The Renault Group has posted a record operating margin at 7.9% of revenue in 2023 versus 5.5% in 2022. At €4.1bn, it was up €1.5bn vs 2022 and the operating margin was at the upper end of previous guidance.

Group revenue for the year was posted at €52.4bn, +13.1% and +17.9% at constant exchange rates vs 2022.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Net income swung into positive territory at €2.3bn, up €3.0bn vs 2022.

Worldwide Renault Group’s sales in 2023 were up 9% versus 2022 to reach 2,235,000 units.

The company also said its automotive net cash financial position is at €3.7bn at December 31, 2023 (up €3.2bn vs December 31, 2022).

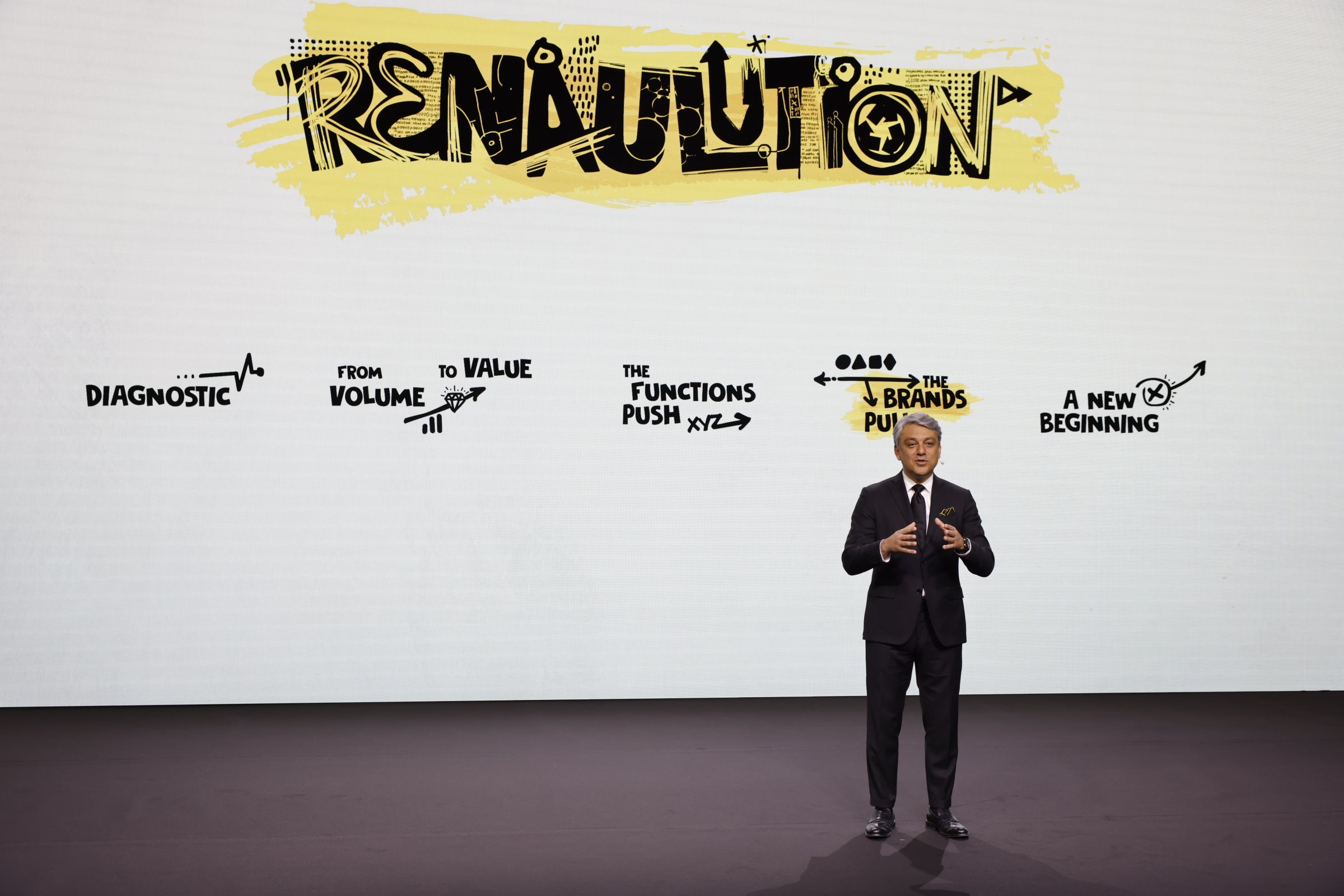

“Today, Renault Group is posting record results. These results are the outcome of a tremendous teamwork and reflect the success of our Renaulution strategy. Our fundamentals have never been stronger, and we will not stop there,” said Luca de Meo, CEO of Renault Group.

“In 2024, we will benefit from an unprecedented number of vehicles launches, showcasing Renault Group’s renewal while continuing to optimize our cost structure. Our organization brings flexibility and boosts performance. This is a strength in a challenging environment.”

The company also forecast cost reductions and faster time-to-market. It said there would be a reduction of production costs per vehicle by 30% for thermal vehicles and 50% for electric vehicles between now and 2027, thanks to the Industrial Metaverse.

Renault also said the production cost reduction will also fuel Ampere target to reduce variable costs between the 1st and the 2nd generation of C-segment electric vehicles by 40% by 2027+, and ‘following a continuous trajectory’.

In 2024, European and Latin America automotive markets are expected to be stable, and Eurasia is expected to decline by 11%.

In this context, Renault Group is aiming to achieve in 2024:

- A Renault Group operating margin ≥7.5%

- A free cash flow ≥€2.5bn