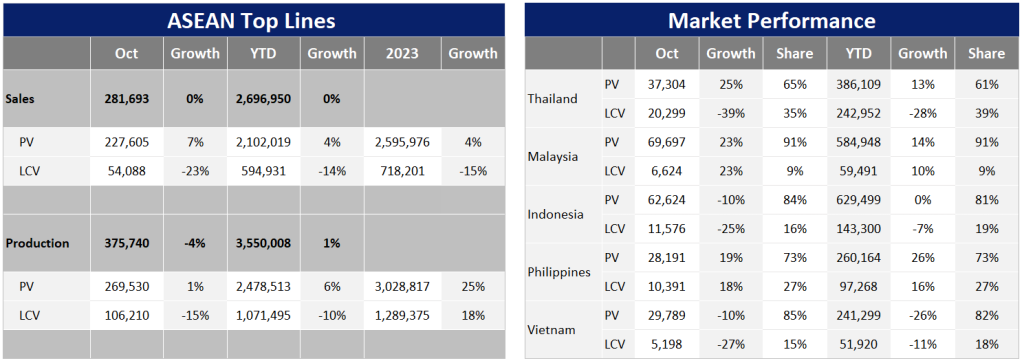

In October 2023, ASEAN Light Vehicle (LV) sales marginally decreased by 0.3% YoY with the positive sales growth saw in Malaysia and Philippines market while LV demand remain weak in the rest of ASEAN5.

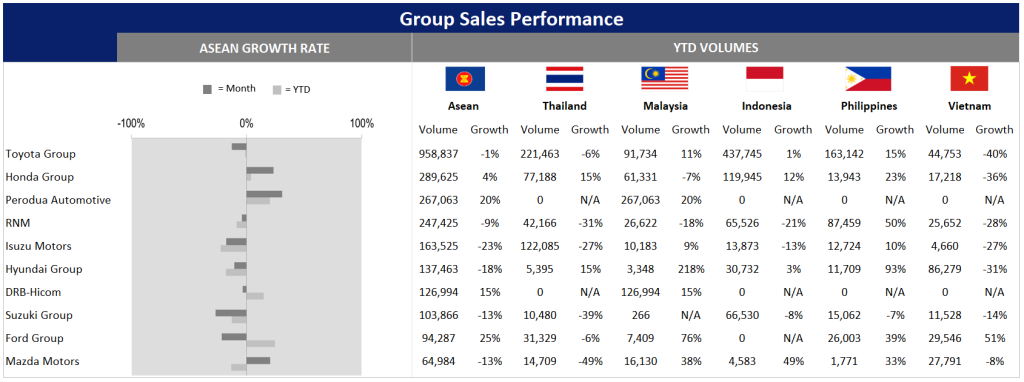

Malaysia’s October 2023 sales registered 76k units, which was significantly higher than the average monthly sales in 2022 that marked 59k units. Noteworthy is that 2022 sales hit an all-time high in the Malaysia LV market. As a result, sales surged a strong 13% YoY in the January to October 2023 period.

For the outlook, we have upgraded Malaysia’s sales 2023 outlook to a new record high of 795k units based on Perodua’s revised 2023 sales target from the original 314k units to 325k units and the positive response to the newly launched Proton S70. Proton is expected to receive bookings for the S70 totaling 5,000 units this year and to hit its monthly sales target of 2,000 units. Moreover, the tourism sector, which is a labor intensive industry, recovered faster and stronger than expectations. This should support consumer spending and job creation.

Philippines LV sales jumped by 19% YoY in October 2023 and 23% YoY in January to October 2023. Despite high vehicle prices and financing rates, the demand has increased, with a double-digit-growth rate since March 2022 thanks to the improvement of supply, pent-up demand and solid remittance inflow. Our Philippines sales outlook scenario remains unchanged that 2023 will be the second highest annual sales number in history at 433k units or an increase of 19% YoY. Then, the market will slightly increase by 0.6% to 435k units following three consecutive years of double-digit growth. The risk to the 2023-2024 forecasts is to the upside, but our projections are cautious, because, after a “catch-up” in supply and sales, the momentum is likely to slow.

