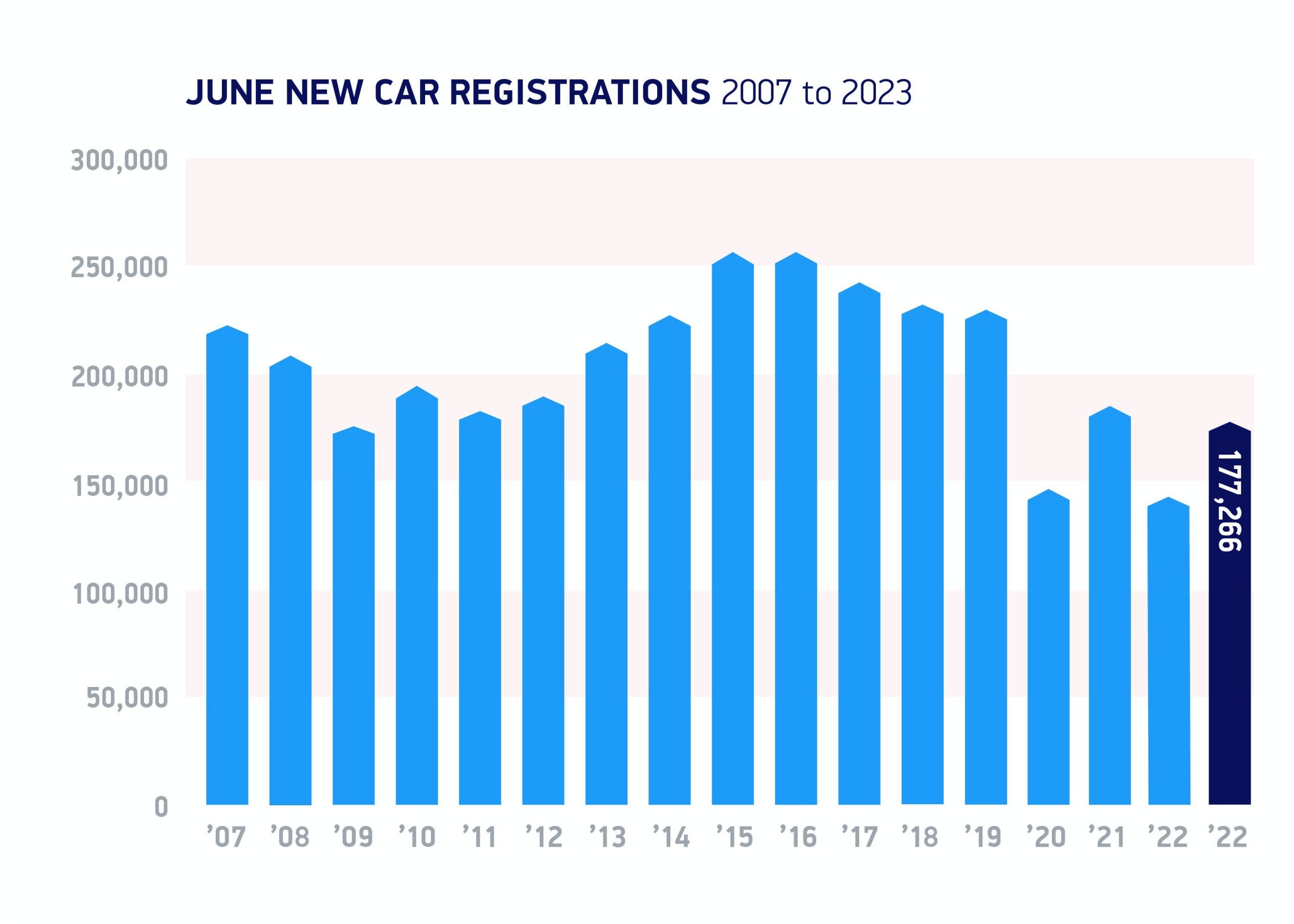

The UK new car market grew 25.8% in June with 177,266 vehicles registered, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

The June performance marks the 11th consecutive month of growth as the industry continues to gradually overcomes the supply chain shortages that have constrained production and sales – creating a low year-on-year comparison base.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The SMMT noted that with waiting times easing and pent-up demand being met, the automotive sector is a ‘rare bright spot in a gloomy economic landscape. However, overall market volumes remain below pre-pandemic levels.

