additionally, the escalating global economic uncertainty poses risks to the country’s exports and remittance inflows.

According to the recent GAIKINDO report release, Indonesia’s LV market experienced a significant decline of 20.4% YoY from January to May, with double-digit decreases recorded in all months: -24.2% YoY in January,

-17.9% YoY in February, -24.7% YoY in March, -19.5% YoY in April, and -14.4% YoY in May. This drop in sales can be attributed to various factors, including consumer and business postponements due to the presidential elections in February, disruptions during Ramadan and the Eid festival in March and April, and challenges in auto loan approvals stemming from high interest rates and non-performing loans.

In light of the weak sales sentiment, the 2024 sales outlook for Indonesia has been revised downwards to a 7% YoY decrease, totaling 862k units. The outlook for 2024 faces additional downside risks due to the prevailing economic conditions influenced by China’s economic slowdown and escalating geopolitical tensions. The decision by the Bank of Indonesia to raise the interest rate to 6.25% in April, aimed at addressing currency depreciation, may further impact auto loan costs and approval standards.

In Thailand, the LV market also experienced a significant decline of 23.5% YoY from January to April, with the PV segment slipping by 11.3% YoY and the Light Commercial Vehicle (LCV) segment plunging by 40.9% YoY. In fact, April marked the 16th consecutive month of double-digit declines for LCV sales. Preliminary data suggests that the Thai market remained subdued in May with a 23.6% YoY decline. Consequently, the sales forecast for 2024-2027 has been adjusted downward, with an expected 10.4% decline to 677k units for this year, marking a 15-year low.

Vietnam’s LV sales dropped by 6.6% YoY in the first four months of this year. However, May saw a rebound in sales, attributed to automakers launching promotional campaigns and reducing prices to boost consumption. The forecast for the year remains cautiously optimistic, with an anticipated increase to 385k units, representing a 1.4% rise.

In conclusion, ASEAN LV sales are projected to decline by 4% YoY to 3.17 million units in 2024, primarily due to the lowered and negative outlook for LV sales in Indonesia and Thailand.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center. For more details on GlobalData’s designated Global Light Vehicle Sales Forecast module, click here