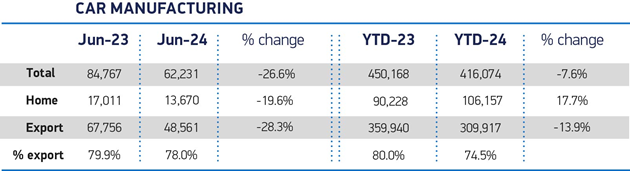

UK car production fell 7.6% in the first six months of the year, according to figures published by the Society of Motor Manufacturers and Traders (SMMT).

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

UK factories turned out 416,074 units, 34,094 fewer than in the same period in 2023, following a 26.6% decline in June caused by multiple model changes. The SMMT said the performance was expected as manufacturers retool lines to make electrified models following some £23.7 billion of UK investment announced last year.

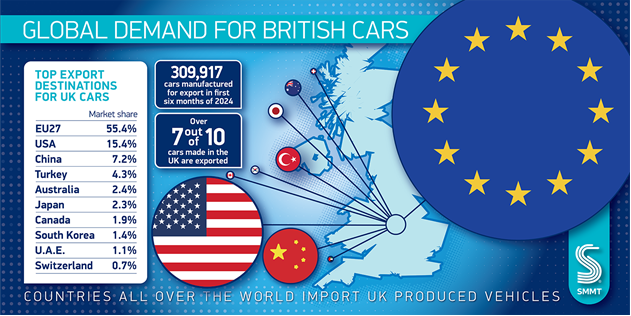

Amid this transition, first half year electrified vehicle (battery electric, plug-in hybrid and hybrid) production was down 7.6%, in line with overall volumes, to 157,224 units. This represents more than a third (37.8%) of all output, unchanged from last year. In the same period, overall car output for the UK market was up 17.7% to 106,157 units, but this was not enough to offset a 13.9% decline in production for export.

Mike Hawes, SMMT Chief Executive, said: “The UK auto industry is moving at pace to build the next generation of electric vehicles – a transition that can be a growth engine for the entire British economy. The new government’s commitments to gigafactories, a decarbonised energy supply and a faster planning system will help boost our competitiveness and sustain employment in a sector that delivers well paid, skilled jobs nationwide. Amid fierce global competition, however, industry and government must work quickly to deliver those commitments, creating an industrial strategy that enables the growth the economy craves.”

