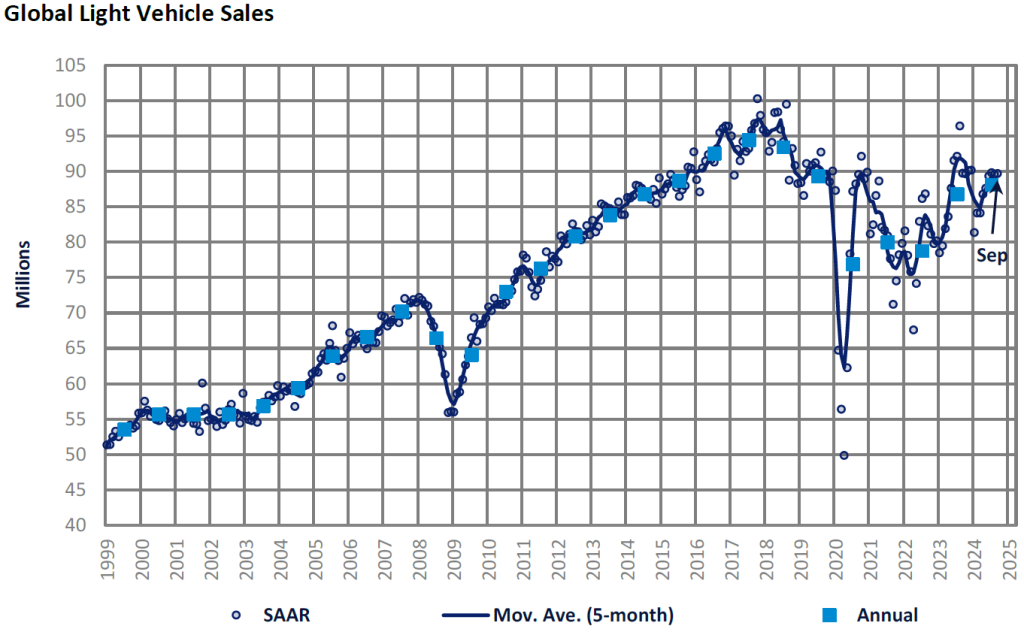

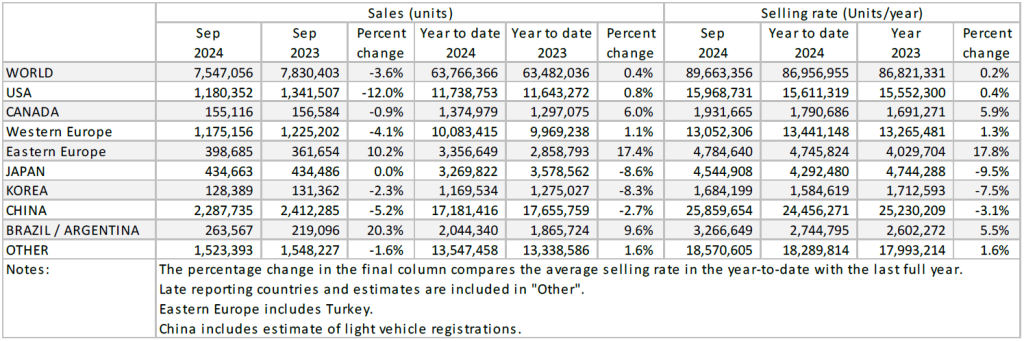

The Global Light Vehicle (LV) selling rate for September stood at 90 million units/year, in line with August’s results. In YoY terms, market volumes are continuing to trend downwards as sales volumes were down circa 4% versus September 2023. Furthermore, YTD sales are now only fractionally up compared to the same period last year.

In September, sales were down across most regions. Sales in China fell 5% YoY, with the economy faces headwinds and despite the ongoing scrappage incentive. In the US, sales fell YoY for the month, with this September having fewer selling days. Finally, sales in Western Europe remained underwhelming, as a weak economy and high vehicle prices dragged on LV market activity.

North America

The US Light Vehicle market saw sales slow YoY in September 2024, the month having fewer selling days this year compared to last year. Sales volumes reached 1.18 million units in September 2024, dropping by 12% YoY. Despite sales slowing YoY, the selling rate saw a strong jump in September 2024 to 16.0 million units/year, up from 15.2 million units/year in August. Incentives reached US$3,125 in September, the highest in the past 12 months, but average transaction prices rose by US$765 MoM, as 2025 model year vehicles reached dealerships in greater numbers.

