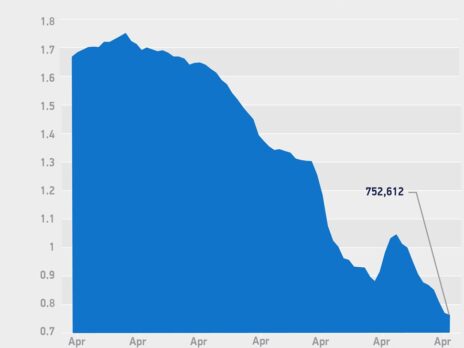

UK car production fell 11.3% in April with 60,554 units rolling off factory lines, according to the latest figures released today by the Society of Motor Manufacturers and Traders (SMMT).

The drop was a result of several factors exerting downward pressure on UK car producers including the ongoing global shortage of semiconductors, the impact of the war in Ukraine on supply chains, model changes and broader industry structural changes.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

These factors also had a significant effect on year-on-year export comparisons, with the closure of a Honda’s UK car plant (Swindon) in 2021 continuing to impact export figures, particularly to the US. Some 7,752 fewer cars were made in the month than a year before and the total was 14.7% below the April 2019 pre-pandemic level. This was itself down 44.5% on April 2018, due to shutdowns rescheduled to mitigate against the possibility of a no-deal Brexit.

Production output for overseas markets fell by 20.8%, driven by a 68.0% decline in shipments to the US, and a 10.4% drop in those to Asia.

However, around 60% of cars exported headed to the EU and there was a 5.0% uplift in EU shipments, while production for the UK grew for the second month in a row, up a massive 60.1%. This substantial rise was primarily the result of new models coming to market, attracting buyers into showrooms, but is also flattered by comparison with April 2021 when the economy was restarting after lockdown with demand subdued.

The shift towards electrification continues. More than one-in-four (26.4%) cars made in April was electrified, equivalent to 16,010 units, up 2.1% on the same month a year ago, boosted by battery electric vehicle output up 38.2% (to 9.9% share).

Mike Hawes, SMMT Chief Executive, said: “The UK car industry is exposed to a host of issues that are undermining output and competitiveness. Global chip shortages and supply chain disruption are exacerbated by spiralling energy costs, additional trading costs and slowing global markets. The foundations of the sector are strong and the transition to zero and ultra-low emission vehicles continues apace but we need more policies and measures that support manufacturing and encourage investment into the UK at this most challenging of times.”

Chris Knight, Automotive Partner at KMPG, also stressed the role of supply shortages. He said: “Consumer demand for new cars remains high despite the cost of living crisis, but supply shortages mean that manufacturers still don’t have the ability to produce cars at pre-pandemic volumes, and won’t for some time.

“Car makers have pivoted, focusing production on higher-margin vehicles – which has proved so profitable that tough decisions lay ahead about whether they want to return to the old model of high volumes and extensive discounting. Smaller and lower margin cars have become less attractive to car manufacturers.

“With consumers experiencing long wait times for lower-margin vehicles there is certainly an opportunity for car makers that are able to ramp up production of lower cost vehicles. For example, Chinese entrants to the European market may feel that this is a market gap they can seize upon, especially for lower price electric vehicles.

“Incumbent OEMs need to be mindful of how these dynamics will shape the competitive landscape in the years to come.”