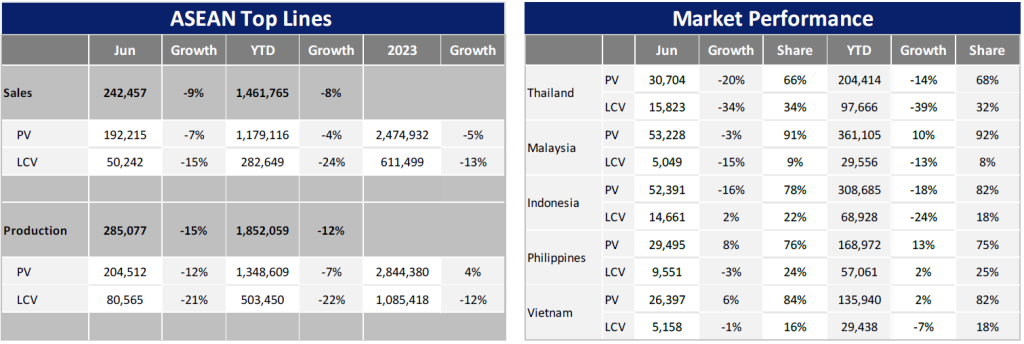

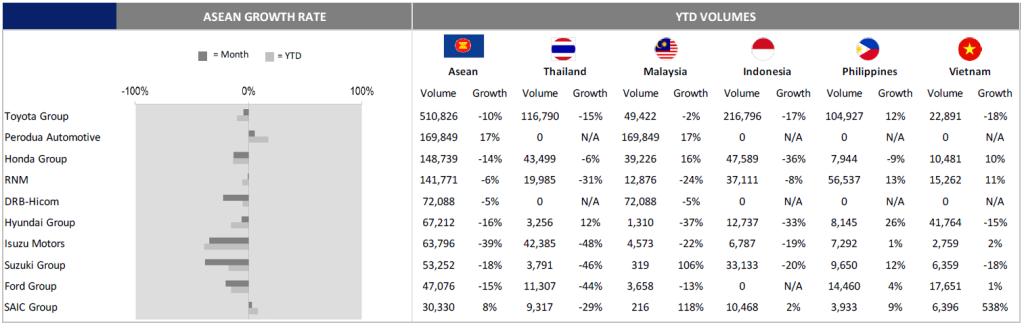

Based on official reports, the ASEAN Light Vehicle (LV) market continued to slow by 9% YoY, with June representing the 11th consecutive month of decline. Consequently, sales in Q2 2024 fell by 5% QoQ, marking the fifth successive quarter of weakening and contributing to an 8% YoY drop for H1 2024 overall. This downward trend was largely attributable to negative sentiment in Thailand and Indonesia.

The Thai LV market plunged by 25% YoY, with double-digit declines persisting for the 8th consecutive month. It is important to note that LV sales in the country have been falling since October 2022, except for a marginal increase of 2% YoY in May 2023. The sluggish performance was largely due to a weak economy, high household debt, and an increase in non-performing loans, leading to a higher rejection rate for auto loans. This impacted not only the Passenger Vehicle (PV) segment but also the Light Commercial Vehicle (LCV) segment, particularly Pickup Trucks.

Furthermore, demand for Battery Electric Vehicles (BEVs) began to wane after initial boosts from the government’s cash subsidy program and the launch of several Chinese BEV models. Notably, Thailand’s BEV registration data showed a decrease of 17% YoY between February and June 2024, following a rise of 684% YoY in 2023 and 353% YoY in January 2024. In addition, Thai LV sales continued to decline by 21% YoY in July and 23% YoY from January to July overall. Meanwhile, BEV registration data showed an improvement of 13% YoY and 0.2% month-on-month (MoM) in July. However, this growth was primarily driven by the BYD Dolphin, as the automaker reduced the price of the imported Completely Built-Up (CBU) model by around 20% at the end of June in order to clear inventory before launching the locally produced version at the end of July. LV demand is expected to remain weak in Thailand, with 2024 sales forecasted to drop to 626k units, the lowest annual volume since 2009 (539k units).

In Indonesia, sales in June fell by 12% YoY, marking the 12th consecutive month of decline and leading to a 19% YoY decrease in H1 2024. The GAIKINDO Indonesia International Auto Show (GIIAS) event in July was anticipated to be a market catalyst. However, recent information indicated that July sales fell around 9% YoY due to tightened auto loan approvals. This weaker than expected result led to minor downward adjustments in the 2024 forecast and sales are now projected to decline by 10% to 833k units this year, representing a second consecutive year of contraction. Previously, GAIKINDO had requested government support for hybrid incentives and the reintroduction of tax cut measures to boost LV demand, but the government denied this proposal in early August.