Canadian Light Vehicles slowed by 1% YoY last month, bringing the monthly results down to 155k units, marking the first YoY sales decline for 2024. While LV sales slowed on a YoY basis, September’s result was much better than expected given the loss of selling days and a lukewarm economy. For Mexico, sales slowed by a marginal 0.5% YoY, dropping to 117k units, making this the first YoY sales decrease since April 2022. Although sales slowed slightly on a YoY basis, this was again due to the unfavourable calendar, with the selling rate growing in September to 1.60 million units/year, up from 1.48 million units/year in August.

Europe

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe Western European LV selling rate fell to 13.1 million units/year in September. In volume terms, 1.2 million units were sold, a 4% decline YoY. Meanwhile, YTD sales passed 10 million units, an improvement of 1.2% from the same period last year. The big picture within the industry remains the same. Strong vehicle pricing, high interest rates, and a lack of incentives, continue to restrict sales. Some improvement is expected moving in 2025 as monetary policy easing supports broad economic expansion along with less expensive EV models being released.

The LV selling rate for Eastern Europe was 4.8 million units/year in September, an improvement on August. 400k vehicles were sold, a 10% increase YoY. YTD sales remain strong at +17%. Sales in Russia continued to grow in September. This is in line with previous expectations as changes to the disposal fee rates and an increase in interest rates are looming, resulting in sales being pulled forward. Sales in Turkey began to fall as deflation begins and tighter monetary policy remains in place.

China

According to advance data, the Chinese domestic market remained lackluster in September, despite the ongoing scrapping subsidy program. The September selling rate is estimated to be 25.9 million units/year, down 3% from August. Sales volume reached almost 2.3 million units, the highest sales year-to-date, but September is historically a relatively strong sales month. In YoY terms, sales declined by 5% in September and almost 3% year-to-date. In contrast, Passenger Vehicle (PV) exports remained robust, expanding by 22% YoY in September, despite the growing trade conflicts with the West.

It is reported that the share of NEVs in the domestic PV market reached almost 55% in September. With the government doubling the scrapping subsidies, the applications for the subsidies have risen sharply over the past month, suggesting that sales will gather momentum before the expiry of the program in December. However, the deep slump in the property sector, a weak job market, and volatile financial markets continue to dampen consumer confidence.

Other Asia

In Japan, the September selling rate was a sluggish 4.5 million units/year, virtually flat from August. Sales continued to be impacted by the supply shortages, especially at Toyota and Daihatsu, that were caused by the vehicle certification issues. Sales were also disrupted by bad weather. A series of major typhoons in late August and heavy rains in many parts of Japan in September disrupted logistics and consumer traffic at dealerships. In the economy, inflation-adjusted real wages started to decline again, squeezing consumers’ purchasing power.

The Korean market picked up for the second month in a row, with the September selling rate surging to 1.68 million units/year. However, that brought the YTD average selling rate to only 1.58 million units/year, suggesting that the market could possibly finish the year with the lowest sales since 2013. Sales this year have been weak, as PV sales were pulled ahead by last year’s temporary tax cut and dragged by the elevated level of household debt. Light Commercial Vehicle sales were hit by the aging model cycle and high financing rates. Nonetheless, Hyundai, Renault Korea and KG Mobility managed to record positive YoY growth.

South America

Brazilian Light Vehicle sales continued their strong run throughout 2024, as volumes expanded by 19% YoY, reaching almost 223k units. Thanks to these strong volumes, the selling rate surged to 2.71 million units/year in September, up from 2.45 million units/year reported in August, and the highest rate since February 2020, indicating that the market is now touching pre-pandemic levels, at least when looking at one month in isolation. Inventory seems to have reached a kind of plateau, as days’ supply remained unchanged in September at 34 days.

In Argentina, Light Vehicle sales reached 41.0k units, growing by 30% YoY. Sales have been slowly improving through the second half of the year, as it seems that some of the reforms put in place by the new administration have had time to impact the market. The selling rate saw a strong boost in September, with it above the 400k unit mark for the past three consecutive months, which is considered to be a positive sign in the current economic landscape.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.