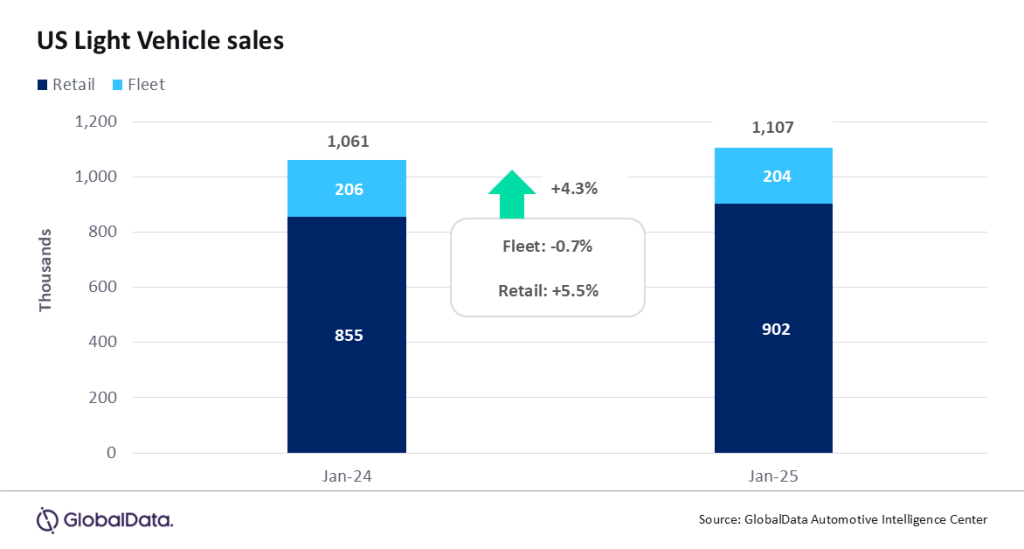

According to preliminary estimates, Light Vehicle (LV) sales grew by 4.3% year-on-year (YoY) in January, to 1.11 million units. With the same number of selling days as in January 2024, a direct comparison of sales was possible. Total sales were sedate compared to December, but that is a normal development at this time of year as the market normalizes following end-of-year sales events.

Global outlook – The global LV sales rate for December reached 95.5 million units, marking the highest monthly level since August 2023, when China’s recovery surged. Sales in the month were up 5% YoY to 8.5 million units, driving the total for 2024 to 88.4 million units, a 2% increase from 2023. Global sales in December were boosted by a 9% growth in China, India, and Eastern Europe. However, sales volume in Japan fell by 9%, while Korea saw a slight decrease of 0.2%. The global market is starting 2025 with momentum and expectations for total sales to reach 91.6 million units, up nearly 4% from 2024. Risks remain elevated, including potential trade and tariff implications globally.

US LV sales totaled 1.11 million units in January, according to GlobalData. The annualized selling rate for the month was 15.7 million units/year, down from 17.0 million units/year in December. The daily selling rate was estimated at 44.3k units/day in January, down from 60.3k units/day in December. According to initial estimates, retail sales totaled 902k units in January, while fleet sales were thought to reach 204k units, accounting for 18.5% of total volumes.

Once again, General Motors sat atop the sales rankings in January, on 194k units, its highest January sales total since 2021. With that said, GM’s market share declined from 18.1% in December to 17.5% in January. Toyota Group bounced back from a disappointing performance in December, with a market share of 14.8%, although its volumes were still down slightly YoY, at 164k units. Ford Group was the third-bestselling OEM, on 136k units. At a brand level, Toyota (141k units) finished January comfortably ahead of nearest challenger Ford (129k), after the Blue Oval brand had narrowly beaten Toyota in December. Chevrolet was third, on 121k units.

The Toyota RAV4 claimed the crown as the bestselling model in January, on 36.3k units, ahead of the Ford F-150 on 34.1k units. Pickup sales typically spike at the end of the year, which had enabled the F-150 to beat the RAV4 in December, but that pattern was reversed in January. The rest of the top five bestselling models were those that we have become accustomed to seeing in such lofty positions in recent times – the Honda CR-V, Chevrolet Silverado and Tesla Model Y.

