Domestic sales by South Korea’s five main automakers combined fell 15% to 120,604 units in March 2024 from 141,138 year earlier, according to preliminary data released individually by the manufacturers.

The data, as usual, did not include sales by low volume commercial vehicle manufacturers while import brands are covered in a separate report.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The 15% March fall followed an 18% year on year decline in February which was blamed in large part on Hyundai production stoppages due to plant refurbishment and production line maintenance plus fewer working days due to the Lunar New Year holidays.

Hyundai and Kia last month also claimed the delayed announcement of government subsidies for battery electric vehicles (BEVs) also affected purchases in the first quarter of 2024.

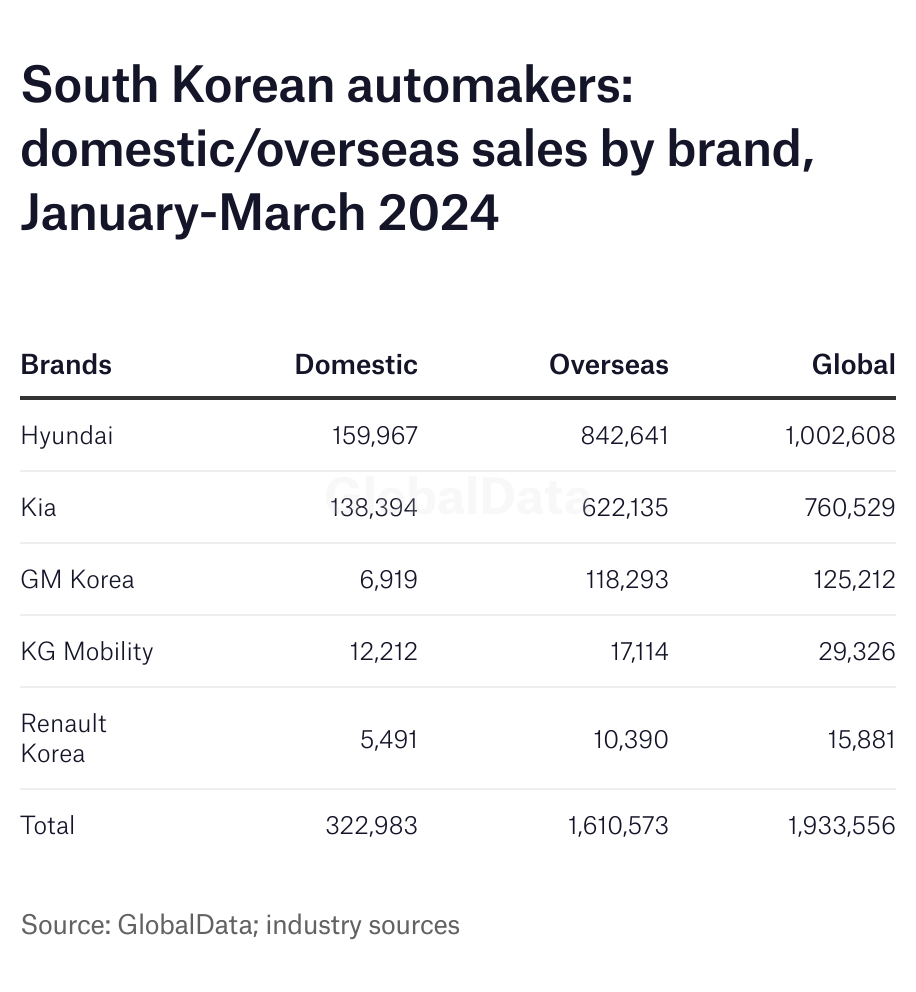

In the first three months of the year, domestic vehicle sales by the mainstream manufacturers fell 12% to 322,983 units, from 367,428 a year earlier, with most manufacturers reporting declines.

Hyundai sales dropped 16% to 159,967 units while Kia volume was 3% lower at 138,394.

KG Mobility was the worst performing brand year to date (YTD) with sales falling 46% to 12,212 units, followed by Renault Korea with a 21% drop to 5,491.

Only GM Korea reported a gain, of 80% to 6,919 units, following the introduction of key new models last year.

Global sales by the ‘country’s ‘big five’ automakers, including vehicles produced overseas by Hyundai and Kia, fell slightly to 1,933,556 units YTD from 1,939,599 a year earlier, underpinned by a 3% increase in overseas sales to 1,610,573 from 1,563,699.

Hyundai Motor global sales fell 4% to 369,132 units in March from 381,885 a year earlier, reflecting mainly a sharp decline in domestic sales. Total volume YTD was down 2% at 1,002,608 from 1,021,827.

Domestic sales fell 16% to 62,504 units last month from 74,529 units a year earlier, including 21,979 Hyundai SUVs and 11,839 Genesis vehicles. YTD sales were also down 16% at 159,967 from 191,047, as the automaker carried out production line refurbishment and maintenance at key factories. The company introduced a facelifted, extended range Ioniq 5 BEV last month and plans to introduce the Ioniq 7 BEV by the end of the year.

