Although petrol cars remained in demand, growth in new passenger car registrations in Europe last month was up thanks to uptake of electric cars which recorded their second highest monthly market share on record in August 2023.

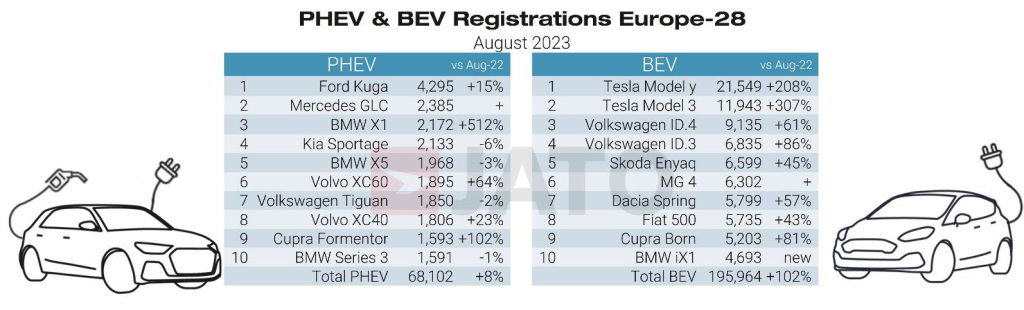

According to JATO Dynamics data for 28 European countries, 22% of registrations were BEVs or 196,000 units of 900,000.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Overall sales rose 20% year on year with the volume of electric cars increasing 102% and petrol just 11%. However, despite the smaller increase in volume, petrol cars still accounted for 53% of the registrations.

Global analyst Felipe Munoz said: “Although the current industry debates often point towards a slowdown in growth for BEVs our data showed growth in demand remains strong due to their increasingly competitive pricing and continuous support from European governments.”

BEV registration growth was strong in Belgium (+224%), Greece (+183), Luxembourg (+164%) and Portugal (164%). With 171% registrations growth in Germany, this country accounted for 44% of the European total. Munoz added: “With an influx of Tesla models and the introduction of BEVs from Chinese OEMs – both of which are battling to produce competitively priced vehicles – demand for EVs across Europe is booming.”

In contrast, however, BEVs took just a single-digit share of the Italian and Spanish markets, 5% and 7% respectively. BEVs in Poland and the Czech Republic had just a 3% share.

Tesla, MG reap benefits

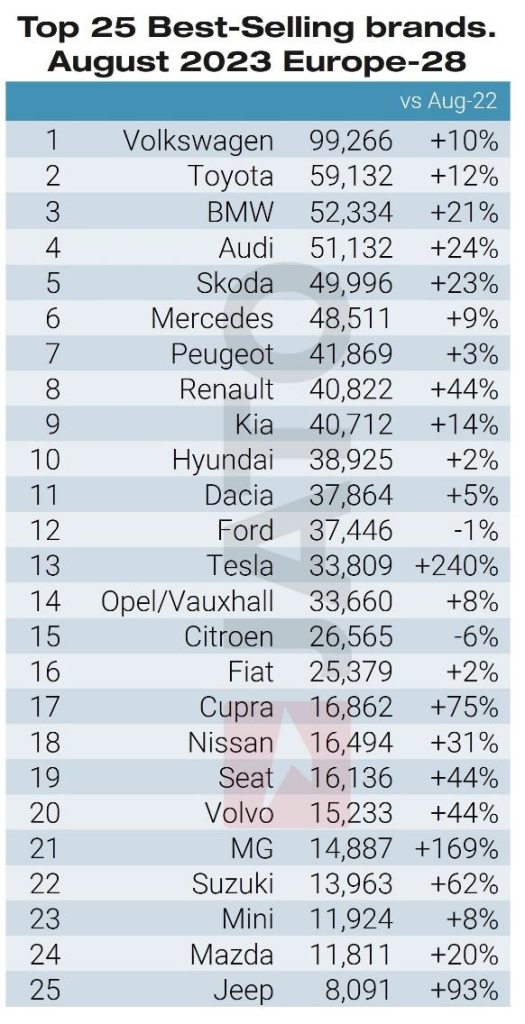

However, not all car manufacturers are being impacted by the BEV boom. Between January and August, Tesla registrations soared from 45,600 units in 2020 to a record 236,400 units this year. Similarly, last month, it gained 2.43 points of market share in the overall EU28 market, achieving a new record of 3.76%, while its share of BEV sales jumped from 10.2% in August 2022, to 17.3%.

Munoz said: “Multiple factors have led to this growth in demand for Tesla vehicles. However, most significantly, the recent price cuts of the Model 3 and Y have helped Tesla keep momentum, despite a limited and somewhat outdated line up. The question now is how European competitors will remain competitive and produce equally affordable BEVs.”

