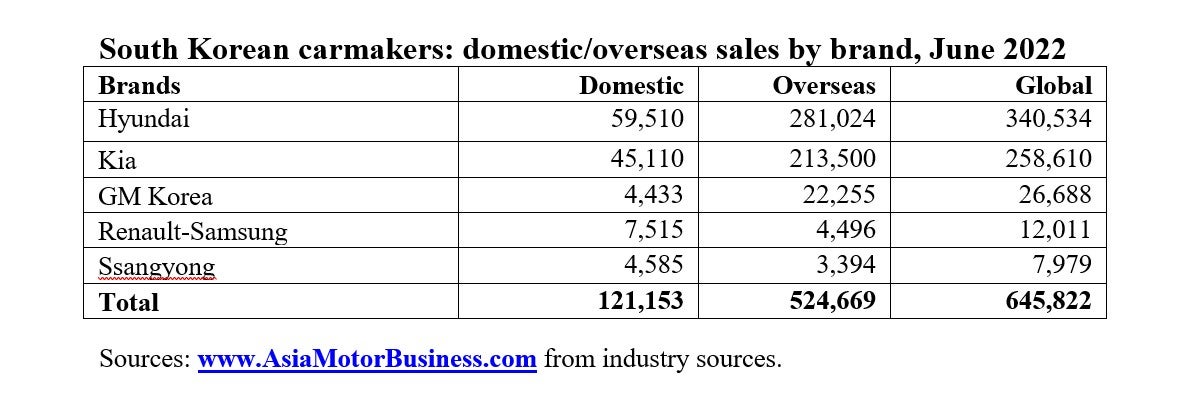

Domestic sales by South Korea’s five main automakers combined fell 10% to 121,153 units in June 2022 from 134,761 units a year earlier, according to preliminary wholesale data released individually by the companies.

The data did not include sales by low volume commercial vehicle manufacturers, such as Tata-Daewoo and Edison Motors, as well as sales of imported vehicles which are covered separately.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The ongoing shortage of semiconductors continued to affect vehicles supplies to the local market with most brands reporting declines in June. Hyundai’s local deliveries dropped by 13% to 59,510 units while Kia sales were down by almost over 8% at 45,110 units; GM Korea 4,433 (-23%); and Ssangyong 4,585 (-20%). Renault Korea was the only company to increase its domestic sales last month, by 34% to 7,515, after a sharp drop in May.

In the first half of 2022, domestic sales were down 11% at 668,886 units from 753,194 in the same period of last year.

Global sales among the country’s big five automakers, including vehicles produced overseas by Hyundai and Kia, fell 2% to 645,822 units in June from 660,209 units a year earlier due mainly to falling domestic volume, while cumulative six month volume was down 5% at 3,542,311 from 3,726,135 units. Overseas sales fell just slightly to 524,669 units last month from 525,448 a year earlier and 3% to 2,873,425 units year to date from 2,972,941 units, reflecting also tight supplies of semiconductors.

Hyundai Motor global sales fell 4.5% to 340,534 units in June from 356,631 a year earlier, reflecting lower domestic and overseas deliveries as the global shortage of semiconductors continued to affect output. Global sales in the first half of the year were almost 8% lower at 1,877,193, including more than 100,000 electric vehicles (EVs), compared with 2,031,185 a year ago.

Domestic sales dropped 13% to 59,510 units last month from 68,407 a year earlier, despite strong demand for SUVs and the upmarket Genesis brand. Six month volume was also down by 13% at 334,396 from 386,095 units. Overseas sales fell 2.5% to 281,024 in June from 288,224 units, while cumulative sales were down 6% at 1,542,797 from 1,645,090 units, reflecting significant headwinds including the suspension of the company’s Russian operations and logistical issues in China.

Hyundai maintained its forecast for an 11% rise in full year global sales to 4,323,000 vehicles in 2022, driven by a 13% rise in overseas sales to 3,591,000 units and a slight rise in domestic sales to 732,000. The automaker said it would “endeavour to alleviate business uncertainties by optimising production and inventory and by tailoring its business strategies to each region”.

