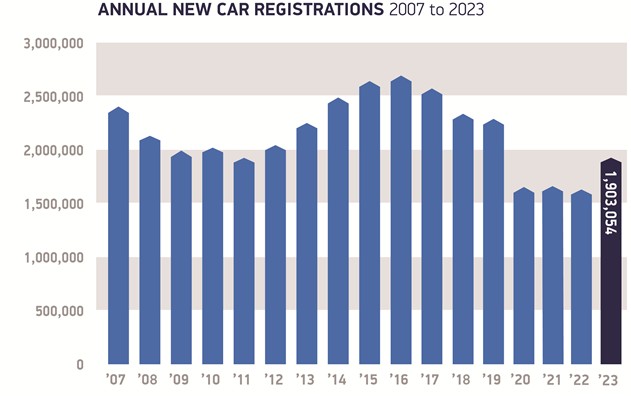

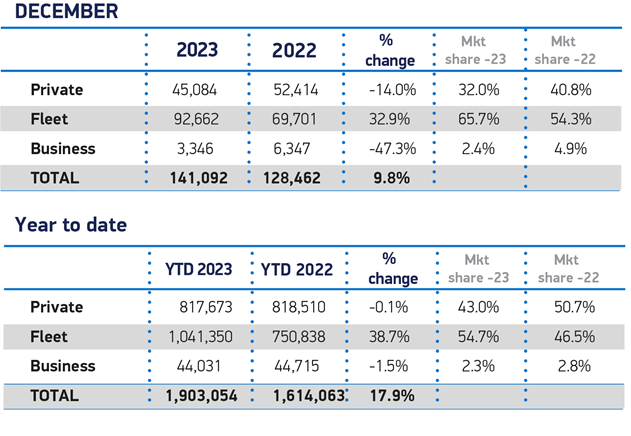

The UK new car market has recorded its best year since the pandemic as a strong December, up 9.8%, wrapped up the 17th month of consecutive growth. Some 1.903 million new cars reached the road during 2023 – an increase of 17.9%, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

Growth was driven by fleet investment as the previous year’s supply constraints faded and helped fulfil pent-up demand. Fleet deliveries rebounded by 38.7% year-on-year.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Private consumer demand remained stable at 817,673 units after a strong recovery in 2022, with cost of living pressures and high interest rates constraining growth. While the overall new car market remains some 17.7% below pre-pandemic levels, the SMMT said the surge in uptake compared with the previous year saw the value of new car sales jump more than £10 billion to around £70 billion, with 288,991 additional vehicles reaching the road.

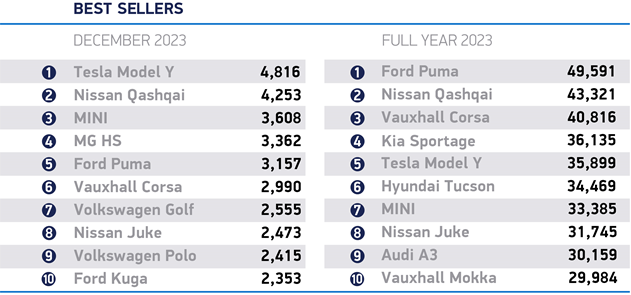

In terms of vehicle type, buyers showed a continued preference for superminis, SUVs and lower medium segment cars, which accounted for 29.8%, 28.6% and 28.2% of the market respectively. These three segments have been the most popular since 2013.

