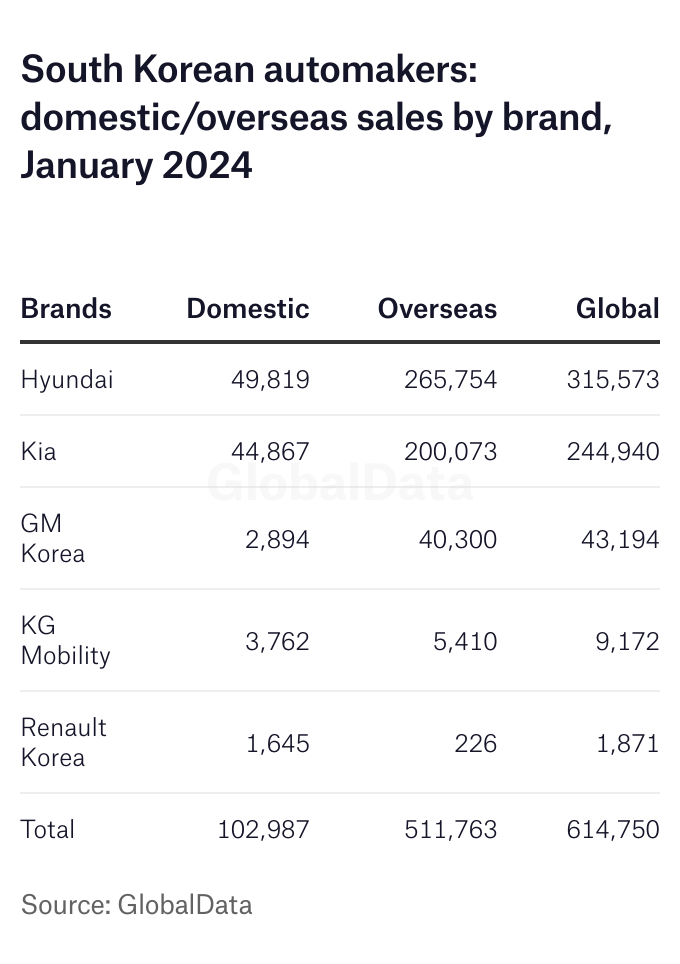

Domestic sales by South Korea’s five main automakers combined fell 2% to 102,987 units in January 2024 from 100,751 a year earlier, according to preliminary wholesale data released individually by the manufacturers.

The data did not include sales by low volume commercial vehicle manufacturers while import brands are covered in a separate report later in the month.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

January sales were supported by a 15% rebound in Kia sales to 44,867 units, after a sharp fall in December, which helped offset a 3% decline in Hyundai sales to 49,819 units. GM Korea continued to enjoy strong demand for its new Trax model, with overall domestic sales jumping by 183% to 2,894 units from weak year earlier volume, while KG Mobility sales plunged 47% to 3,762 units and Renault Korea was down 22% to 1,645 units.

Global sales by the country’s five largest automakers, including vehicles produced overseas by Hyundai and Kia, increased 5% to 614,750 units in January from 582,497 units a year earlier. This was due to higher overseas sales which increased 7% to 511,763 units from 477,949 previously.

Hyundai Motor global sales rose 2% to 315,573 units in January from 310,123 a year earlier, reflecting higher overseas shipments. Domestic sales fell 3% to 49,819 last month from 51,503 units, despite strong demand for the new Grandeur sedan and Santa Fe SUV. Overseas sales increased 3% to 265,754 units from 254,793, driven by strong demand for SUVs including the Kona and Santa Fe.

Hyundai said it aimed to sell 4,243,000 vehicles worldwide in 2024, including sales of its Genesis luxury brand, just slightly higher than last year’s volume. This includes 762,000 domestic sales and 3,455,000 overseas.

The automaker said it aimed to optimise its product line and vehicle supply management for each region this year to maximise profit. It also plans to strengthen EV production, establish flexible business strategies to adapt to market changes and “reinforce pre-emptive risk management capabilities”.