In contrast, Vietnam’s sales rose by 5% YoY in June, its 3rd consecutive month of growth. Moreover, LV sales shifted from a 20% YoY decline in 2023 and a 9% YoY decline in Q1 2024 to an 8% YoY increase in Q2 2024. As a result, Vietnam’s H1 2024 sales stood at the same level as seen in H1 2023, at 165k units. This reflects the beginning of a nascent recovery in LV demand after more than a year of depression amid the country’s property crisis. The outlook for Vietnam’s LV sales has been slightly adjusted, with a projected increase of 1% YoY to 383k units in 2024. Another key development in this report is that the Vietnamese government is reportedly considering reintroducing the temporary registration fee reduction scheme for domestically-produced vehicles, running from August 2024 to January 2025. However, there has been no official announcement as of yet. Additionally, the measure may not be reintroduced since many companies are offering discounts equivalent to 50-100% of the registration fee, and because signs of market recovery have already been observed.

The Malaysian LV market dropped by 4% YoY in June due to Proton’s planned one-week plant shutdown for maintenance. Our advanced data showed that July sales rebounded by 13% YoY to 73k units, the highest monthly total so far this year. Consequently, Malaysian LV sales increased by 8% YoY from January to July. As sales in July were stronger than expected, a slight upward revision was made to the 2024 sales outlook, to 788k units. Nonetheless, the projection still anticipates that the country’s 2024 sales will drop by 1% YoY from a record high of 795k units in 2023.

LV sales in the Philippines increased by 5% YoY in June and 10% YoY in H1 2024. However, the growth rate began to decelerate from 20% YoY in 2023 to 11% YoY in Q1 2024 and 9% YoY in Q2 2024. Additionally, our market intelligence reported that the LV market increased by only 5% YoY and 1% MoM in July. The slowdown was likely due to the fulfillment of backlogged orders, the fading of pent-up demand, and a gloomy economy, particularly high inflation. We have slightly lowered the Philippines’ sales outlook to 456k units, or a 4% YoY increase, in 2024.

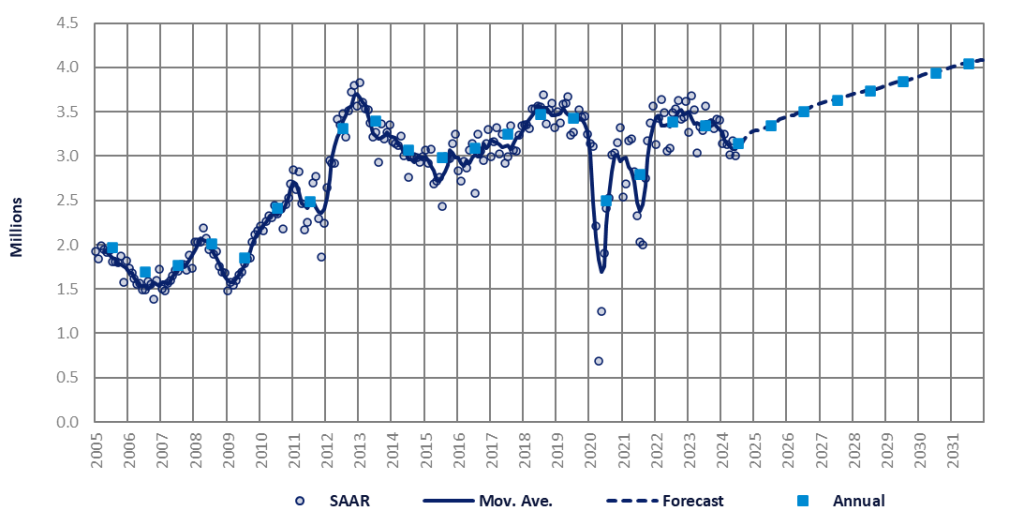

As a result, overall ASEAN LV sales are now projected to drop by 6% YoY to 3.09 million units, weighed down by weak results in Thailand and Indonesia. We also expect that regional monthly sales will not return to a positive growth rate until 2025, as there are no new optimistic factors, signs of recovery or stimulus measures, particularly in Thailand and Indonesia. It is important to note that these two countries accounted for approximately 46% of total ASEAN LV sales in H1 2024 compared to 51% in 2023.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.