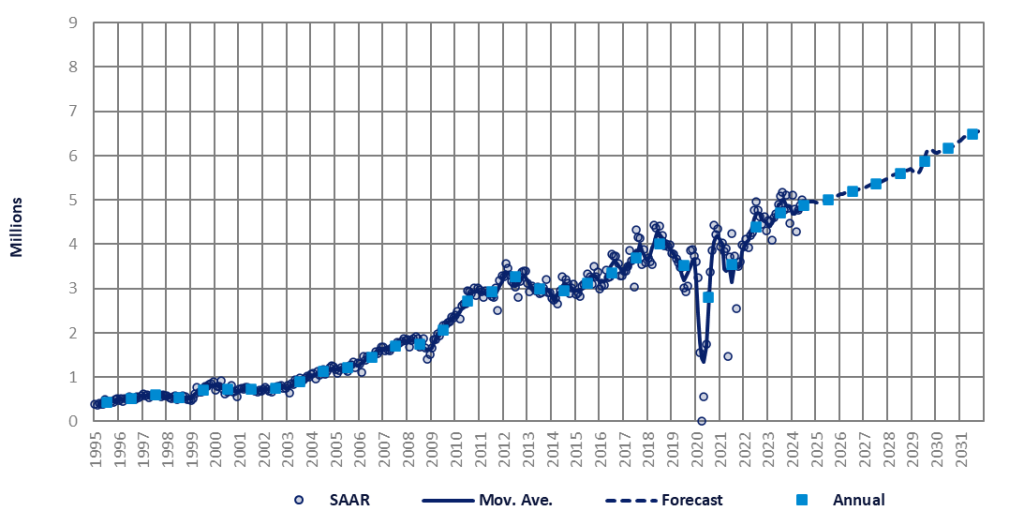

The Indian market lost steam in July, with the selling rate dropping to 4.9 million units/year – a 2% decline from a robust June.

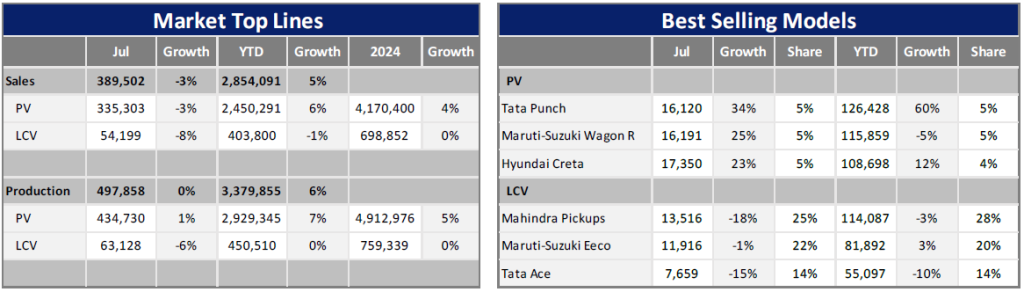

In absolute figures, Light Vehicle (LV) wholesales reached 389k units, indicating a modest month-on-month (MoM) increase of 1%. However, this number reflects a 3% decline on a year-on-year (YoY) basis. Passenger Vehicle (PV) sales suffered their first contraction since February 2022, with volumes of 335k units marking a YoY decrease of 3%, despite a 1% MoM uptick. In addition, demand for Light Commercial Vehicles (LCVs) with gross vehicle weight of up to 6T fell on a YoY basis for the third consecutive month in July, totaling 54k units. This represents a 1% MoM decrease and an 8% YoY drop. The selling rate also decelerated on a MoM basis for the third successive month.

