The Indian market remained strong in August, despite automakers curtailing wholesales of older and low-selling models with high inventory levels, as the selling rate improved by 2% from July to reach 5.0 millon units.

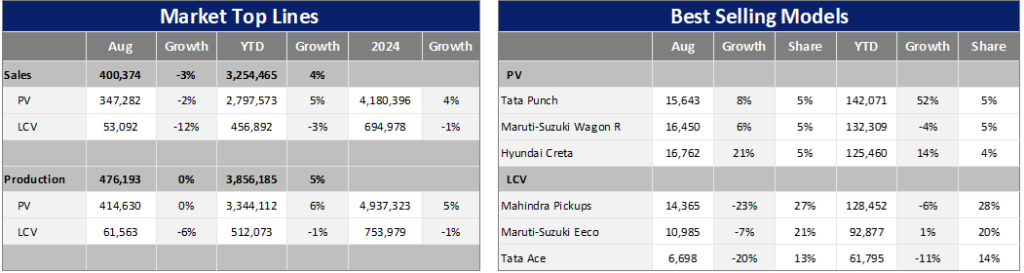

Total Light Vehicle (LV) wholesales in the month increased by 3% month-on-month (MoM) to exceed 400k units. However, there was a 3% year-on-year (YoY) decrease due to a high base last year. Sales of Passenger Vehicles (PVs) surpassed 347k units, reflecting a 4% MoM increase but a 2% YoY decline. Additionally, the volume of Light Commercial Vehicles (LCVs) with a gross vehicle weight of up to 6T stood at 53k units (-2% MoM, -12% YoY).

In addition to stock rationalization, demand also appears to be somewhat lukewarm. This is evident through the continued discounts and price promotions offered to buyers, as well as subdued retail sales in August.

According to data from the Federation of Automobile Dealers Associations (FADA), retail sales of PVs and LCVs in August decreased to 352k units from 365k units in July.

Consequently, PV inventory levels rose to a record high of 70-75 days (more than double the normal levels), equivalent to 780k units, by the end of August. Most unsold units were inexpensive entry-level Cars and older SUVs.

“Rather than responding to the situation, PV OEMs continue to increase dispatches to dealers on a MoM basis, further exacerbating the issue,” said FADA’s former president Manish Raj Singhania.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe total number of LVs delivered to dealerships from January to August amounted to 3.3 million units, reflecting a 4% YoY growth. This figure comprised 2.8 million PVs (+5% YoY) and 457k LCVs (-3% YoY).

It is important to highlight that wholesales in H1 2024 were influenced by a significant backlog of orders, decreased demand during the general elections, and inventory management considerations.

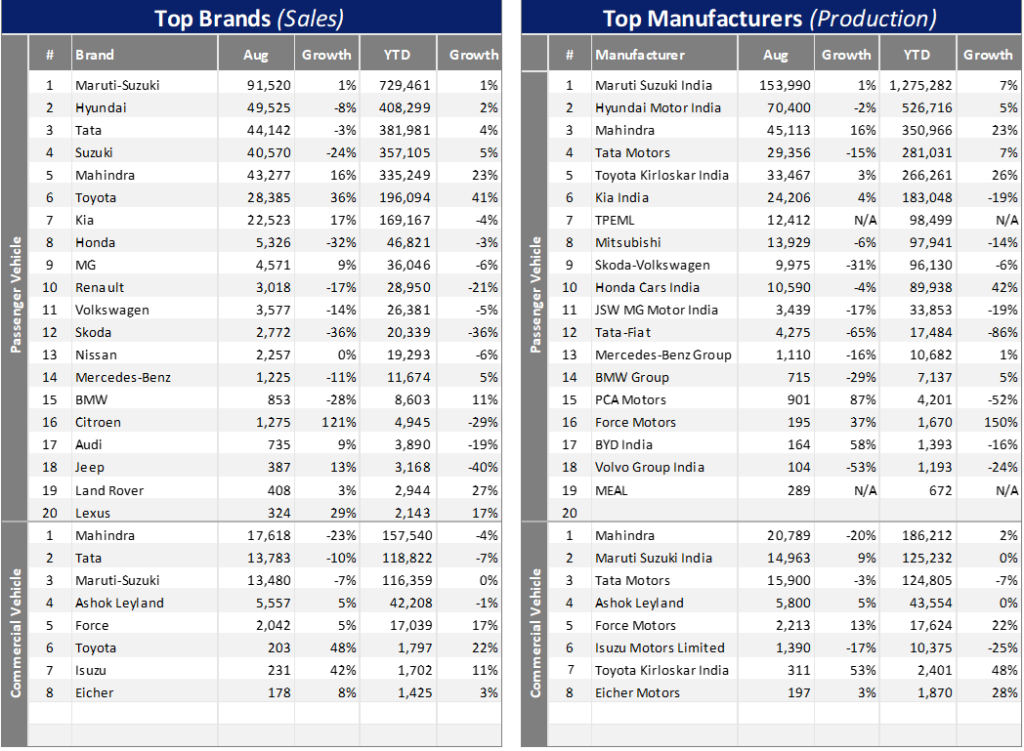

Preliminary data for September from the top five OEMs indicates that market leader Suzuki Group’s PV wholesales crept up by 1% compared to the previous month, while Hyundai improved its volume by 3% MoM. In addition, Tata Motors’ PV figure declined by 7% MoM, which was in stark contrast to an 18% MoM upsurge from Mahindra. Lastly, Toyota’s sales (mostly PVs) slumped by 16% MoM.

In the forthcoming months, wholesales will be influenced by India’s festival cycle, which extends from September to November. This period, historically marked by robust demand, is expected to prompt automakers to maintain sufficient inventory levels.

For instance, Suzuki Group reported that its inventory was at a 36-day supply at the end of August. The automaker has also indicated its intention to uphold this inventory level throughout the festive season.

We remain cautiously optimistic about the sales outlook for the rest of this year. With the onset of the festive and marriage season, OEMs will likely continue to implement attractive pricing and incentive strategies. They also plan to launch a number of new models and generations in the coming weeks. Plus, the government’s final FY2024/2025 budget included a record level of capital investment and measures to promote rural development, which could help boost LCV sales.

On the negative side, there are downside risks to sales arising from extreme weather, a weak rupee, persistent inflation, and high interest rates.

Our LV sales forecast remains unchanged, with minor adjustments in 2024. Although the market has lost some momentum, sales are still projected to reach an all-time high of 4.9 million units this year (+3.4% YoY) and 5 million units in 2025 (+2.7% YoY). Currently, the risk to the forecast is slightly on the upside for PVs, while it is on the downside for LCVs.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.