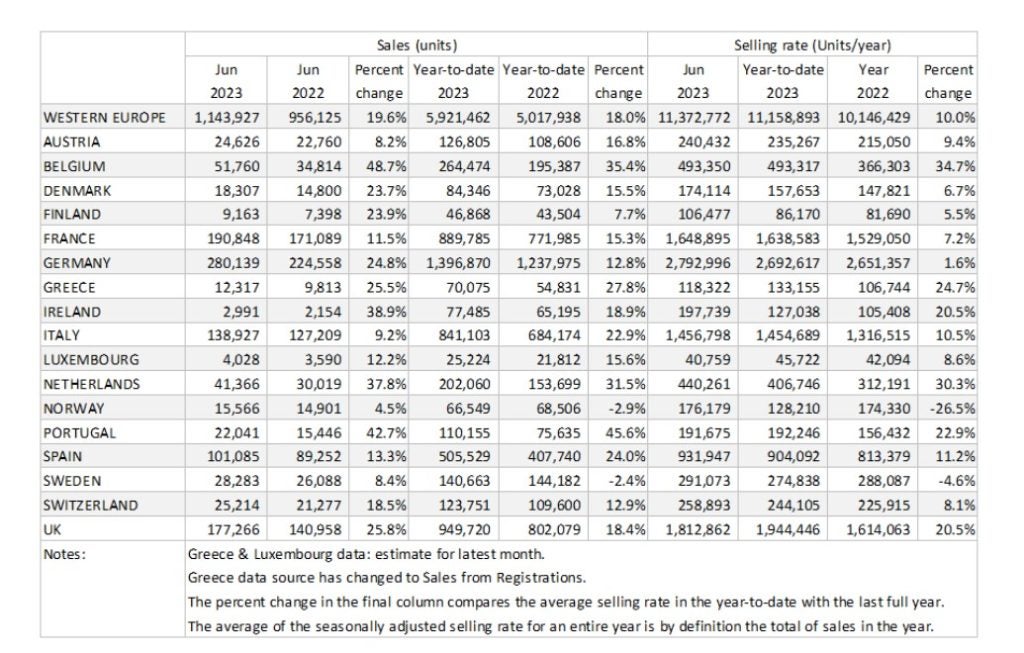

Western Europe’s car market in June was 19.6% ahead of last year at 1.14 million units according to data released by GlobalData.

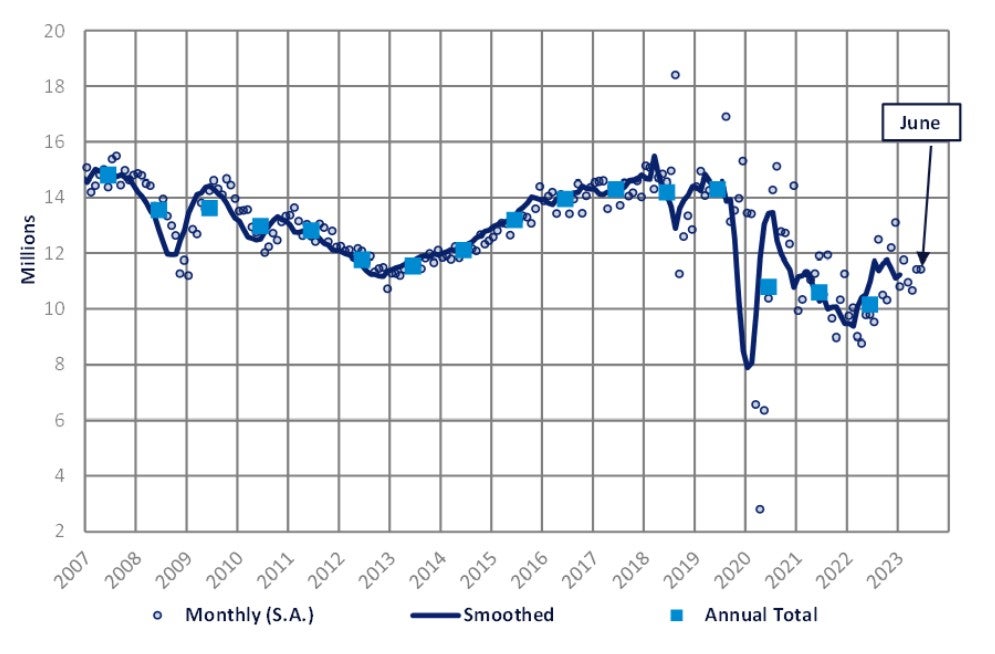

The car market in Europe is continuing to rebound as sales constraints caused by the global semiconductor crisis continue to ease.

