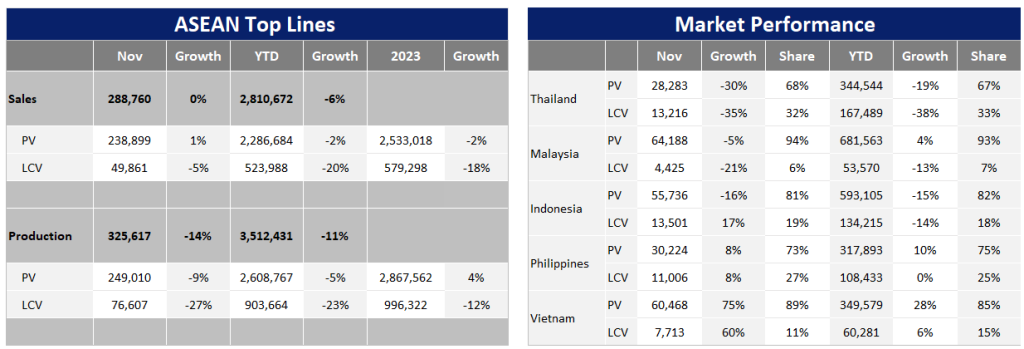

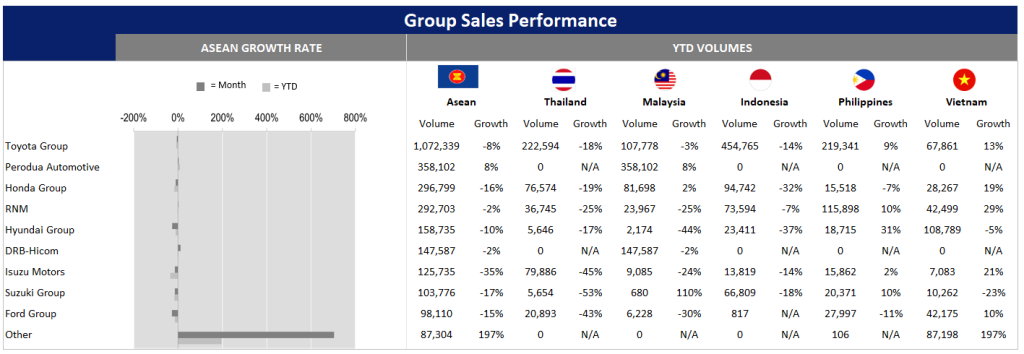

According to official reports released by national automotive associations, total ASEAN Light Vehicle (LV) sales fell by 5% year-on-year (YoY) to 3.12 million units in 2024, aligning with GlobalData’s estimates of 3.11 million units. The Thai and Indonesian markets experienced declines of 26% YoY and 14% YoY, respectively, due to tightened auto loan approvals. Also contributing to the downturn in Indonesia was the pull-ahead effect from the temporary tax cut that took place in 2021-22.

In contrast, Malaysia, the Philippines, and Vietnam saw LV sales increases of 3%, 8%, and 23% YoY in 2024, respectively. Malaysia’s volumes were largely supported by Perodua’s large backlog of orders and the entry of new Chinese brands, particularly Electric Vehicle (EV) models.

In the Philippines, robust LV demand was driven by economic recovery, strong remittance inflows from overseas Filipino workers, and the introduction of affordable Chinese models. Due to this positive momentum, the country’s 2025 sales outlook has been raised to 500k units (+6% YoY).

The strong results in Vietnam were partly due to a low comparison base, as sales in 2023 were subdued following the bursting of the property bubble. In 2024, the stabilization of the property sector, coupled with a strong rebound in the country’s substantial export and manufacturing sectors, contributed to increased investment and consumer confidence. Additionally, the re-introduction of a registration fee cut from September to November accelerated demand at the end of 2024. The central bank’s decision to cut interest rates twice in 2023 also positively impacted consumer spending. For 2025, we have increased the forecast for LV sales to a record high of 499k units (+7% YoY). The outlook’s upside potential is supported by the market’s resilience and robust economic growth.