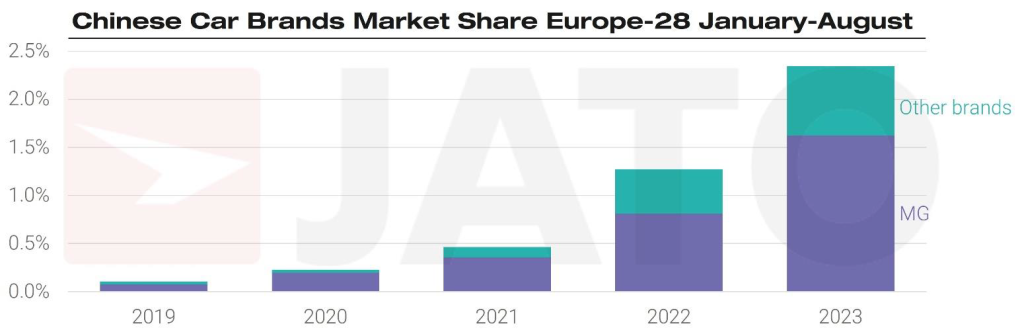

MG also steadily climbed the ranking in August, gaining the second highest market share year on year in both BEV and overall markets. Last month, MG hit the European top 20 brands, outselling Jeep, Mazda, Mini and Suzuki. In the BEV market, MG registered more cars than Audi, Opel/Vauxhall, Peugeot, Renault or Skoda.

MG volume made up 69% of 197,800 units registered by Chinese car brands through August. Despite success for some, many still face the challenge of shifting negative perception among consumers in Europe.

Brands falling behind

Ford, Hyundai-Kia, Stellantis and the Volkswagen brand were among those impacted by the rise of Tesla and MG. Stellantis brands Citroen and Peugeot will require more electric models as their diesel range continues to experience falling demand. While Hyundai-Kia and Volkswagen are posting increases with their electric models, growth is not keeping up with the market average, being overshadowed by Tesla and MG.

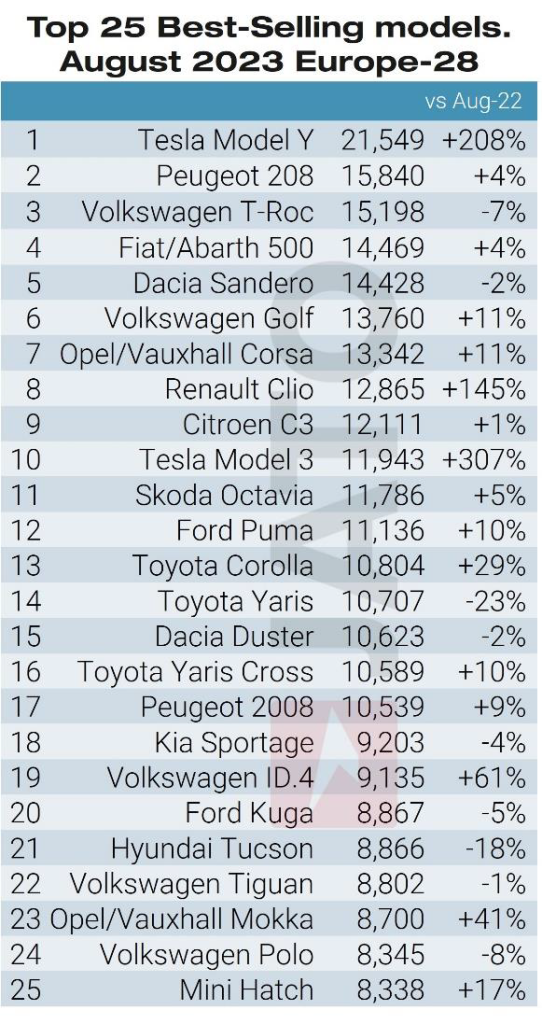

Tesla Model Y projected 2023 top seller

The Tesla Model Y continued to lead the European overall ranking by model with 21,549 units, increasing 208% from August 2022. During the first eight months of the year, volume reached 169,420 units, the highest among all models available in Europe. Munoz said: “It’s likely that the Model Y will become Europe’s most popular new passenger car by the end of the year. As a non-European model leading in Europe, it will be a remarkable and historic moment.” The Model Y led in Belgium, Denmark, Netherlands, Norway, Sweden and Switzerland, as well as hitting the top five in both Germany and the UK.

Other notable players includes the Renault Clio (+145%); Tesla Model 3 (+307%); Volkswagen ID.4 (+61%); and BMW X1 (+392%). Good performances were also recorded by the MG 4, the sixth top-selling BEV, and the BMW iX1 with 4,693 units. These were stronger than results posted by the Mercedes EQA (3,706 units) and the Volvo XC40 BEV (3,108 units). The Renault Austral, with 4,460 units, was the fourth most popular Renault and the Jeep Avenger saw a strong month with 3,669 units, 2,127 of which were BEV.