Overseas sales were just slightly lower at 306,628 units in March from 308,867 but were up 1.4% at 842,641 units in the first quarter, from 830,780, driven by strong demand in North America, Europe and India.

Hyundai last month reaffirmed its target of selling 4.24m vehicles worldwide in 2024, including Genesis, a slight increase on 2023 volume. The company lowered its domestic sales forecast to 704,000 units while increasing its overseas sales expectations to 3.54m units, helped by the expected completion of its Metaplant Georgia facility in North America in the fourth quarter.

The country’s top automaker said it aimed to optimise its model line and vehicle supply management for each region to maximise efficiency and profit. It also said it planned to strengthen BEV production, establish flexible business strategies to adapt to market changes and “reinforce pre-emptive risk management capabilities”.

Kia global sales fell 2% to 272,026 units in March from 278,741 a year earlier, reflecting weaker domestic and overseas sales, resulting in a 1% decline in first quarter sales to 760,529 units from 768,251, including low volume, special purpose vehicles (SPVs) such as military models.

Domestic sales, including a very small number of SPV exports, fell 8% to 49,321 units last month from 53,370 a year earlier, with the Sorento SUV (as usual) the best selling model followed by Carnival and Sportage. Q1 sales were 3% lower at 138,394 units from 142,755 previously.

Overseas sales fell 1% to 222,705 units in March from 225,371 while Q1 volume was just slightly lower at 622,135 units from 625,496, led by the Sportage and Seltos SUVs plus the K3 sedan.

Earlier this year, Kia said it aimed to sell 3.2m vehicles in 2024- 530,000 locally, 2.663m overseas and a further 7,000 SPVs worldwide.

The automaker also said it would continue to expand its BEV line worldwide this year with the launch of the new EV5 compact SUV and the global roll out of the new K4 sedan.

Kia aims to complete redevelopment of its Kia AutoLand Gwangmyeong BEV plant this year to produce the compact EV3 and EV4 BEVs for domestic and export markets. The medium term plan was to sell 4.3m vehicles annually by 2030, of which 1.6m units were expected to be BEVs.

GM Korea global sales increased 26% to 51,388 vehicles in March, from 40,781 a year earlier, as the automaker continued to enjoy strong demand following the introduction of the Trax crossover at its Changwon plant last year. Q1 sales were up 50% at 125,212 units from 83,223 a year earlier, with the Trailblazer SUV and Trax by far the company’s best selling models, with most output shipped overseas.

Local sales increased 20% to 2,038 units last month from 1,699 units while Q1 sales jumped 80% to 6,919 units from 3,837. In addition to the Trax and Trailblazer, the company’s local model line also includes the US Bolt EV, Colorado and Sierra Denali pickup trucks plus the Equinox, Traverse and Tahoe, and Cadillac Lyric SUVs.

Exports increased 26% to 49,350 units in March from 39,082, while YTD volume was up 66% at 118,293 units from 71,054 previously.

KG Mobility (nee Ssangyong) global sales continued to fall in March, by 21% to 10,702 units from 13,619 a year earlier, with sharply lower domestic sales more than offsetting rising exports. Q1 sales were down 16% at 29,326 from 34,993 units.

Domestic sales plunged 47% to 4,702 units last month from 8,904 as competition from other domestic manufacturers and importers continued to intensify. YTD volume was down 46% at 12,212, from 22,819 units, despite the launch last year of the new Torres EVX SUV powered by a lithium iron phosphate battery pack. The company said it planned to strengthen its local sales network to help lift domestic sales.

Exports rose 27% to 6,000 in March from 4,715 a year earlier, and 40% to 17,114 YTD from 12,234 units, after the company signed significant export orders from Middle East distributors in the last two years while sales in Australia, UK and Turkey also increased.

A KG Mobility spokesman last month said: “We are not only focused on increasing exports, which continue to rise, but also strengthening our position in the domestic market including by improving customer satisfaction”.

Renault Korea global sales fell 54% to 7,133 vehicles in March, from 15,621 a year earlier, reflecting sharply lower domestic sales and exports. Q1 global sales were down 52% at 15,881 from 32,816 units.

Domestic sales fell 23% to 2,039 vehicles last month, from 2,636, as the company continued to struggle with rising competition from local automakers and imported brands. Q1 domestic sales were down 21% at 5,491 units from 6,970.

Exports plunged 61% to 5,094 vehicles in March, from 12,985 a year earlier, while Q1 shipments were down 60% at 10,390 units from 25,846.

Earlier this year, Renault Korea announced plans to add more hybrids to its line under the Aurora 1 programme to help revive sales, including a Geely-based mid size hybrid SUV in H1 2024.

The company recently agreeed with Geely to produce the Polestar 4 BEV at its Busan plant from the second half of 2025, for sale locally and export. Management have also discussed sourcing EV batteries from local producers LG Energy Solution, SK On and Samsung SDI.