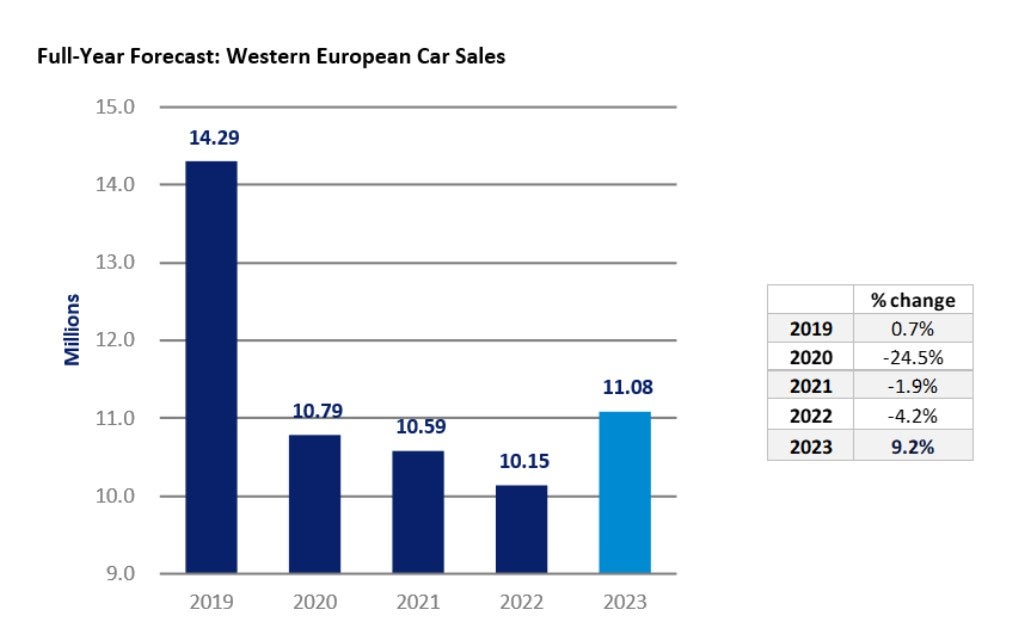

However, the market is running well under pre-pandemic levels.

GlobalData forecasts the West European car market at 11 million units this year. GD analyst Jonathon Poskitt warns that the market rebound caused by easing supply shortages will be of diminishing strength in the second half. “That cushion of backed up orders will be of diminishing strength during the course of the year,” he said.

Poskitt also points out that a regional car market of around 11 million units for this year is well below normal and almost a quarter below where we were in pre-pandemic 2019.

“The challenge for OEMs is still very much one of managing their model mix and market geography to maximise profitability in this highly unusual market environment,” Poskitt adds.

The Western Europe passenger vehicle (PV) selling rate stood at 11.4 million units/year in June, in line with May. Registrations for the latest month totalled 1.1 million units (+19.6% YoY), the third time this year crossing the 1 million unit level. However, the market is still down 16% from pre-pandemic 2019 levels.

France experienced solid growth in June, recording its highest monthly sales figure of the year at 191k units, with YoY growth of 11.5%. Spain also stood out as it outperformed expectations with 101k registrations and a growth of 13.3% YoY.

Aside from Italy, the top five Western European markets experienced double digit YoY growth for June 2023. While 2022 is a weak base of comparison, it is reassuring to see a solid recovery in these countries as production improves and backlogged orders are met.

The Western Europe PV selling rate remained at 11.4 million units/year in June, with vehicle registrations totalling 1.1 million units (+19.6% YoY). The region’s market has benefited from an improvement in supply constraints, production, and higher delivery rates for consumers. Year-to-date, the region has recorded 5.9 million units, which is 18% higher than YTD June 2022.

In June 2023, the German PV market performed close to expectations at 280k units, growing almost 25% YoY. The selling rate stood at 2.8 million units/year, with the market recording 1.4 million units YTD – almost 13% higher than YTD June 2022. The UK PV market recorded 177k units in June, rising for the eleventh consecutive month at +25.8% YoY. With a selling rate of 1.8 million units/year, the UK market has registered 950k units YTD, which is 18.4% higher than YTD June 2022. For both countries the supply issues have continued to ease, with waiting times lowered and order backlogs being met.