Kia global sales increased 4% to 244,940 vehicles in January from 235,105 a year earlier, reflecting sharply higher domestic sales and continued growth in overseas shipments. Global sales continued to be driven by strong demand for SUVs, particularly the Sportagewith 45,905 deliveries last month, followed by the Seltos and Sorento with 27,517 and 21,346 respectively.

Domestic sales rebounded by 15% to 44,867 units last month from 38,981 a year earlier, after falling 11% in December, driven by strong demand for the Sorento SUV and the recently launched Carnival MPV. Overseas sales increased 2% to 200,073 units from 196,124 a year earlier, with the Sportage and Seltos the best selling models outside South Korea.

Kia said it aimed to sell 3.2m units in 2024, including 530,000 domestic sales, 2.663m overseas and a further 7,000 special purpose vehicles. The automaker plans to continue to expand its BEV range worldwide with the launch of the new EV5 compact SUV and the EV6 sedan this year, following the global roll out of the EV9 SUV, Carnival MPV and the facelifted K5/Forte sedan in the fourth quarter of last year.

Kia said it aimed to complete the redevelopment of its Kia AutoLand Gwangmyeong BEV plant this year, which will produce the compact EV3 and EV4 for domestic and overseas sale. The medium term plan is to sell 4.3m vehicles annually by 2030, of which 1.6m units are expected to be BEVs.

GM Korea global sales surged 166% to 43,194 vehicles in January from a very weak 16,251 units a year earlier, as the automaker continued to enjoy a strong rebound following the introduction of the Trax crossover at its Changwon plant early last year. The Trailblazer SUV and Trax crossovers remain by far the company’s best selling models, with most output shipped overseas.

Local sales jumped by 183% to 2,894 units last month from 1,021 units a year earlier, following last year’s launch of the Trax and facelifted Trailblazer. Other GM models sold locally include the Bolt EV, the Colorado and Sierra Denali pickup trucks and the Equinox, Traverse, Tahoe and Cadillac Lyric SUVs. Exports surged by 165% to 40,300 units in January from 15,230 previously.

KG Mobility global sales continued to fall sharply in January, by 16% to 9,172 units from 10,973 a year earlier, reflecting sharply lower domestic sales.

Domestic sales plunged 47% to 3,762 units last month from 7,130 as competition from other domestic manufacturers and importers continued to intensify. Last September the company launched the new Torres EVX SUV powered by a lithium iron phosphate battery pack, its second battery powered model after the launch of the Korando Emotion in early 2022.

Exports jumped 40% to 5,410 units in January from 3,873, with the company having signed a number of significant export orders from Middle Eastern distributors in the last two years.

KG Mobility has yet to finalise its acquisition of bankrupt Edison Motors, a local electric commercial vehicle manufacturer that just over two years earlier had successfully bid to acquire Ssangyong Motor from bankruptcy but failed to complete the acquisition. KG Mobility is also involved in a legal battle to retain the KG Mobility trademark after it was registered by an unrelated company earlier last year.

Renault Korea global sales plunged 81% to 1,871 vehicles in January from 10,045 units a year earlier, with local sales and exports both declining sharply.

Domestic sales fell 22% to 1,645 units last month from 2,116, as the company continued to struggle with rising competition from domestic manufacturers and from imported brands. The company revealed plans to add more hybrid models to its line to help revive sales, including a Geely-based mid-sized hybrid SUV in the second half of 2024 under its Aurora 1 programme.

Renault Korea recently announced it had reached an agreement with China’s Geely group to produce the Polestar 4 battery electric vehicle (BEV) at its Busan plant from the second half of 2025, for sale locally and for export. Management have also been discussing sourcing EV batteries from local producers including LG Energy Solution, SK On and Samsung SDI.

Exports plunged 97% to 226 units in January from 7,929 a year earlier, with the company citing disruption to its shipping operations due to the security crisis in the Red Sea. The company said it was “concerned about the long-term decline in export competitiveness of the company and its partners” due to disruption and added shipping costs due to the tensions in the Red Sea.