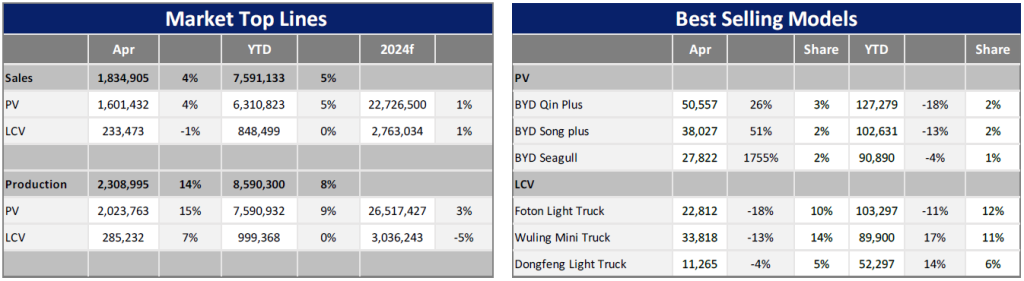

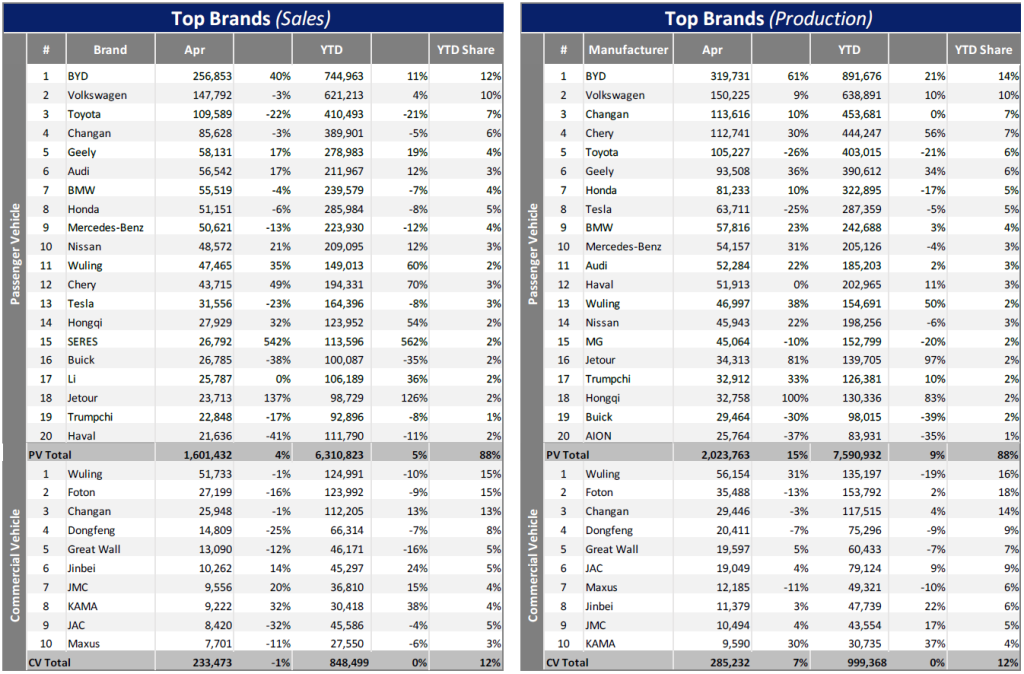

In April, the Chinese market exhibited a degree of volatility due to a confluence of factors but overall, maintained demand stability. Domestic Light Vehicle (LV) sales, excluding exports, surged to 1.8 million units, marking a 3.5% year-on-year (YoY) growth.

Notably, Passenger Vehicle (PV) sales for the month increased by 4.2% YoY to 1.6 million units. Meanwhile, Light Commercial Vehicle (LCV) sales totalled 233k units, with a minor YoY decline of 0.8%. However, a pronounced wait-and-see sentiment emerged in the market, influenced by the ongoing price war, and led to a 13.7% month-on-month (MoM) decrease in PV sales. LCV sales also saw a significant MoM drop of 18.8%. Amidst this price competition, traditional fuel (ICE) vehicles are reaching their price-cutting limits, while the market share of new energy vehicles (NEVs) is expanding rapidly. This shift is prompting some consumers to delay purchases, thereby dampening the potential for sales growth.

The wait-and-see sentiment led to a 13.7% MoM decrease in PV sales while the LCV sector also saw a significant MoM drop of 18.8%. From January to April 2024, cumulative domestic LV sales reached 7.2 million units, reflecting a 4.8% YoY increase. PV specifically achieved 6.3 million units, with a 5.5% YoY growth. LCV sales were over 800k units from January to April 2024, showing a slight 0.4% YoY growth.

