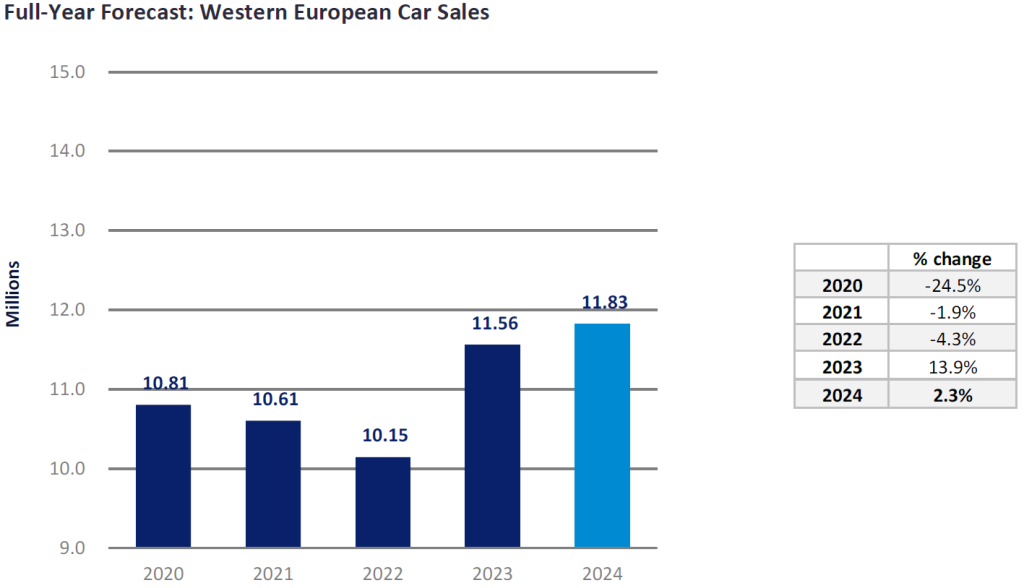

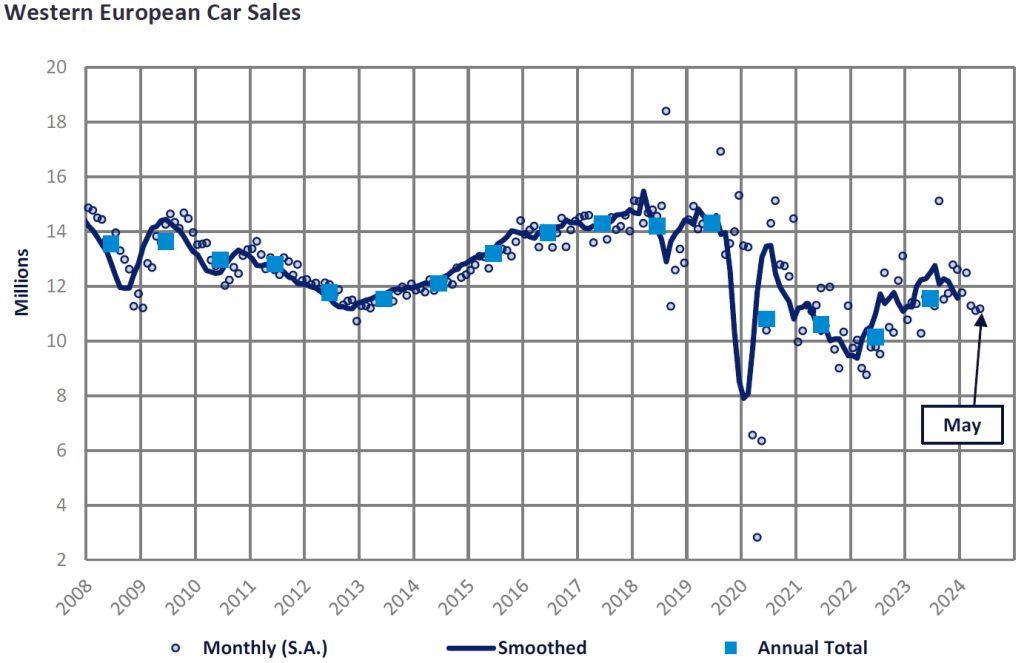

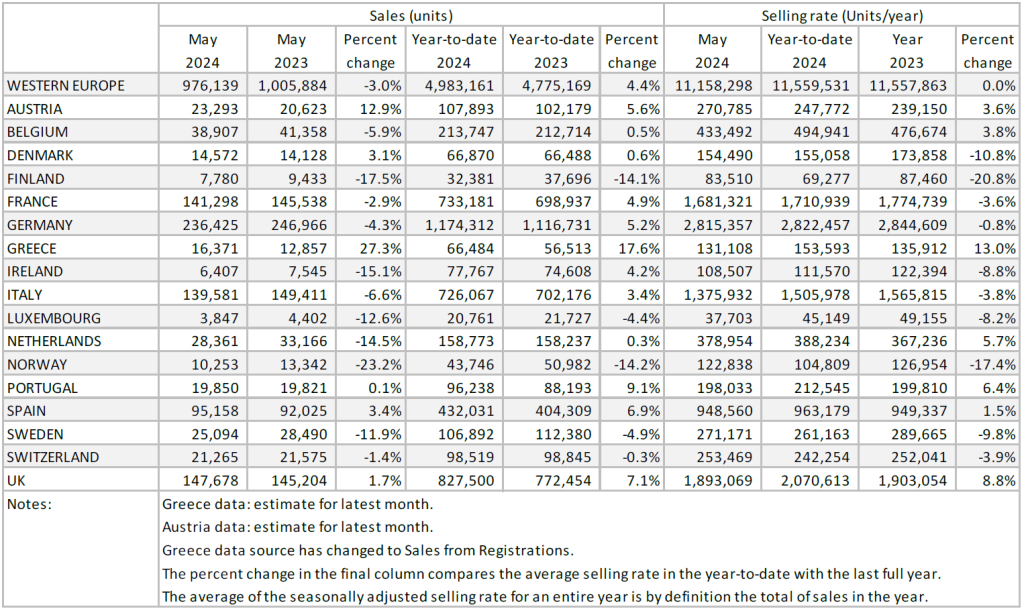

The Western Europe PV selling rate reached just over 11 million units/year in May, broadly in line with April, but weaker than the close of 2023 or the year-to-date (YTD) average. With 976k cars registered, this represents a 3.0% decline year-on-year (YoY). However, YTD sales grew by 4.4%.

Sales continued to struggle in Western Europe and declined YoY in many countries within the region. A subdued macroeconomic outlook and underwhelming market performance so far this year have led us to trim the near-term forecast slightly. While supply issues have faded, the market has not experienced a strong outturn throughout the start of the year. That said, vehicle pricing has been slow to ease. Furthermore, the European Central Bank’s (ECB) decision to cut rates for the first time in five years is the first step on the road to monetary policy easing and further rate cuts will support economic future activity. Still, geopolitical risks have the potential to undermine the forecast.

The PV selling rate for Western Europe stood at 11.2 million units/year in May. In YoY terms, sales volumes were down 3.0% YoY with the market struggling due to persistent economic headwinds. For context, Western Europe volumes last month were 25% below pre-pandemic May 2019. Our growth outlook remains positive even though full-year growth will not match the YTD performance. Additionally, as the ECB cut rates for the first time in June, and with further cuts assumed, we can expect consumption to receive a boost and push the market forward from recent poor performances.