Recent information indicates that Malaysia, Indonesia, and Thailand experienced a slowdown in LV sales in January 2025. Registration data in Malaysia showed that volumes dropped by 24% YoY during the month. The sharp decline was likely due to a high base in January 2024 and pull-ahead demand in December 2024. On average, monthly sales totaled 66.9k units from January to November 2024 and 66.3k units from December 2024 to January 2025. January sales were also partially disrupted by the New Year and Lunar New Year holidays.

Despite weaker-than-expected sales in the first month of the year, Malaysia’s 2025 outlook remains unchanged at 762k units (-7% YoY), as sales in Q1 tend to be volatile, and our forecast for the year is already cautious for several reasons: 1) Consumers’ overstretched spending could further raise already high household debt; 2) Credit conditions are unlikely to ease any time soon due to high household debt; and 3) The central bank is not expected to cut interest rates in the near future, as inflation is set to rise due to a weak ringgit and the government’s fiscal tightening, including petrol price rationalization.

Finally, global uncertainty, particularly the US’s higher tariffs on China and elsewhere, remains a major risk for Malaysia’s export-dependent economy.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAccording to the GAIKINDO report, LV volumes in Indonesia fell by 12% YoY in January 2025, due to the VAT hike at the beginning of the year. Moreover, consumers likely postponed purchases in January as they awaited the Indonesia International Motor Show event in February.

The Indonesian LV market is not expected to improve in 2025, as negative conditions for vehicle purchases are likely to persist. It is reported that banks remain cautious about lending, as household debt and the default rate are high. Although the central bank made a surprise interest rate cut in September 2024 and again in January 2025, the recent rapid depreciation of the rupiah could make further rate cuts difficult. As such, LV sales in the country are projected to increase by 4% YoY from 801k units in 2024 to 834k units in 2025. However, the outlook is subject to downside risks, particularly strict financing and high household debt, which may suppress new vehicle purchases.

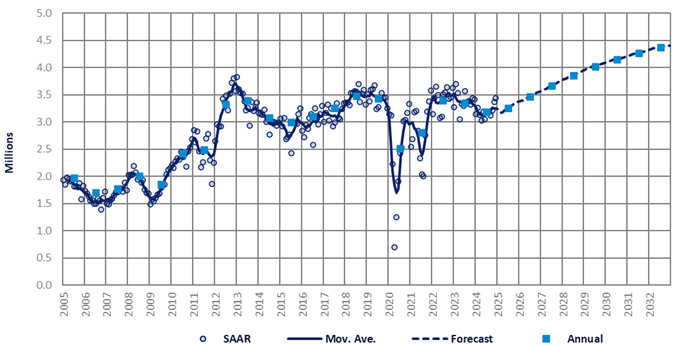

For Thailand, preliminary data suggests that the LV market had a favorable start to the new year. The January 2025 selling rate reached 684k units/year, a 33% increase from a subdued December, although this rate still falls short of the market’s historical standards. In YoY terms, January sales decreased by 8%, compared to an already diminished volume from the previous year.

Although January sales were stronger than anticipated, volumes in Q1 are typically subject to volatility. Moreover, we do not foresee an immediate easing of credit conditions, and the economic outlook is becoming increasingly uncertain. In light of these factors, we have slightly reduced our Thai forecast for 2025-28. We now project sales to rise by approximately 5% to 592k units in 2025, which will only represent 60% of the pre-pandemic level of 986k units in 2019. On a positive note, however, there are reports that the government is contemplating measures to bolster the automotive industry.

In conclusion, the ASEAN LV market is anticipated to slightly increase by 2% YoY in 2025, with positive sales growth across the region except for in Malaysia. However, the outlook for Indonesia and Thailand is subject to downside risks, which could lead to a third consecutive year of declining regional sales.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.