As we move through 2024, the price war in the Chinese vehicle market continues and the competitive pressure is intensifying. Increasingly, consumers' car purchasing intentions have pivoted towards New Energy Vehicles (NEVs), leading traditional OEMs, who mainly focus on ICE vehicles, to significantly reduce prices in an attempt to retain their steadily declining market share. The Chinese OEMs are also reducing the prices of new energy vehicles to try to take the lead in this expanding field. According to financial reports published in the first quarter of 2024, many automotive companies are facing huge losses or a significant decline in profits, and so car companies are now looking at reducing manufacturing costs. At the same time, with the slow recovery of China's economy, potential buyers are paying more attention to the cost-effectiveness of the models on offer. After seeing Li Auto’s great success with Extended Range Electric Vehicles (EREVs) last year, more OEMs are focusing on the EREV technology route.

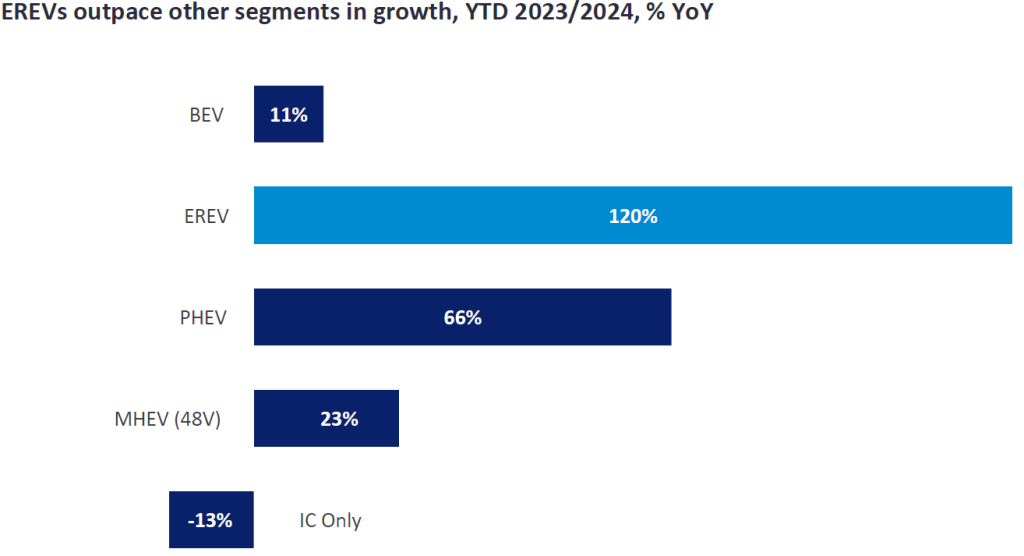

In terms of sales, it is obvious that all new energy vehicle segments have achieved year-on-year (YoY) growth — including MHEV (48V) — but the YoY growth of EREV is particularly impressive. As of May, this year, sales of EREV models have increased by 120% YoY. This figure is somewhat flattered by a low base last year, but Li Auto has maintained a high level of sales while AITO has also continued to increase sales by reducing costs through EREV and passing on the benefits to consumers.

From a technical perspective, EREV has long been underestimated by mainstream OEMs as a solution in the new energy technology route; they have preferred to directly invest in or develop pure electric models. However, they may have overlooked the pain points of current consumers, namely, the range anxiety issue. Most consumers require the option of long-distance travel, and the current battery technology or charging station layout cannot completely dispel consumers' doubts over this issue. Moreover, as battery capacities increase, an inevitable increase in the price of pure electric vehicles follows. In contrast, existing EREV models generally have a range of over 1,000km in full electric mode. This technology is very mature, and the cost is very low - the additional price of a range extender system is now only about CNY3,000 (US$415). This results in the price to the consumer being only about 50% of the price of the same level of pure electric or ICE vehicles. In other words, a high cost-performance ratio is the core reason behind the significant increase in EREV model sales.

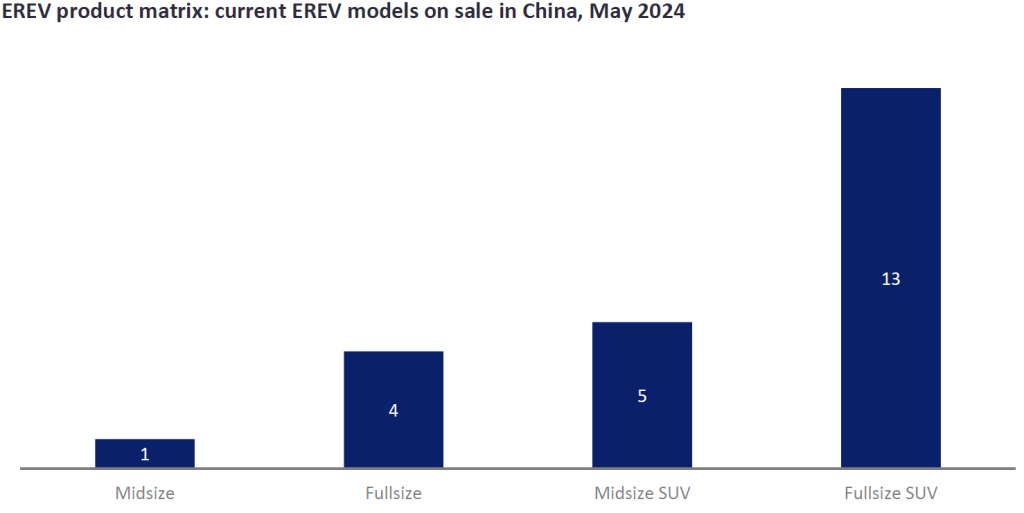

However, the EREV technology solution still has its limitations. Due to the inclusion of an engine, range extender, and battery system, the wheelbase of the vehicle tends to be larger. As a result, it can be observed that this system is often only fitted to models that are Midsize and above, and as the wheelbase increases, more models are equipped with this system. At the same time, due to the low technical barriers of EREV technology, models equipped with this system often increase their investment in autonomous driving and smart cockpits, allowing consumers to truly feel a sense of high-end quality, rather than just experiencing the usual values associated with the brand in question.

Looking at the latest results, Li Auto has delivered an impressive financial performance with a gross margin of over 20% thanks to EREV technology. AITO has also achieved a commendable financial turnaround. Subsequently, we have observed players such as Avatar, Mi, IM and even XPeng announcing plans to launch EREV models. While European and American automakers continue to adhere to the pure electric path, it remains to be seen whether Chinese OEMs, facing market and cost pressures, can alleviate competitive pressures and emerge from their current predicament through EREV technology.

Patrick Zhang, Powertrain Market Analyst, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.