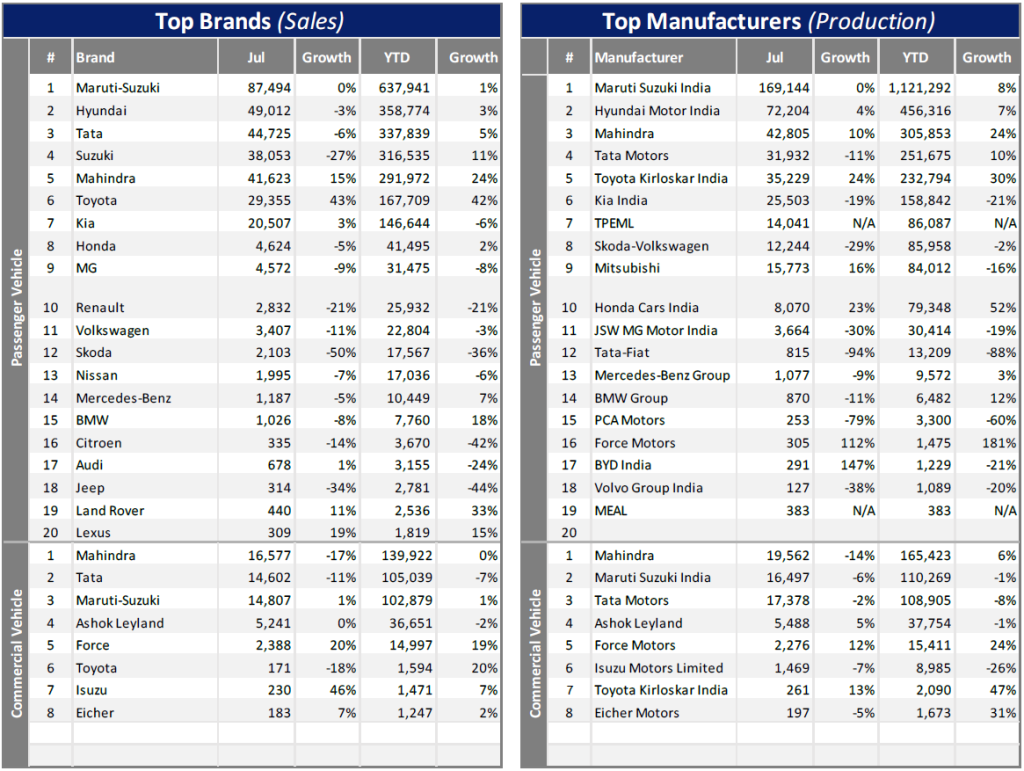

Automakers curtailed deliveries to dealerships in July for models with high levels of unsold inventory. Nevertheless, this was balanced by increased dispatches of newer vehicles with outstanding orders.

Retail sales of PVs and LCVs in July rose to 365k units, rebounding from a downward trajectory observed in June (322k units) and May (349k units), according to data from the Federation of Automobile Dealers Associations (FADA). Retail sales of PVs were particularly buoyed by new model introductions and compelling pricing strategies, with OEMs and dealers offering substantial price reductions and other enticing consumer incentives.

However, PV inventory levels escalated once again to a record high of 67-72 days, more than double the standard levels, as reported by FADA.

In contrast, wholesales and retail sales of LCVs faced headwinds due to persistent rainfall, negative sentiment in rural markets, and limited availability of financing. Total LV wholesales in the first seven months of the year grew by 5% YoY to 2.9 million units, comprising 2.5 million PVs (+6% YoY) and over 400k LCVs (-1% YoY). Hence, the year-to-date (YTD) average selling rate reached 4.8 million units/year.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

In response to high inventory levels and intense competition, OEMs and dealers are extending substantial discounts and other incentives across various models, including those recently launched, thus creating a “buyers’ market”.

Preliminary data for August from the top five OEMs reveals minor variances in PV wholesales compared to the previous month. Suzuki Group, the market leader, saw a 5% MoM increase in PV volumes, while Hyundai’s sales edged up by 1%. Meanwhile, Tata Motors’ PV wholesales dipped by 1% MoM, whereas Mahindra’s sales rose by 4%. In addition, Toyota’s figures showed a 3% decline from June.

As the festive season approaches, a period typically associated with higher sales, OEMs are expected to maintain attractive pricing and incentive strategies to stimulate buyer interest and drive demand. The introduction of several new models and generations throughout the remainder of the year should also bolster sales.

On the downside, sales continue to face risks from extreme weather events, such as heatwaves and floods, a record-low rupee, persistent inflation, and elevated interest rates.

Given the weaker-than-anticipated LCV sales, the sales forecast for 2024-2027 has been revised slightly downward. Nonetheless, LV sales are still projected to reach a record high of 4.9 million units this year, representing an increase of 3% YoY. The long-term outlook remains unchanged, with the market expected to expand to 6.5 million units by 2031.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.