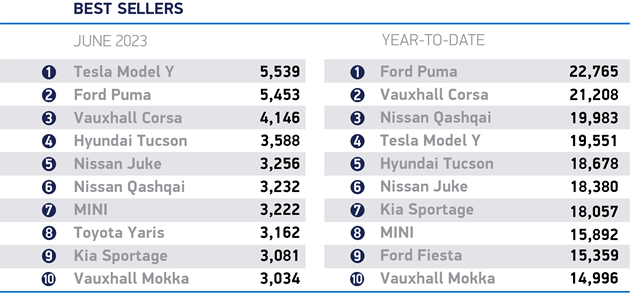

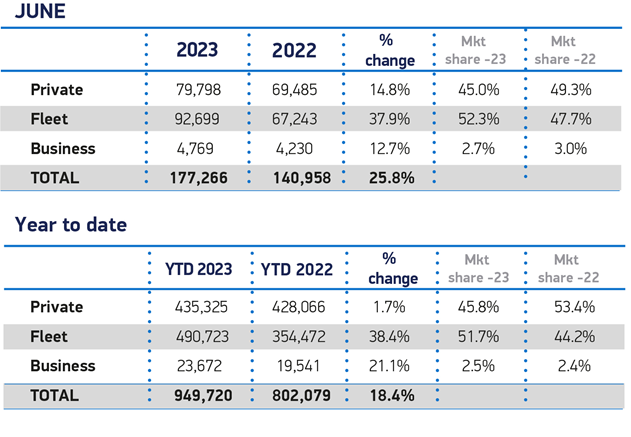

Growth in June was driven by large fleet registrations, up 37.9% to 92,699 units, reflecting the normalisation of supply. Private demand grew more modestly, up 14.8% to 79,798 units.

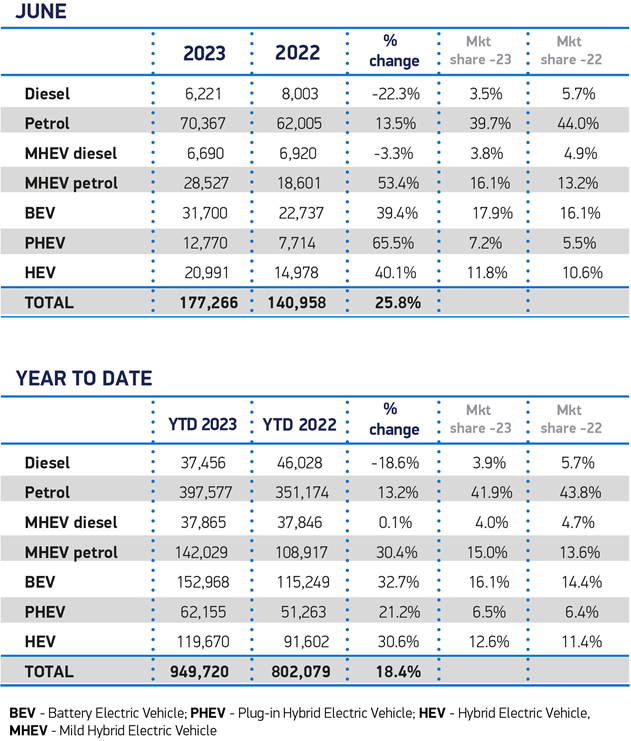

Deliveries of petrol cars increased 22.7%, to remain the most popular powertrain, while those of hybrids (HEVs) and plug-in hybrids (PHEVs) also rose, by 40.1% and 65.5% respectively. Diesel registrations were down 13.5%.

Battery electric vehicle (BEV) registrations grew again, with the segment up 39.4% as 31,700 buyers chose to get behind the wheel of a zero emission car – 17.9% of the total market. It is business and fleets, however, rather than private buyers, that continue to drive this growth, thanks to attractive incentives on offer. Manufacturers are offering a range of BEV deals for private buyers, including flexible subscription models and attractive finance rates.

Almost a million (949,720) new cars joined UK roads in the first six months of 2023, with total registrations up 18.4% and BEV uptake at record levels with 152,968 deliveries so far this year – some 13 times greater than the same period in 2019.

BEV market share for 2023 is now 16.1% but, with a zero emission vehicle mandate requiring 22% BEV registrations per manufacturer due to come into force in less than six months’ time, the SMMT warned that ‘more needs to be done to accelerate the transition’.

Given that recharging an EV at home can offer a 60-70% cost per mile saving compared with refuelling a petrol or diesel vehicle, the SMMT is calling for a cut in VAT on public charging to help quicken uptake.

Drivers able to charge at home pay just 5% VAT to power up their EV, compared with 20% for those without access to a driveway or designated private parking space who are reliant on the public network. The SMMT claims that VAT equity would make switching to an electric vehicle feasible for more people regardless of home ownership or property status.

Mike Hawes, SMMT Chief Executive, said: “The new car market is growing back and growing green, as the attractions of electric cars become apparent to more drivers. But meeting our climate goals means we have to move even faster. Most electric vehicle owners enjoy the convenience and cost saving of charging at home but those that do not have a driveway or designated parking space must pay four times as much in tax for the same amount of energy. This is unfair and risks delaying greater uptake, so cutting VAT on public EV charging will help make owning an EV fairer and attractive to even more people.”

Richard Peberdy, UK Head of Automotive for KPMG UK, warned of the impact of rising UK interest rates for the sales outlook. “Increased car production volumes are clearing the backlog of car orders that built up over recent years of reduced supply,” he said. “But rising interest and mortgage rates threaten new orders, while also altering which brands and models consumers are opting for.”

Peberdy also sees a more competitive brand landscape ahead. “With new entrants from China and a continued growth of Korean brands, more competition is emerging in the UK car market at a range of price points. This will alter brand market share over the coming years, especially for electric vehicles, disrupting the dominance of legacy players.”