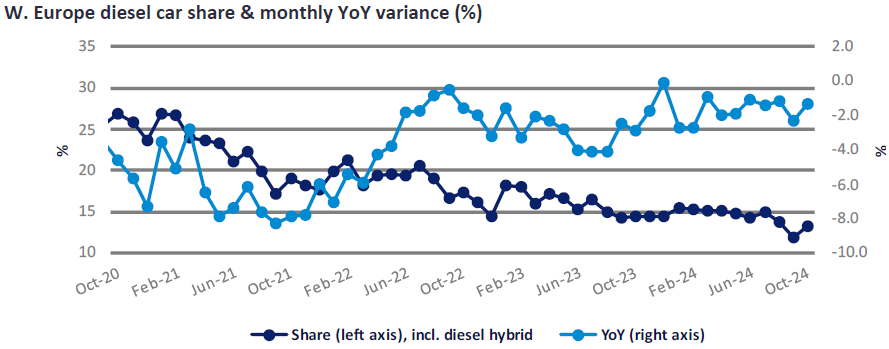

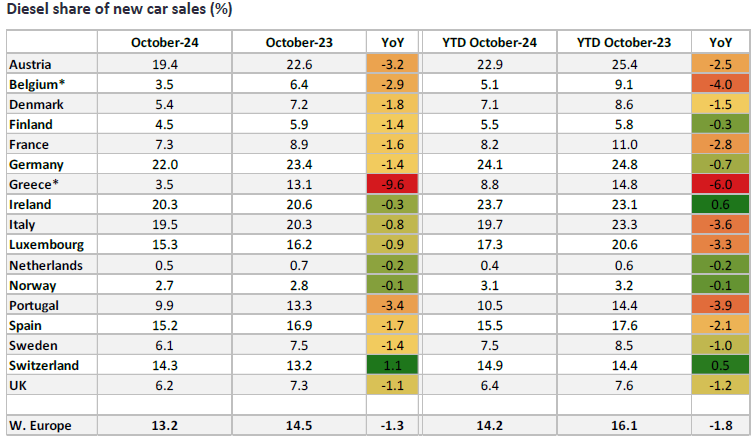

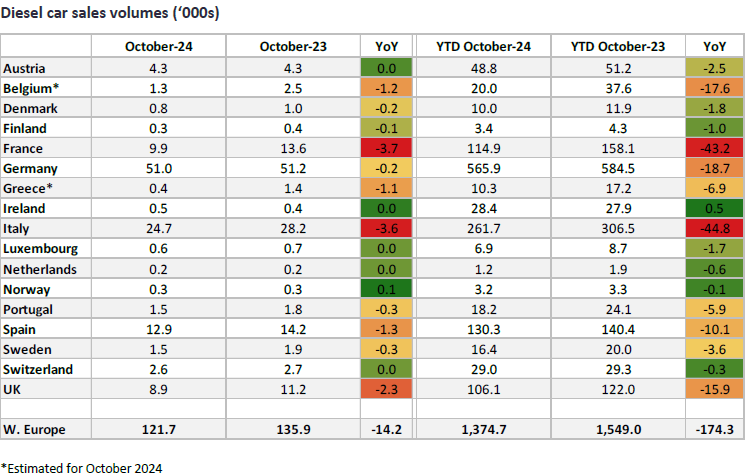

Diesel share of new car sales in the region for October came in at 13.2%, a rise from the low point of 11.9% confirmed for September, and 1.3 pp below the value seen in October 2023. Year-to-date, diesel has accounted for 14.2% of PV sales in the region, a fall of almost 2 pp versus the figure for the same period in 2023. So, the protracted decline in diesel popularity continues to be seen, with it remaining stubbornly popular in certain segments, such as larger SUVs, but with PHEVs continuing to make inroads into this area. Volume-wise, 122k diesel cars were sold in October (136k a year earlier) with cumulative sales in 2024 amounting to 1.375 million units versus 1.549 million for January to October 2023.

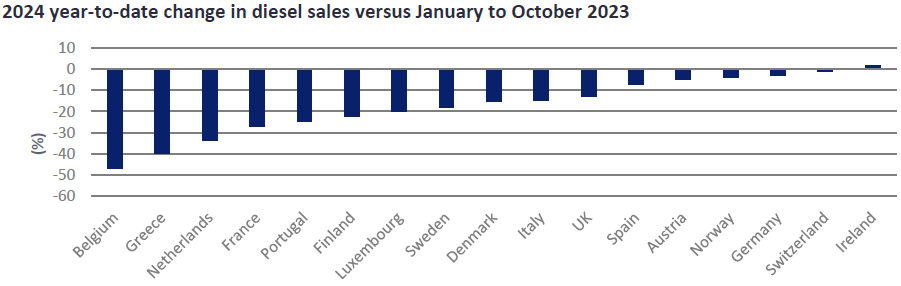

Germany continues to prop up the region’s diesel sector, accounting for 41% of sales YTD with the October figure being almost the same as that seen a year earlier – decline is very slow. By contrast, France, with a tax system that strongly favours small, low-emission vehicles, continues to see rapid erosion of its once-huge diesel sector. Sales to October were almost 30% down on those of the January to October 2023 period. Spain’s diesel sector is more resilient (-7% YoY), while Italy and UK diesel sales have declined by circa 15% so far in 2024 versus 2023. Only Ireland has seen diesel sales grow this year.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.