The Spanish PV market registered 95k vehicles in May, a 3.4% improvement YoY. Purchases by rental companies, as Spain attracts a record number of tourists, have boosted YTD sales up to 432k units (+6.9% YoY). The selling rate remained broadly in line with the YTD average, at 949K units/year — we expect the market to reach 1 million registrations this year. Germany’s PV market decreased to 236k units (-4.3% MoM), while YTD volumes were 5.2% higher than the same period last year at 1.17 million. Sales continue to struggle due to a stagnating economy and a lack of EV purchase incentives. In selling rate terms, the market increased MoM, with the May result standing at 2.8 million units/year.

The Italian PV market performed below expectations, with only 140k registrations in May — this marks a 6.6% decline compared to last year. The selling rate fell this month, to 1.4 million units/year; however, YTD sales increased 3.4% though this positive comparison is evaporating. France also undershot our predictions — 141k PVs were registered in May (-2.9% YoY). The selling rate stood at 1.7 million units/year, broadly in line with our expectations for 2024’s annual volume. Meanwhile, 148k units were registered in the UK PV market, a 1.7% increase YoY. The fleet segment of the market has continued to perform well. Full-year growth remains the assumption for the UK.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center. For more details on GlobalData’s designated Global Light Vehicle Sales Forecast module, click here