UK vehicle production hit 1,025,474 units in 2023, according to the latest figures published by the Society of Motor Manufacturers and Traders (SMMT).

With 905,117 cars and 120,357 commercial vehicles (CVs) produced, overall output was up 17.0% on the previous year. The easing of pandemic-related challenges, from chip shortages to lockdowns, and increasing electrified model production, combined to drive annual output above one million for the first time since 2019.

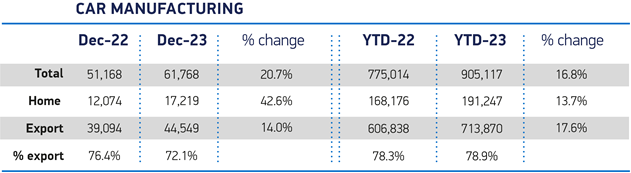

Strong December performances for both car manufacturing, up 20.7% year on year, and CV volumes, up 80.3%, rounded off a positive year.

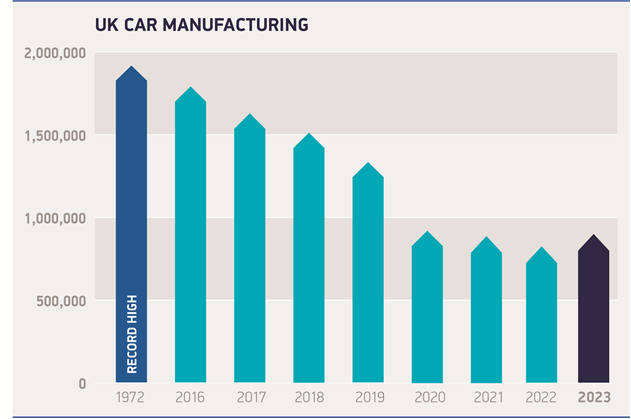

Overall, UK car production rose 16.8% to 905,117 units in 2023, its best growth rate since 2010, with the total retail value of all models made coming in at more than £50 billion. While 191,247 cars were built for domestic buyers, the lion’s share of output was shipped overseas. Year on year, exports rose 17.6% compared with a 13.7% rise in output for the British market. However, UK car production still remains well below pre-pandemic levels and annual output over 1.5 million units as recently as 2018.

Besides the impact of the pandemic and subsequent supply shortages caused by the chips shortage, overall UK passenger car production has been hard hit by structural issues such as the closure of Honda’s Swindon plant and the loss of Vauxhall (Stellantis) Astra production from the Ellesmere Port plant in northwest England. In 2018, the Honda Swindon plant built some 160,000 cars (mainly Civic, but some CR-Vs) and Vauxhall (Stellantis) turned out over 77,000 Astras.

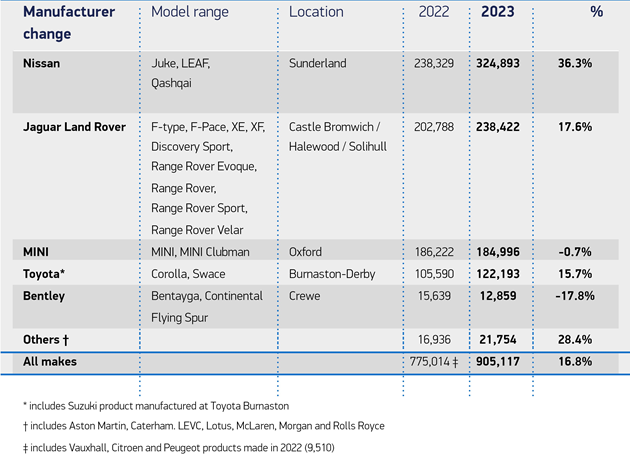

Also, Tata Jaguar Land Rover (JLR) output in Britain is some 200k lower when comparing 2023 with 2018 (at 238k versus 449k). Land Rover has moved Discovery and Defender manufacturing from the UK to its plant in Slovakia.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIn 2023, the EU remained by far the sector’s largest global market, taking 60.3% of exports, with shipments up almost a quarter (23.2%) to 430,411 units. The US was the next biggest destination with a 10.3% share of exports (73,571 units), followed by China with 7.2% (51,202 units), despite shipments to both slipping by -9.1% and -2.7% respectively. Turkey, conversely, saw exports surge 223.8% to 27,346 units, making it the UK’s fourth biggest global market ahead of Japan, Australia, South Korea, Canada, UAE and Switzerland.

The UK’s largest car manufacturer last year was Nissan (Sunderland plant – makes Juke, Leaf and Qashqai) with output of 324,893 units, some 36% of the UK car output total.

Mike Hawes, SMMT Chief Executive, said: “Receding supply chain challenges, new model introductions and a massive £23.7 billion of investment put UK vehicle production firmly back on track in 2023. Industry will now focus on the delivery of these commitments, transitioning the sector at pace to electric and scaling up the supply chain. With global competition as fierce as it has ever been and amid escalating geopolitical tensions, both government and industry must remain singularly focused on competitiveness, with all the jobs and growth this will bring. We are in a much better position than a year ago, but the challenges are unrelenting.”

The SMMT noted that headwinds remain for the sector this year, most immediately with attacks on shipping in the Red Sea raising the spectre of delays and cost pressures.