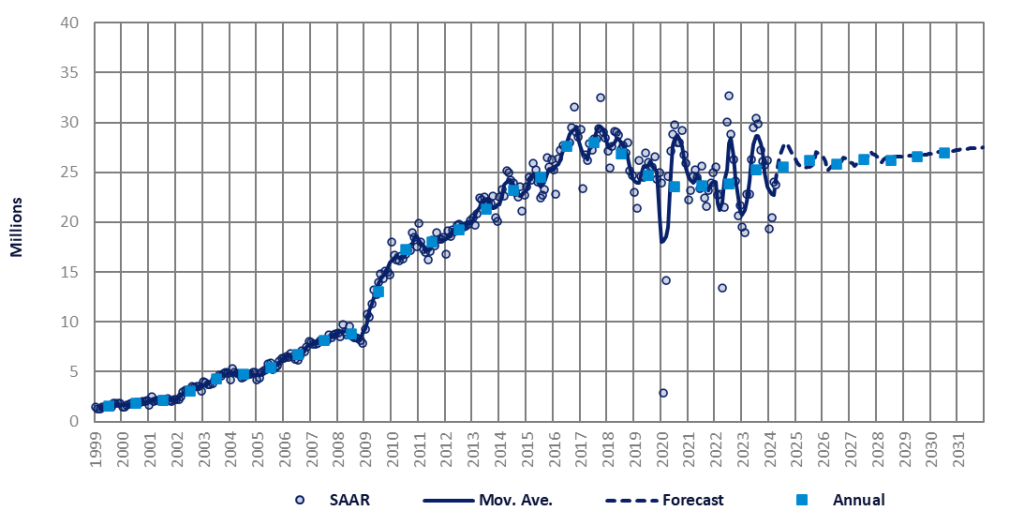

The April selling rate improved to 23.7 million units per year, an uptick from the average of 20 million units per year observed in the first two months. However, this rate remains subdued compared to the Q4 2023 average of 26 million units per year. On a YoY basis, domestic PV sales (wholesales minus exports) rose by 4.2% in April and 5.5% year-to-date (YTD), bolstered by a lower comparative base. In contrast, PV exports have seen a remarkable YTD expansion of 35% YoY.

In terms of production, total LV output for April stood at 2.3 million units. This figure represents a robust 13.7% YoY increase, despite a 9.4% MoM decline. Cumulatively, 2024 YTD volumes have amounted to 8.6 million units, indicating a commendable growth of 7.8%. Delving into the specifics, PV production, which constitutes 90% of the overall LV production, achieved a significant milestone in April, reaching 2.0 million units. This marks an impressive YoY surge of 14.7%. In contrast, the LCV sector reported a more modest yet noteworthy increase, with April’s production tallying 285k units, up 6.9% from the previous year.

In April of this year, China’s PV exports sustained their robust growth trajectory, with shipments totalling 424k units. This figure reflects a substantial YoY increase of 36.9% with exports constituting 20.9% of overall PV production. The expanding share of exports within total production underscores the significant and growing contribution of international sales to the industry’s growth. The burgeoning potential of overseas markets has encouraged several Chinese automotive manufacturers to contemplate establishing overseas factories to further reduce production costs. Looking ahead, conservative projections based on current trends suggest that China’s annual light vehicle export volumes are on track to surpass five million units within the next 2-3 years.

In April, China’s NEV production surged to 812k units, reflecting a substantial YoY increase of 35% but a modest MoM growth of 0.5%. This robust performance underscores a notable shift in market dynamics and strategic realignment by domestic manufacturers. The Battery Electric Vehicle (BEV) segment contributed 480k units, with a more moderate YoY increase of 7%. However, it experienced a slight MoM decrease of 2.9%. Despite this, BEVs remain a pivotal segment within the new energy vehicle market. Conversely, the Plug-in Hybrid Electric Vehicle (PHEV) segment excelled with an impressive YoY increase of 108%, producing 333k units. It also demonstrated a robust MoM growth of 5.7%. This sustained high growth rate indicates a booming consumer preference for PHEVs, which provide the versatility of electric and combustion engine capabilities.

Traditional fuel (ICE) vehicles, facing limited scope for further price reductions, are persistently challenged by the rise of new energy vehicles, contributing to a sustained downturn in market consumption. This factor is also a significant impediment to the overall recovery of the automotive market. However, the national “old for new” policy, along with regional implementation of supportive measures and financial incentives in loans and insurance, is revitalising market sentiment. The gradual de-escalation of price wars for new market products has ignited consumption enthusiasm among previously hesitant consumer groups. It is anticipated that these combined efforts will usher the domestic market into a more robust phase of development in the future. While these developments are encouraging, it would be wise to also carefully consider the long-term impact of over-reliance on policy-driven stimulus. Therefore, a balanced approach that encourages innovation and self-sustainability in the automotive industry is critical to lasting market health.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center. For more details on GlobalData’s designated Global Light Vehicle Sales Forecast module, click here