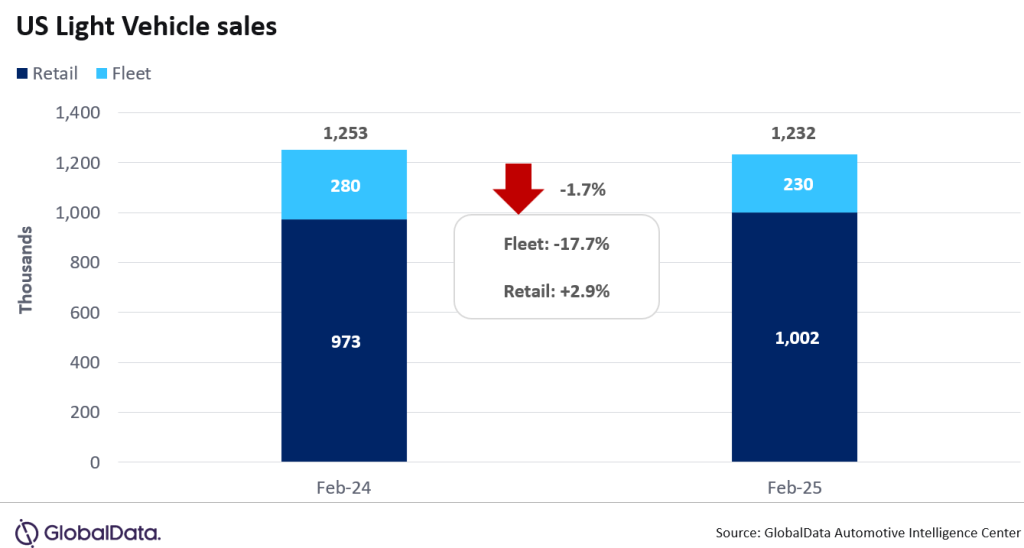

According to preliminary estimates, US Light Vehicle (LV) sales fell by 1.7% year-on-year (YoY) in February, to 1.23 million units. However, February 2025 had one fewer selling day than the same month a year earlier, making sales appear slightly weaker than the underlying reality. On a selling day-adjusted basis, sales increased by 2.4% YoY in February.

US vehicle market annualised selling rate up in February

US LV sales totaled 1.23 million units in February, according to GlobalData. The annualized selling rate for the month was 16.4 million units/year, up from 15.7 million units/year in January. The daily selling rate was estimated at 51.3k units/day in February, up from 44.4k units/day in January. According to initial estimates, retail sales totaled 1.00 units in February, while fleet sales were thought to reach 230k units, accounting for 18.7% of total volumes.

General Motors kept hold of its position as the bestselling OEM in February, on 215k units, with its market share of 17.5% matching its performance in January. Toyota Group was once again in second place, with sales of 175k units, and a market share of 14.2%. Ford Group was third on 159k units, and its market share was 12.5%, its highest since October 2024. At a brand level, Toyota came out on top, on 150k units, just 3k ahead of Ford. As is typically the case, Chevrolet was third, on 138k units.

The top five bestselling models appeared to be unchanged from January’s results. The Toyota RAV4 once again finished first in the rankings, on 37.6k units, while the Ford F-150 was second on 35.6k units. However, the comparison with one year ago is notable: in February 2024, the RAV4 outsold the F-150 by over 11k units, at a time of year that is traditionally strong for SUVs. In that sense, a 2k gap between the RAV4 and F-150 may not have been too disappointing an outcome for the latter. The Honda CR-V, Chevrolet Silverado and Tesla Model Y rounded out the top five.

Compact Non-Premium SUV was once again comfortably the leading segment in February, with a 21.9% market share, although this was down by 0.6 pp from January. Likewise, Midsize Non-Premium SUV delivered a somewhat mediocre performance in February, with a market share of 14.6%, although this was enough to stay ahead of Large Pickup on 13.1%. While Large Pickups saw their lowest share in 11 months, its share was up by 0.8 pp YoY.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataDavid Oakley, Manager, Americas Sales Forecasts, GlobalData, said: “Although February sales were up slightly YoY on a selling day-adjusted basis, there was a sense that the market was holding its breath as uncertainty over tariffs and other policies continued. Although in theory it might have been logical for buyers to bring forward purchases in order to avoid higher prices from the now-implemented tariffs on imports from Mexico and Canada, there was little evidence of this in the February data. One possible explanation is that the general public is not sufficiently aware of how interconnected the North American automotive supply chain is.

