While EVs, SUVs and Chinese made cars have been the main drivers of growth in recent years, April data for 28 European markets revealed that was no longer the case.

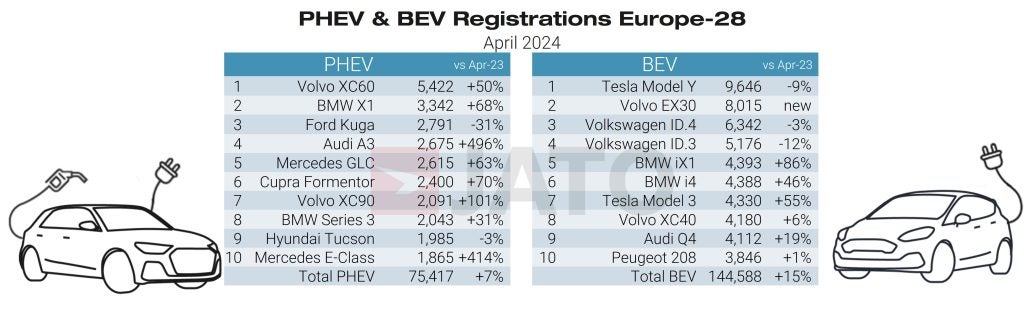

In April 2024, the market share of battery electric vehicles (BEVs) increased by just 0.3% from 13.1% in April 2023 to 13.4% in April 2024 while monthly registrations for the category rose 15%. Although this figure was higher than the year on year growth of the overall market, it was markedly lower than the monthly increases recorded last year.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

JATO said: “The electric car market is not performing as well as it was this time last year. This is largely due to the ongoing price cuts which has raised concerns among consumers over the residual value of EVs and uncertainty as to how prices will evolve in the coming months.”

Volkswagen dominated the BEV market in April, despite recording a 7% year on year decline. Tesla followed closely with 0.6% growth in registrations with the Model Y maintaining first place in the ranking for BEV models.

However, BMW was the main driver of growth in April, with registrations of its electric models soaring 82% year on year. The German manufacturer registered 14,179 units over the course of the month, just 28 units less than Tesla. Volvo also performed well with 13,275 units registered, a 141% increase from April 2023. This was largely due to strong demand for the EX30, Europe’s second best selling BEV during the month.

In April, BYD registered 2,746 units, outpacing the likes of Cupra, Nissan and Toyota to become the 15th best selling BEV brand. Meanwhile, OEMs which saw a decline in registrations of electric models in April included Opel/Vauxhall (-37%), Polestar (-26%), Skoda (-13%) and MG (-12%).

Despite the success experienced by BYD in April, Chinese made cars are yet to become a major force in Europe. Their overall market share in Europe rose from 2.22% in April 2023 to 2.35% in April 2024. MG accounted for 68% of the 25,360 total units registered by Chinese brands during the month.

JATO: “Although there is lots of noise around the arrival of Chinese car brands in Europe, they are still something of a rarity evidenced by the slow uptick in registrations over the past year. MG, a brand that many still associate with the west, accounted for two in three registrations of Chinese made vehicles.

“The continued inability of Chinese made vehicles to truly penetrate Europe’s automotive market could be a result of the ongoing perception issues that Chinese OEMs face, particularly in light of negative attention.”

April was largely a positive month for the EU28 passenger car market as 1,080,517 new vehicles were registered, an increase of 12.6%, driven largely by demand for B-hatchbacks and compact cars. Year to date, 4,461,734 new units were registered, up 6.7%.