Based on our recent research, Indonesia November 2023 sales continued to drop in the fifth consecutive month of declines. As such, the Indonesia LV market fell by 2% YoY in January to November 2023. The weak sentiment is due to a) tighter financial conditions; and b) that consumers are waiting to assess the new government’s policy after the presidential election in February 2024. Overall, Indonesia sales outlook remain unchanged from our previous report with the projection at 928k units in 2023, then return to 1.03 million units in 2025.

The further key developments for the Indonesia LV market are: a) one of Presidential candidates announced an intention to cancel the capital relocation project. It is notable that the move of the capital city from Jakarta to its new location in Kalimantan was expected to drive urbanization and motorization; b) the Indonesia government just approved its revised BEV incentive program, in which carmakers must summit their BEV production plans and obtain a quota for imported BEV to enjoy a 0% import tariff. Also, the government postponed the minimum requirement of Domestic Local Content Level (TKDN) at 40% before 2024 to 2026, 60% before 2030 and 80% in 2031. This is aimed to attract new players to invest in the country as there are only two qualified models; the Hyundai Ioniq5 and the Wuling Air under the previous requirement.

Thailand’s LV sales fell by 7% YoY in January to October 2023. Light Commercial Vehicles (LCV) accounted for the entire loss after sales plunged by 28% YoY. In contrast, Passenger Vehicle (PV) sales increased by 13% YoY, but that was not enough to offset the LCV decline. In 2022, the ratio of PV/LCV sales was 51%/49%, with LCV sales falling; this ratio changed to 61%/39% in the first 10 months of this year. Total LV sales are now expected to decline by 7.5% to 766k units this year and increase by only around 5% to 804k units in 2024. The near-term sales outlook is subdued, because the economy is continuing to slow, the recovery in tourism appears to have lost momentum, and the export outlook is uncertain.

Vietnam LV sales fell 24% YoY in January to October 2023 and 13% YoY in October. However, the Vietnamese market gained some momentum ahead of the expiry of the temporary reduction in the registration fee in December 2023. So, we expect that the market to pick up a bit in November and December 2023 before the expiry of the registration fee reduction scheme – and ahead of the Lunar New Year in February 2024. Full-year 2023 sales are now projected to contract by 17% to 393k while sales in 2024 are set to increase by 8% to 425k units. Currently, the risk to such forecasts is skewed to the downside, due to global uncertainty. We, however, remain optimistic about the sales outlook, as the nation’s central bank has already started to cut interest rates and the economy is expected to accelerate next year, driven by a rebound in exports and tourism.

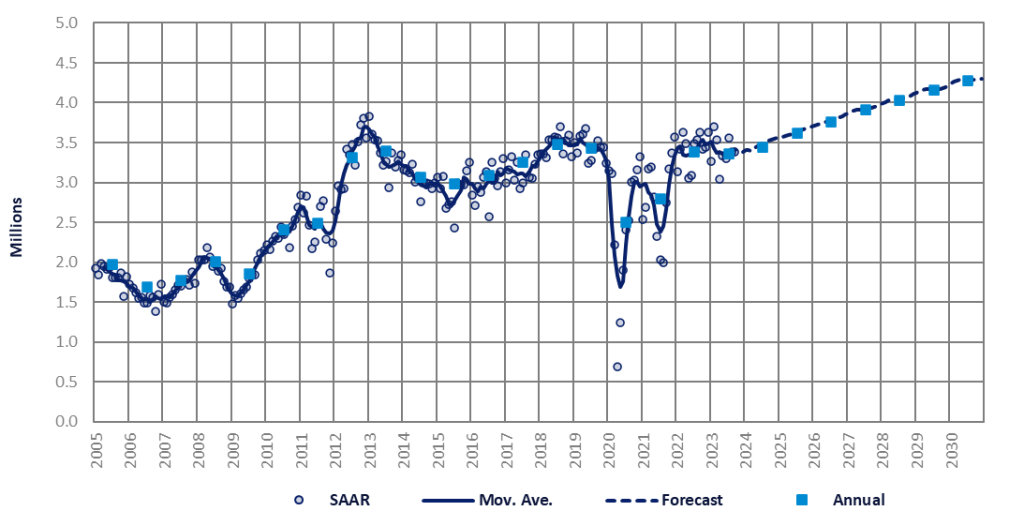

Thus, the overall ASEAN LV 2023 sales projection remains unchanged at 3.31 million units in 2023 and 3.39 million units in 2024.