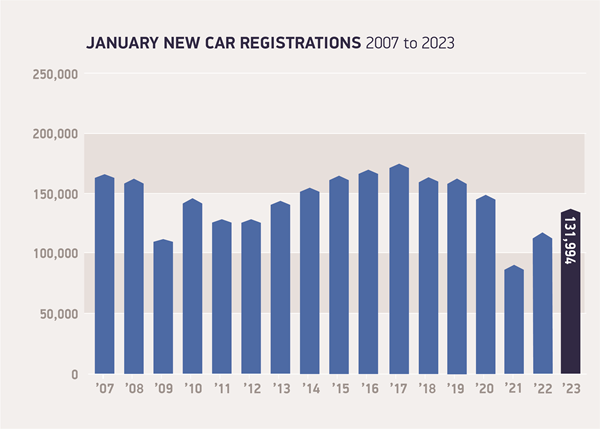

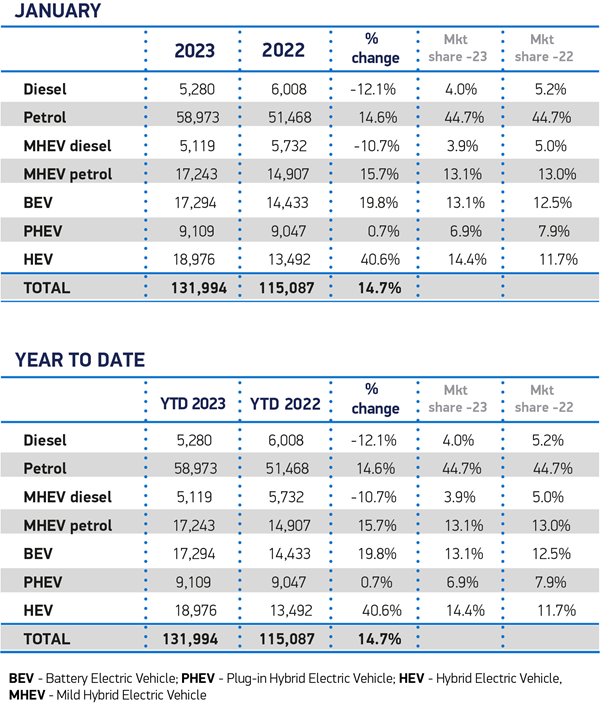

The UK new car market grew 14.7% in January to reach 131,994 units, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

The SMMT said it was the best start to the year since January 2020’s pre-Covid 149,279 units and marks the sixth successive month of expansion.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Electrified vehicles drove the increase. Hybrid electric vehicles (HEVs) comprised 14.4% of new car registrations, increasing volumes by 40.6%. Battery electric vehicle (BEV) registrations rose 19.8% to reach 17,294 units, or 13.1% of new registrations – slightly below the average recorded for 2022. Plug-in hybrid vehicles (PHEVs) recorded a 0.7% rise, although their share fell to 6.9% of new cars reaching the road.

It was also a strong month for large fleet registrations, which increased by 36.8% to 69,540 units, while registrations by private buyers fell by 4.3% to 59,639 units – reflecting some easing of supply and evidence of how shortages last year distorted market performance. Registrations by businesses, the smallest segment at 2,815 units, rose by 45.6%.

Plug-ins are forecast to comprise more than one in four UK new car registrations this year, representing growth of 32.1% or approximately 487,140 units, and almost a third (31.0%) of the market in 2024 at 607,150 units.

However, the SMMT also noted that the rollout of infrastructure needed to charge them is failing to keep pace. During Q4 2022, the ratio of new chargepoint installations to new plug-in car registrations dropped to one for every 62 – a significant fall compared with the same quarter last year, when the ratio was 1:42. As a result, in 2022, one standard public charger was installed for every 53 new plug-in cars registered, the weakest ratio since 2020.

The SMMT said that mandating rollout targets for infrastructure and regulating service standards would give drivers certainty they can always find a working, available charger. Infrastructure must be built ahead of demand otherwise ‘poor provision risks delaying the electric transition’, the SMMT warned.

Mike Hawes, SMMT Chief Executive, said: “The automotive industry is already delivering growth that bucks the national trend and is poised, with the right framework, to accelerate the decarbonisation of the UK economy. The industry and market are in transition, but fragile due to a challenging economic outlook, rising living costs and consumer anxiety over new technology. We look to a Budget that will reaffirm the commitment to net zero and provide measures that drive green growth for the sector and the nation.”

The strong start to the year is mirrored in the latest market outlook, which anticipates 1.79 million new car registrations in 2023, an 11.1% increase on the past year but still well below 2019 levels. This also represents a 0.8% reduction on October’s outlook, against a weak economic backdrop. However, a further 9.3% increase is expected next year, with 1.96 million new cars expected to join the road in 2024.

Chris Knight, UK Automotive Partner, KPMG, said: “Car makers have enjoyed a period of higher profits due to the low availability of new cars, which has also increased used car values. As supply issues gradually resolve, combined with a reduction in household spend for the majority of buyers, we’re seeing a more competitive landscape and a return to better deals and discounting in the new car market. This is also cooling used car values.

“We expect to see a plethora of new auto brands launch in the UK in the coming months, further increasing consumer choice at all budget levels.”