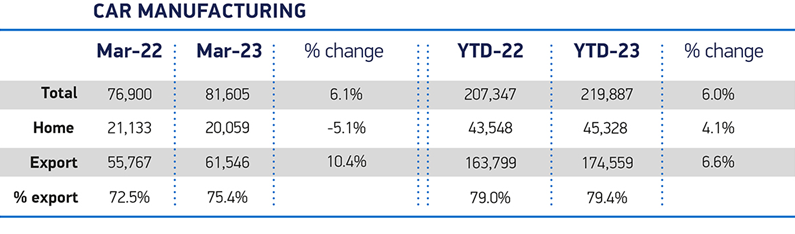

UK car production rose 6.0% in the first three months of 2023, to 219,887 units, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT).

As the global shortage of semiconductors and other components begins to ease, factories produced 12,540 units more than Q1 last year, driven by exports which increased 6.6% and represented almost eight in 10 cars made in Britain.

March rounded off the period with volumes up 6.1% to 81,605 as exports drove growth, up 10.4% to 61,546 units, offsetting a 5.1% decline in car production for the UK as 20,059 cars were made for the domestic market.

At 63.6%, the EU took the largest share of exported cars, (39,172 units), as shipments rose 4.9%, while those to the next biggest markets, the US and China declined by 4.1% and 8.3% respectively.

Exports to Turkey, Japan, Australia and South Korea, meanwhile, all rose, though combined they represented just 11.9% of all cars heading abroad in March. Canada, Mexico and Israel rounded off the top 10 markets for UK car exports last month, with only those to Canada down, by 111 units.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataElectrification continues to be a growing part of the UK auto output picture as British car makers continued to manufacture the latest hybrid, plug-in hybrid and battery electric vehicles. Combined volumes of these models surged 75.0% in March to 32,546 units. Four in 10 cars built in the month featured ultra-low or zero emission powertrain technology. This trend is set to continue as new products come on stream, with more than 20 models of electric cars, vans, buses, trucks and taxis expected to be in production in the UK by 2025.

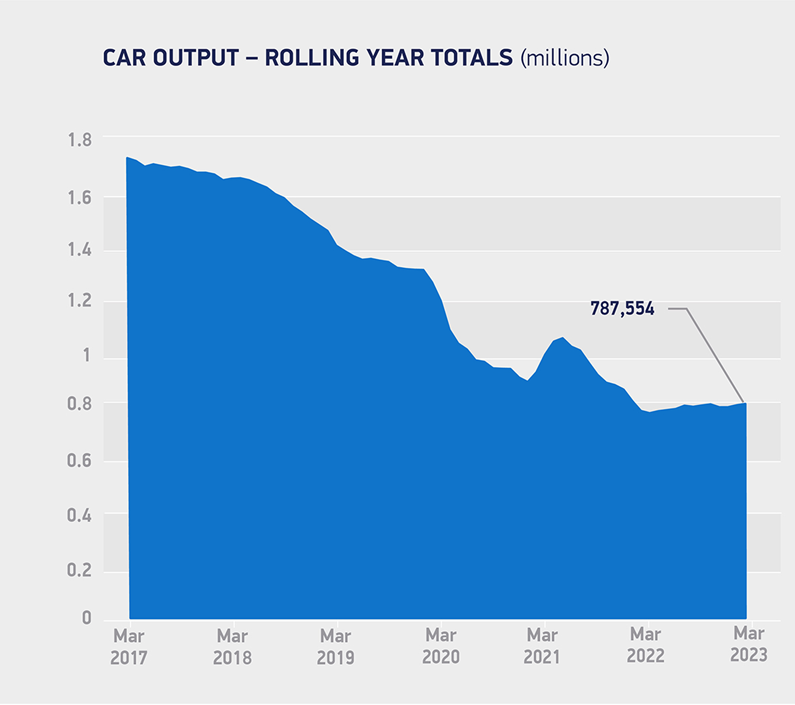

Mike Hawes, SMMT Chief Executive, said: “A second consecutive month of growth for UK car production gives cause for optimism, though volumes are still well below pre-pandemic levels. If British car manufacturing is to get back towards those levels, with all the economic benefits that brings, we need to match the best in global competitiveness. That means driving down the high cost of UK energy, reforming business rates and vigorously promoting Britain globally to secure the investments essential to a zero carbon automotive future.”

Responding to the SMMT car production data, Richard Peberdy, UK Head of Automotive, KPMG, pointed out that UK car output is still lower than pre-pandemic levels and sounded a cautious note on the long-term outlook for investment in the UK’s automotive industry. He said: “Driven by increased demand for hybrid and electric vehicles, and a gradual easing of component shortages that have impacted recent years, UK car production saw pleasing growth in the first quarter of 2023.

“But despite this upturn in production, overall volumes of vehicles produced remains lower than before the pandemic.

“Whilst it’s good news that production levels are again increasing, big questions still remain unanswered about how the UK will produce electric vehicles at much larger scale and what the nation’s strategy is to ensure that its car industry can compete with countries who have already developed bold policy moves to encourage inward investment in next generation manufacturing facilities .”