Fitch Ratings has underscored the potential misconduct risk in the UK banking sector as the Financial Conduct Authority’s (FCA) investigation into motor finance loans issued between 2007 and 2021 sheds light on possible irregularities.

The FCA’s scrutiny, initiated due to a surge in customer complaints, has prompted concerns over the misconduct’s impact on UK banks, though Fitch suggests that the larger banks’ robust profitability may insulate them from significant remediation costs.

The FCA, having banned discretionary commissions in 2021, recently announced a review of historical commission arrangements in the motor finance market, sparking uncertainty about potential actions that may follow the regulatory review.

Fitch acknowledges the heightened uncertainty surrounding the probe’s outcomes but anticipates that any remediation costs, particularly for larger banks, are unlikely to have a substantial impact on their credit ratings, given their strong profitability.

The scale of potential remediation costs hinges on the FCA’s assessment of compensation, with the regulator yet to announce the compensation costs following its review.

Based on the FCA’s 2019 estimate of annual excess interest costs amounting to GBP 507 million, Fitch estimates that interest overpayments during the 14-year review period could exceed £7 billion.

However, the timeline for compensation remains unclear, as the FCA has extended the standard 8-week deadline for providing a final response to customer complaints until September 25, 2024.

Fitch acknowledges that while the scale of potential compensation costs may not rival the mis-selling of payment protection insurance, which surpassed GBP 50 billion, the investigation underscores the risk of misconduct leading to remediation costs that could impact UK banks’ earnings, influencing Fitch’s bank ratings.

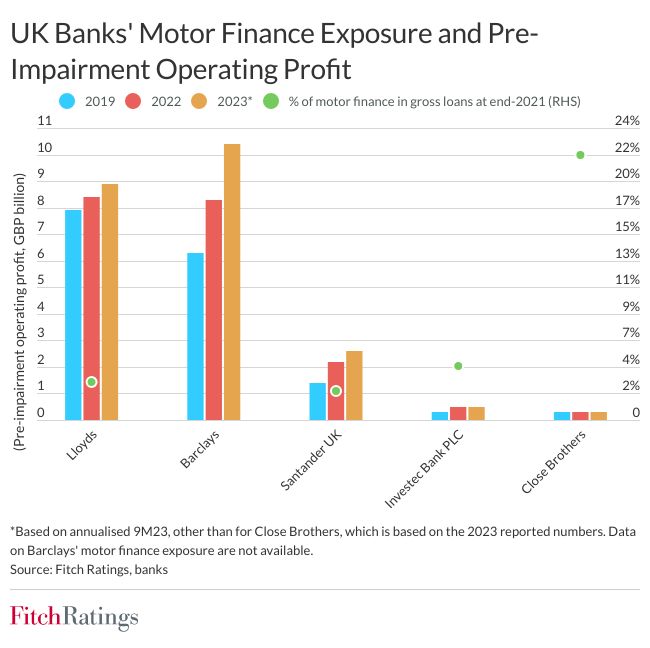

Remediation costs are expected to vary among banks in Fitch’s portfolio, with larger motor finance lenders like Lloyds Banking Group and Santander UK Group Holdings providing 2% to 3% of their gross loans as motor finance loans at the end of 2021.

In contrast, Barclays ceased offering this financing in 2019. Investec Bank Plc had a moderate 4% of gross loans in motor finance at the end of 2021, while Close Brothers Group recorded a significantly higher 22%.

However, the diverse loan volumes and underwriting timing across banks during the review period will influence compensation cost calculations.

Potential pressure on bank ratings could emerge if remediation costs significantly impact earnings over an extended period, potentially straining capital ratios and hindering business growth prospects.

Despite the recent strengthening of UK banks’ profitability, supported by higher interest rates and controlled costs, the lingering risk of misconduct underscores the need for vigilance in the banking sector.