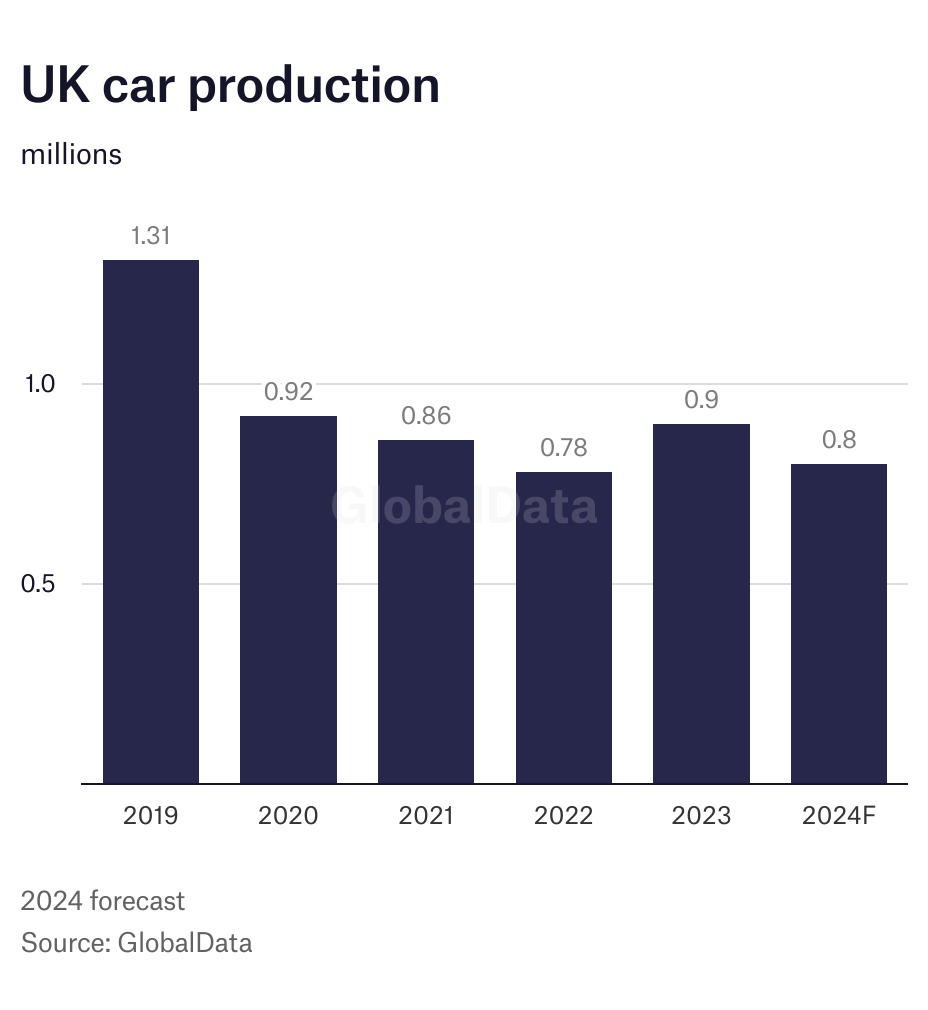

UK car output remains way under pre-pandemic levels and is struggling to recover volume as it faces challenges in electrification and developing more export business to replace recently lost manufacturing capacity, according to a GlobalData analyst.

Justin Cox, an analyst at GlobalData, points out that UK car production is running way under where it was pre-pandemic. “The UK auto industry is struggling in overall volume terms this year,” he says. “This year there is certainly some negative impact from significant model changes and that’s to be expected.”

“Our forecast for this year sees UK car output at a little over 0.8 million units. It was much higher before the pandemic, but we see it settling in the medium-term at around a million units a year.”

In 2019 UK car production was 1.3 million units.

Cox also points out that the UK’s auto industry has been hit by structural changes to output by some manufacturers and some of that lost capacity will be difficult to replace. “There’s been the closure of Honda’s Swindon plant and the loss of Vauxhall (Stellantis) Astra production from the Ellesmere Port plant in northwest England. Jaguar Land Rover has also moved Discovery and Defender manufacturing from the UK to its plant in Slovakia. That’s inevitably sent the UK production base-line down.”

EVs a challenge presenting ‘huge questions’

Richard Peberdy, UK Head of Automotive for KPMG, pointed out that carmakers in Britain are mandated to scale-up the percentages of electric vehicles that they sell each year, but that there are issues with low private individual demand for EVs that the new Government may want to address.

“The journey to 100% hybrid & electric new car production may be sped up further, should the Government reinstate the 2030 target [for end of ICE-only car sales; pushed back to 2030 by previous administration],” he said.

However, he added that ‘huge questions’ remain unanswered regarding how new electric vehicle sales can be significantly increased from its current level.

“Market share has somewhat plateaued and private new EV sales are falling so far this year,” he noted. “Charging infrastructure, particularly for those without off-street parking, remains a common cited concern, as is the purchase price from new and the scale of depreciation. The latter factors are also driving growth in the used EV market, although the emergence of cheaper brands and models into the UK market may improve affordability options from new.”

Peberdy raises the issue of incentives to grow individual demand for EVs. “Increasingly, the UK automotive industry is suggesting that incentivisation will be needed to grow consumer demand for buying new EVs,” he says. “This has proved successful for increasing business fleet EV sales, especially for use in salary sacrifice schemes – which have been a big driver of overall EV sales and also played a role in limiting private sale numbers.”