Johnson Matthey Battery Systems, part of the Johnson Matthey group and formerly known as Axeon, develops and manufactures battery systems for a number of applications, including performance hybrids and PHEVs. In this interview, company executives explain how the business has evolved since acquiring the battery materials business of Clariant and update us on some materials research and market trends.

Could you tell us little more about what and who you supply?

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

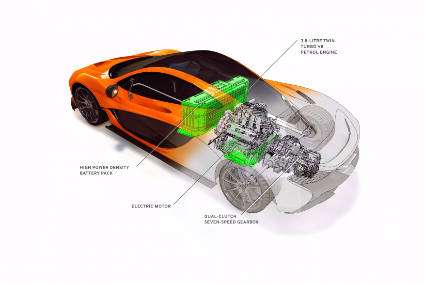

We supply the battery pack for the high-performance McLaren P1 vehicle and we are working closely with a number of OEMs and Tier 1 suppliers on a variety of battery designs, ranging from 48V to high voltage batteries for high performance vehicles and heavy duty applications.

How has your business developed since the acquisition of the battery materials business of Clariant?

The acquisition of Clariant’s Energy Storage business was an important further step in the development of Johnson Matthey’s Battery Technologies business. It provided us with a strong position in lithium iron phosphate from which to develop a broad portfolio of battery materials and strongly complemented our battery materials manufacturing assets and our expertise in battery systems.

More recently, we have in-licenced technology for nickel-rich cathode materials, further broadening our offer in battery technologies. These, together with our continued investment in battery materials R&D, will support our work to develop the next generation of higher performance products that can meet the challenging energy storage requirements of batteries for the automotive sector.

The development of our Battery Technologies business is one aspect of Johnson Matthey’s ten-year strategy to grow new business areas that build on our skills in advanced materials and target new opportunities in adjacent markets with strong growth potential.

In terms of battery configuration, to what extent is the market moving toward prismatic and away from cylindrical?

Cylindrical cells have been used for a variety of reasons; for example, Tesla use them for cost and energy density reasons and as prismatic cells have improved in both areas, in particular in cost from standardisation with the VDA format, we are expecting prismatic cells to start to dominate the market with pouch as the second option. The fundamental life limitations with cylindrical cells will start to limit their appeal and attractiveness as prismatics continue to improve.

Motorists’ appetite for start-stop applications shows no signs of easing. What are your predictions for such applications in BRIC countries?

We are part of the supply chain for 48 volt systems so any product we supply into this market we will do so as a component supplier to a wider system. The vehicle manufacturers will be looking at the various market opportunities and where to deploy their products.

With such a dependency on low carbon vehicle technology, does it concern you that EV sales are sluggish in some markets?

This does not concern us as there are many other forms of electrified powertrain that use advanced energy storage solutions – MHEV/PHEV/HEV/REEV – and that we will be supplying battery systems for. MHEV applications are showing strong demand and PHEV/HEV are growing strongly too.

For Johnson Matthey generally, sluggish sales of EVs are not a major concern as a significant portion of the group’s business is in emission control catalysts for internal combustion engines.

What are your thoughts on how fast the hybrid and electric commercial vehicle market could grow in North America?

There are strong growth drivers in a number of markets around the world. North America represents a substantial opportunity in commercial vehicles and we are active in that market. The European and Asian markets are developing and growing and we have solutions to fit the local vehicle market conditions in both passenger car and commercial vehicle spaces.

Whichever way you look at it, EVs remain expensive and give motorists range anxiety. What needs to happen to EV batteries to improve this situation?

This is indeed a recurring theme. Cell costs need to continue to reduce and capacity needs to continue to increase. We are competing with the calorific content of fossil fuels and parity would be the game changer in the market, but we know this is a long way off – if ever achievable. In the meantime, we have to use advanced techniques and intelligent strategies to improve the cost, life, anxiety conundrums and this is where Johnson Matthey has specialist knowledge and technical expertise that come into play.

Also, Johnson Matthey is working on advanced lithium-ion cathode materials and has recently licensed some new materials technology. Fundamental materials research, and the ability to scale them to high volume batch sizes, is a key element in the push to improve range through increases in energy density. Although progress over the last four or five years has been modest across the industry our detailed understanding of how to improve energy content, safety and life is starting to filter through to new materials and, hence, new cell solutions to meet the needs of increasingly demanding xEV vehicle requirements.

Could you also comment on the ways in which the megatrend for alternative fuelled vehicles is driving innovation in sensors?

The only development of sensing technologies that we see is the further development of Hall Effect sensors and current shunts for current measurement as well as the development of ASIC solutions for cell voltage and temperature measurement. There are probably other significant developments on the wider vehicle architecture but our market position as a battery system and solution provider means we are not exposed to the latest developments in other fields of sensing technology.

More: Global light vehicle OE batteries market – forecasts to 2031