The Compact Non-Premium SUV segment has been performing strongly for some time, but January was a particularly notable example of that trend, as its market share hit 22.6%, close to the all-time high of 22.8% set in February 2024. In contrast, Midsize Non-Premium SUV fell back to a market share of 14.3%, in line with its recent lows in September and October 2024. Large Pickup also saw a weakening in market share in January, to 13.4%, its lowest since May 2024. While not yet confirmed by transaction price and incentive data, these sales figures would suggest that once end-of-year deals were removed, consumers reverted to a preference for more affordable models in January.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataDavid Oakley, Manager, Americas Sales Forecasts, GlobalData, said: “January sales finished in line with expectations. The first month of the year is typically a low-key one for the automotive industry, as the market pauses for breath after the frenzy of activity that tends to be seen in December. Furthermore, lower volumes and recent disruptions to seasonality mean that the January selling rate is often a poor predictor of the market’s performance in the coming year. Some trends observed over recent months – such as robust sales for hybrid vehicles – appeared to continue in January. While it is possible that some consumers chose to bring forward purchases of Electric Vehicles amid reports that the Trump administration may seek to remove tax credits, this does not seem to have significantly altered the overall state of the market. Similarly, wildfires in Los Angeles and spells of winter weather elsewhere likely had only a marginal impact on sales”.

Inventory levels are expected to have risen by 3% from the end of December as production catches up with the spike in demand at the close of 2024. That would translate to a days’ supply of 63-65 days, significantly higher than the 47 days in December. Production in North America is projected to increase by 1% in 2025 to 15.5 million units, ahead of any impact or fallout from tariffs. We continue to anticipate production levels to be closely aligned with demand.

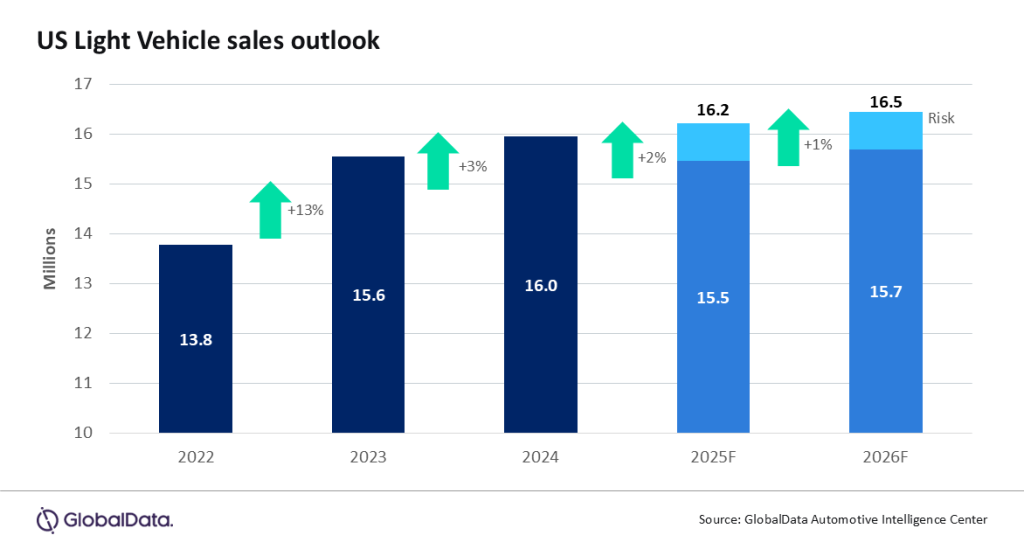

Our baseline forecast for LV sales in the US in 2025 is 16.2 million units, up 2% YoY from 2024. Due to the declining trend in the level of fleet sales from H2 2024, we anticipate fleet demand to remain flat compared to 2024, causing its share of total LVs to drop below 17.5%. Retail sales are projected to increase to 13.4 million units from 13.1 million in 2024.

Jeff Schuster, Vice President Research and Analysis, Automotive, said: “The outlook for US auto demand hinges on the scale, extent, and duration of import tariffs that are being considered by the Trump administration. Negative implications could be significant, with up to 1 million units of demand potentially at risk in the US alone. Retaliatory measures would significantly raise global risks and escalate the situation to a full-fledged global trade war, disrupting the current momentum in the auto industry. Ultimately, consumers stand to lose the most.”

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.