Alternatively, many may have assumed the tariffs were a negotiating tactic that would not be realized. If tariffs remain in place for a sustained period of time, future months could make February’s results appear rather healthy by comparison”.

February inventory levels are expected to have risen by 2% from January, with the daily selling rate holding at a strong, 51.3k for the month. On a days’ supply basis, we would expect it to fall from 63 last month to 55 this month. Production in North America is projected to increase by just 0.7% in 2025 to 15.46 million units, but any material duration of tariffs now in place will certainly have a negative impact on production levels.

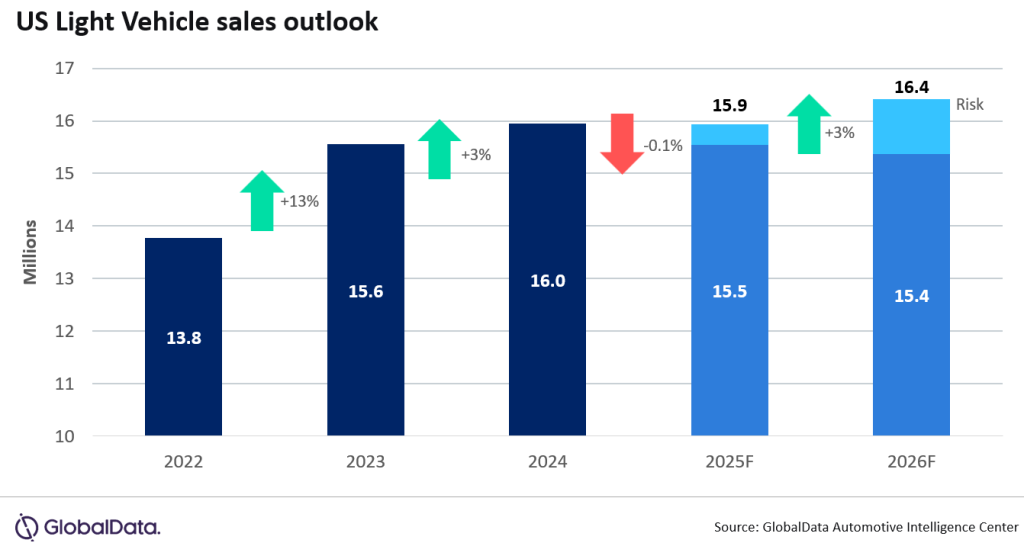

As a result of the tariffs being implemented on Canada and Mexico, we have made an initial cut of approximately 250k from our baseline forecast bringing the 2025 outlook for LV sales in the US in 2025 to 15.9 million units, down 0.1% YoY from 2024. The volume cut is expected to be split across fleet and retail, but more pronounced on the fleet side of the business. Fleet sales are expected to decline to 17.5% of total sales and volume fall by 1.4% from 2024. If tariffs on Canada and Mexico remain in effect through the end of 2025, we would expect LV demand in the US to fall significantly to 15.5 million units, a decline of 700k from our baseline pre-tariff forecast.

Jeff Schuster, Vice President Research and Analysis, Automotive, said: “While February’s performance was healthy, it is difficult to look past the potential damaging impact caused by the tariffs on vehicles produced in Canada and Mexico, which will negatively affect most automakers included GM, Ford and Stellantis. This environment makes it extremely difficult for the industry to plan, and if the current volatility continues, we would expect some additional fallout in launch activity and volumes in markets with a tariff imposed. The industry cannot change vehicle sourcing as quickly as it would appear the administration is expecting, given the complexity of auto manufacturing and the supply chain, making these actions quite impairing in the near-term. The reality is that the industry is now under great pressure to minimize any impact to the consumer from the tariffs without deteriorating financial health or margins. We would expect some absorption of the price increase initially but that cannot last very long before the consumer pays more, and economic growth suffers.”

Global outlook – Global LV sales in January increased by 1% YoY to 6.7 million units, with some markets continuing the momentum from the 2024 close. The selling rate for January finished at 88.5 million units, a January level not seen since 2018. Sales results in January were mixed across markets, with growth being driven by strength in Japan (up 12%), stability in North America (up 5%), and a surge in Argentina (up 103%). China experienced a 2% decline as much of the country did not have access to the incentive extension before the Lunar New Year holiday.

Additionally, Western Europe faced political and economic headwinds that caused demand to contract by 3% in January. Despite the high level of uncertainty, including the increasing potential for a global trade war, global LV sales are showing resilience. The forecast for the year remains at 91.6 million units, representing an increase of nearly 4% from 2024.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.