Kia global sales rose 2% to 258,610 vehicles in June from 254,062 a year earlier with a further slowdown in domestic sales more than offset by stronger overseas sales. In the first half, global sales were down 2% at 1,418,617 from 1,444,107 units with overall deliveries affected by continued tight semiconductor supplies.

Domestic sales fell 8.5% to 45,110 units last month from 49,280 a year earlier and were down 6% at 262,532 units year to date from 278,384 units despite strong demand for SUVs such as the Sorento and Sportage. Overseas sales rebounded 4% to 213,500 units in June from 204,782 a year earlier, after declining 5% in May, led by strong demand for the Sportage and Seltos SUVs. First half overseas sales were just slightly lower at 1,155,910 compared with 1,165,723.

Kia maintained its full year global sales forecast of 14% growth to 3.15 million vehicles in 2022, including 562,000 domestic sales and 2.59 million units overseas, helped by new models such as the EV6 GT and the redesigned Niro.

GM Korea global sales were slightly lower at 26,688 vehicles in June from 26,876 units a year earlier, reflecting sharply weaker domestic sales which was offset by higher exports. Cumulative six month sales were down 21% at 122,756 units from 154,783 previously with output significantly affected by the global shortage of semiconductors.

Domestic sales dropped 23% to 4,433 units in June from 5,740 units a year earlier and 47% to 17,551 year-to-date from 33,160. The automaker continues to beef up its domestic line with imports from the US with the recent arrival of the upgraded Equinox and Tahoe SUVs. The company said it would launch GMC in the second half of the year with the Sierra Denali truck set to lead the brand’s market entry.

At the end of last year, the company said it planned to launch 10 new electric models in South Korea by 2025, all of which it plans to import from North America.

Exports rose 5% year on year to 22,255 units last month from 21,136 units, driven by strong deliveries of the Trailblazer SUV, while cumulative volume was still down 13% at 105,205 from 121,623 units.

GM Korea plans to cease operations at its Bupyeong 2 plant by the end of the year, with production of the Trax compact SUV and Malibu midsize sedan to end in November. Production will be concentrated at the Bupyeong 1 and Changwon plants which have a combined capacity of 500,000 vehicles on three shifts. They make the Chevy Trailblazer SUV and the Spark mini car respectively. A new cross over utility is scheduled to go into production in Changwon later this year.

Renault Korea saw its global sales fall by over 15% to 12,011 vehicles in June from 14,166 units a year earlier, reflecting a sharp drop in export sales which it blamed in part on the global semiconductor shortage. Overall sales in the first six months of the year were still up 36% at 76,156 from 55,926 units, reflecting strong export growth earlier.

Local sales rebounded by 34% to 7,515 units last month from 5,610 a year earlier after falling 20% in the previous month while cumulative volume was down 9% at 26,230 from 28,930 units. Exports fell 47% to 4,496 units in June from 8,556 units after strong growth earlier in the year as the company stepped up shipments of the XM3 and QM6 SUVs to Europe with cumulative volume up 86% at 50,293 from 27,086.

Last month the company announced it planned to produce its first EV in 2026 by which time it expects domestic EV demand to rise to 20% of overall vehicle sales, rising to 30%-40% by 2030.

Bankrupt Ssangyong Motor global sales fell 6% to 7,979 vehicles in June from a weak 8,474 units a year earlier, reflecting a sharp fall in domestic sales as chip supplies remained tight. Cumulative six-month sales were still up 19% at 47,589 units from 40,134 units.

Domestic sales fell 20% to 4,585 units last month from 5,724 a year earlier, while year to date volume was up 6% at 28,177 from 26,625 units. Exports rose 22% to 3,394 units in June from weak year earlier sales of 2,780 units, while cumulative volume was up 43% at 19,412 from 13,539 units. The company launched its first battery powered SUV in March, the Korando e-Motion, to help strengthen its domestic sales.

Seoul Bankruptcy Court late last month said a consortium led by the local steel and chemicals company KG Group had been selected as the successful bidder in its latest auction for the bankrupt automaker, having offered the best deal in terms of “acquisition price, fundraising plans and financial status”. The winning bid was valued at KRW950bn (US$736m), including KRW600bn in operating capital with the consortium given until 15 October to complete the deal.