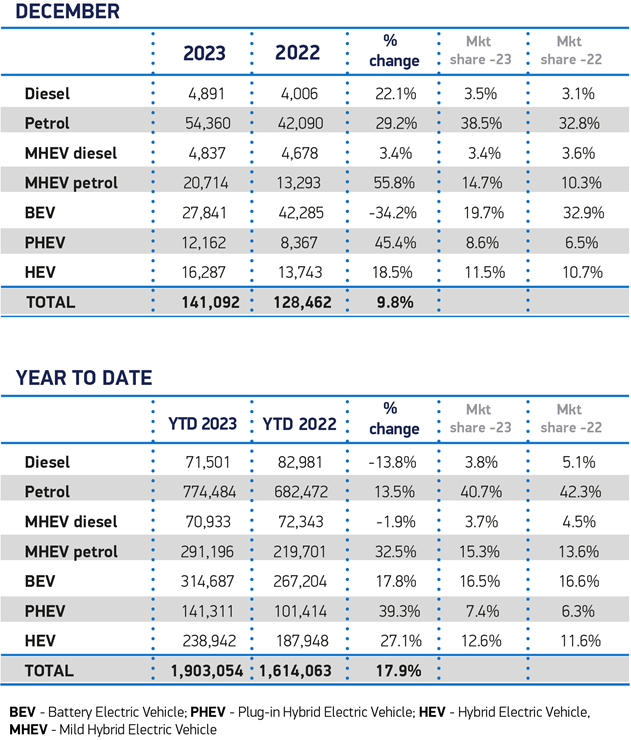

The SMMT also said that higher sales of low and zero emission vehicles meant average new car CO2 fell by 2.2% to 108.9 g/km. Hybrid electric vehicles (HEVs) recorded robust growth, up 27.1% to reach a 12.6% market share. Plug-in hybrids (PHEVs) also enjoyed a strong year, with a 39.3% increase in registrations to account for 7.4% of the market.

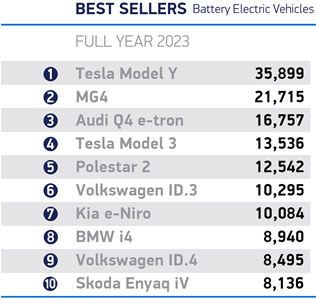

Battery electric vehicle (BEV) uptake reached a record volume – up by almost 50,000 units with 314,687 new registrations. Indeed, 2023 saw more BEVs reach the road than in 2020 and 2021 combined. However, BEV volumes actually fell by 34.2% in the last month of the year, but this is a reflection of an abnormal December 2022 when significant numbers of orders were able to be fulfilled in the month. The SMMT also said the next few months are also likely to be volatile due to the regulatory uncertainties that have beset the market over the past few months – most obviously the last-minute deal on UK-EU Rules of Origin, which avoids tariffs on EVs but which has made planning difficult.

Overall, BEVs accounted for one in six new cars registered in 2023, with the majority taken by business and fleet buyers who benefit from tax incentives. In contrast, just one in 11 private buyers chose a BEV.

The SMMT also noted that since the end of the Plug-in Car Grant in June 2022, the UK is the only major European market with no consumer BEV purchase incentives – but it is now also the only market with mandated minimum targets for new ZEV registrations.

With mainstream consumer demand flat, the SMMT is calling on government to support private buyers by halving VAT on new BEVs for three years. This temporary cut, the trade body said, would give private consumers access to fiscal support at a level similar to that enjoyed by business buyers, enabling manufacturers to deliver larger volumes of zero emission vehicles. Combined with a retention of the business incentives that have already proven their value in increased EV uptake, the measure would accelerate the UK’s market transition, the SMMT said.

Over the past five years, BEV uptake has risen almost 20-fold, with the Treasury reaping a VAT windfall due to these vehicles typically having higher purchase costs than their ICE counterparts, the SMMT noted.

The SMMT said halving VAT for BEV purchases would give consumers an estimated additional £7.7 billion in BEV buying power to the end of 2026, while reducing the Treasury’s tax take by just 22% per vehicle for each additional driver switching from an ICE to a BEV. This would encourage an extra 270,000 new car buyers in Britain to go electric and put 1.9 million new EVs on the road by the end of 2026.

Mike Hawes, SMMT Chief Executive, said: “With vehicle supply challenges fading, the new car market is building back with the best year since the pandemic. Energised by fleet investment, particularly in the latest EVs, the challenge for 2024 is to deliver a green recovery. Government has challenged the UK automotive sector with the world’s boldest transition timeline and is investing to ensure we are a major maker of electric vehicles. It must now help all drivers buy into this future, with consumer incentives that will make the UK the leading European market for ZEVs.”