Chinese EV maker Li Auto has announced that it delivered 30,060 vehicles in September, setting a new monthly record and bringing the company’s Q3 deliveries to 105,108 – up 296.3% year-over-year.

Driven by robust market demand, an array of new models and improved EV infrastructure, the Tesla rival exceeded 10,000 monthly deliveries for the second consecutive month. The cumulative deliveries of Li Auto vehicles in 2023 totalled 244,225 as of the end of September.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

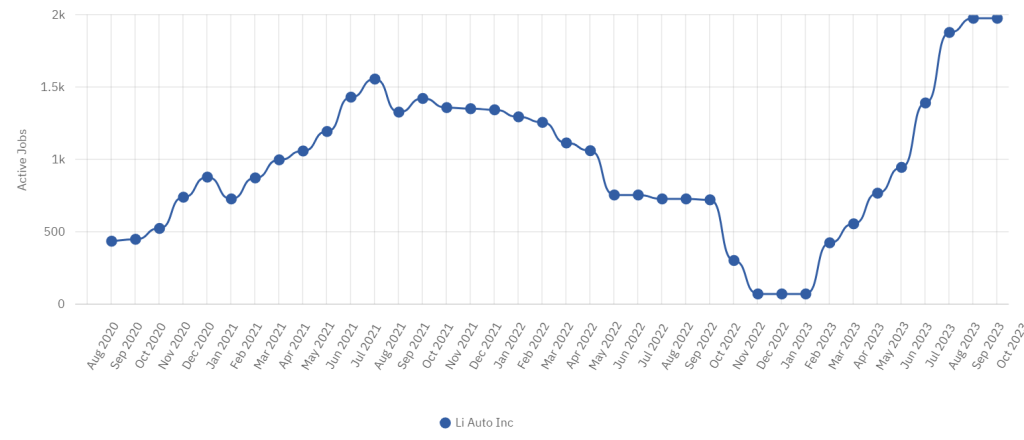

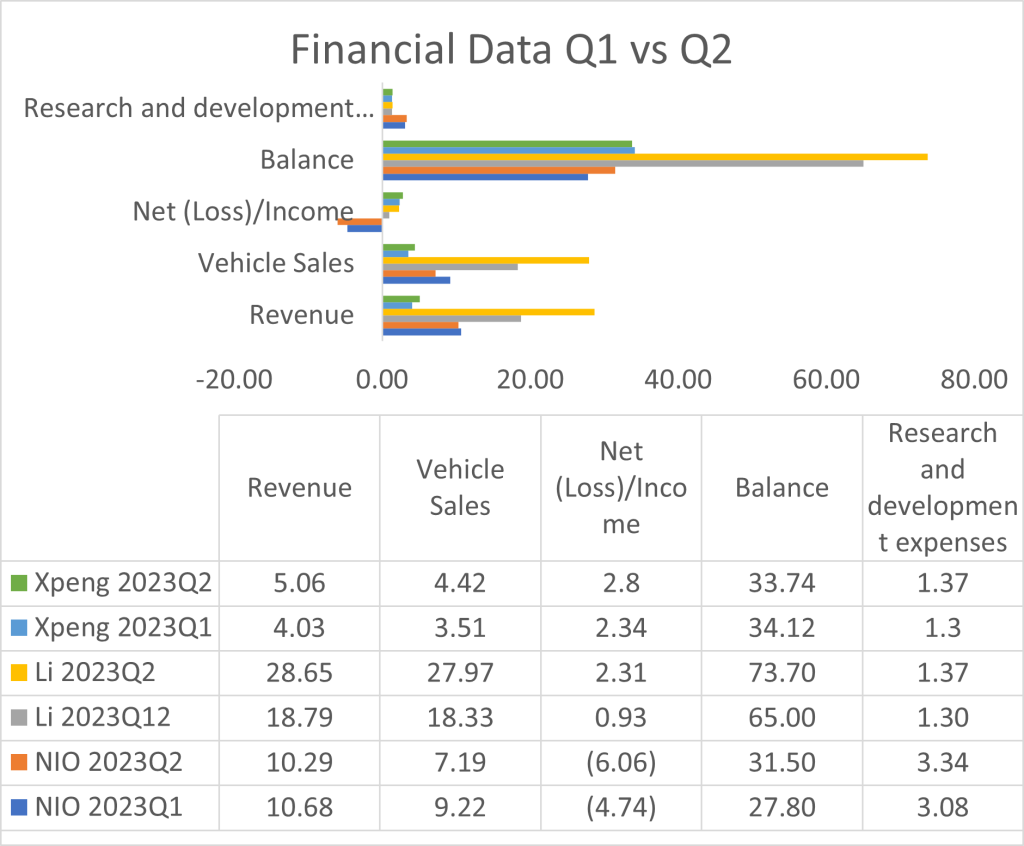

The company, whose deliveries are growing at a faster pace than Nio and XPeng, said that its market share is growing in China’s CNY200,000 ($28,000) and higher new energy vehicle (NEV) price segment. Its recent success has also been reflected in a sharp rise in hirings, with GlobalData’s jobs analytics indicating around 2,000 current vacancies at Li Auto.

By contrast, September deliveries for premium EV maker Nio increased 44% year-over-year and decreased 19% compared to August, while XPeng’s deliveries increased 81% year-over-year and increased 11.8% on the previous month.

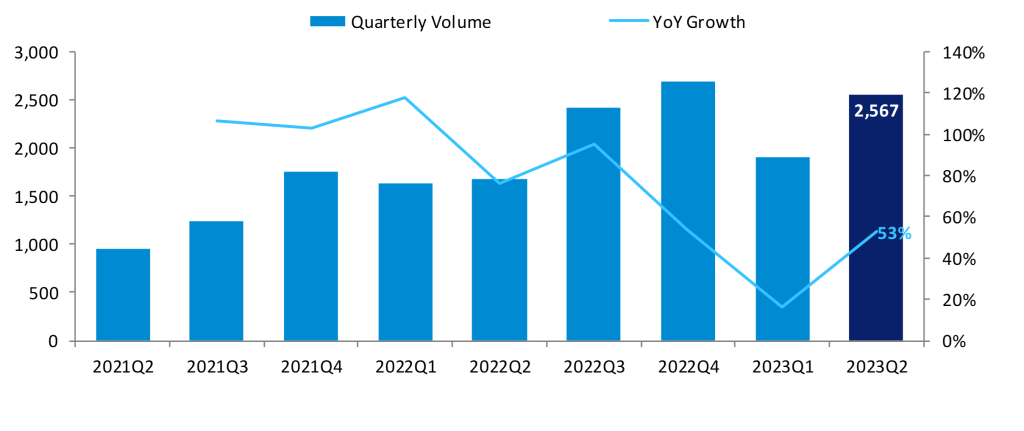

GlobalData says that the uptick in sales volumes among Chinese EV-makers like Li and XPeng was most likely helped by tax reductions and lower interest rates on existing mortgages issued by the central government. October sales are also expected to benefit from the Chinese public holiday “Golden Week”.

Alongside an over-the-air update to its Li L series, Li Auto also reported that it has “made major progress in developing [its] energy replenishment network, with construction of over 100 super-charging stations along highways nationwide completed as of 30 September.”

According to GlobalData, China’s electrified vehicle sales recovered from Q2 2023, with the total volume increasing by 53% compared to Q2 2022 to 2,567,487 units. The “price war” which hit the EV market at the end of March caused sluggish sales in Q1, as demand was postponed and consumers waited for the lowest prices.

China’s global EV market has been booming for some time with unit volumes expected to reach 10 million a year by 2025. GlobalData’s analysts say that, stimulated by central government policy (tax exemptions, subsidies and procurement contracts) and the pressure of CAFC (Corporate Average Fuel Consumption) credits, Chinese OEMs have accelerated their launches of new NEV models.

In its analyst conference call in August, Li Auto said that it expects to launch four new models in 2024, including an EREV (extended range electric vehicle) and three BEV models. The company currently has three models on sale – Li L7, Li L8 and Li L9 – all of which are EREVs.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.